Windletter #64 - Where is the electrical demand

Also: Vestas secures 4.2 GW offshore from SGRE, wind power record in Germany, 40 years of wind power in Albacete, and more.

Hello everyone and welcome to a new issue of Windletter. I'm Sergio Fernández Munguía (@Sergio_FerMun) and here we discuss the latest news in the wind power sector from a different perspective. If you enjoy the newsletter and are not subscribed, you can do so here.

The most read from the last edition has been: the challenges of wind energy in Spain in 2024, the video of slacklining between two wind turbines, and the video of the first kilowatt hours from Vineyard Wind.

The Government unblocks the five wind farms that will supply electricity to Alcoa

Lately, there is a lot of talk (although perhaps not as much as there should be) about electrical demand and the need to stimulate it to accelerate the energy transition. This is nothing new, and it is also a topic that I discussed in this article on Nergiza in 2018.

The fact is that, despite efforts to stimulate it, in recent years, in European countries, electricity demand continues to trend downward. Deindustrialization and self-consumption are causing a decrease in electricity consumption in measured in meters every year.

In the case of Spain, much of this decline in consumption is linked to the shutdown of electro-intensive industries. Specifically, as Javier Revuelta tells in the video podcast of El Periódico de la Energía, there are two plants in Spain (currently hibernating) that alone have an annual energy consumption of about 10 TWh, around 1,000 MW of base load, which is about 4% of the electricity consumed in the country.

One of them is Alcoa and its San Cibrao plant, which has been stopped since the end of 2021. Alcoa claims to have accumulated losses of 700 million in Spain since 2020, and one of its hopes to resume operation is through renewable PPAs.

Specifically, hope lies in 5 wind farms (all of them owned by Greenalia) intended to supply energy to Alcoa at competitive prices. The problem is that these wind farms had been left without authorization for access and connection to the grid because the Environmental Impact Statement (EIS) from the ministry arrived late.

These wind farms are Borrasca (84 MW), Levante (106.4), Ventisca (89.6), Boura (72.8), and Monzón (50.4). Together, they total 320 MW.

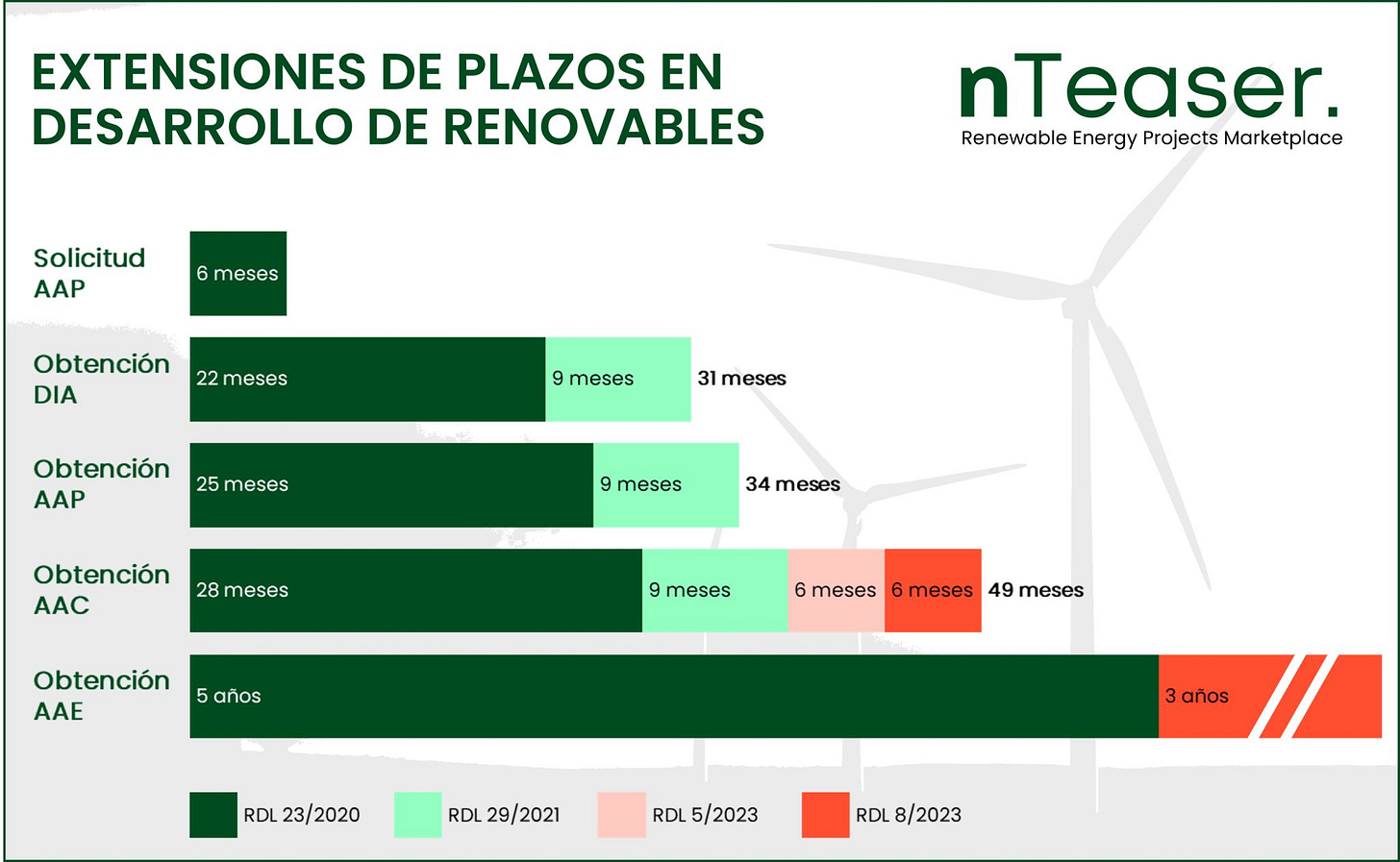

The good news is that through the latest legislative change, the government has resurrected these five wind farms thanks to the extension of administrative milestones. This latest legislative change that has given some air to the promoters is very well explained in this LinkedIn post by nTeaser and in the wonderful infographic they have published.

This way, these parks could connect to the grid at some point in 2025, generating competitive energy and allowing Alcoa to resume activity, thereby increasing demand.

This renewable PPA format could be extrapolated to other electro-intensive sectors and may be one of the great hopes for the electrical and renewable sector in Spain. For example, it is known that there is a flood of connection requests from data centers. There is talk of around 10 GWs, and although it is very likely that not all will be built, it gives us a clear signal that investors see Spain as a country with cheap electricity prices in the future.

To this, we should add the additional demand generated by electric vehicles and heat pumps.

When will electric demand grow again in Spain?

_

Vestas "snatches" a 4.2 GW offshore wind turbine contract from Siemens Gamesa for Vattenfall

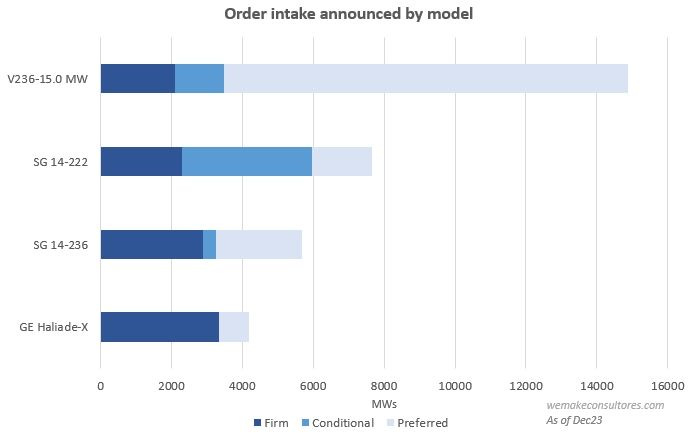

A bombshell in the offshore sector. Vattenfall has decided to replace SGRE as the preferred supplier for its Norfolk projects, totaling an impressive 4.2 GW, as reported by Kiko Maza on his LinkedIn profile.

SGRE, with its SG14.0-236, had been chosen by Vattenfall in 2021 as the preferred supplier. However, and although the reasons for this change are unknown, it is very possible that SGRE wanted to substantially renegotiate the contract terms due to the recent turbulence in the sector. Most likely, the financials didn't add up.

Interestingly, a few months ago, Vattenfall had announced the suspension of one of the Norfolk projects and put the other two under review. So, everything points to the consequence of this review being that Vattenfall has shifted towards Vestas. Thus, the V236-15.0 MW becomes the model for the largest project portfolio

But be aware that this story has one more twist. Practically at the same time as this change of preferred supplier was announced, Vattenfall sold the 4.2 GW developments to RWE for 1.1 billion euros.

The projects are in an advanced stage of development, with maritime space reserved and grid connection already secured.

My doubts are: What competitive advantage does RWE have that allows them to make these projects viable while Vattenfall had put them on hold? Why did Vattenfall change the preferred supplier just before selling the developments, and why wasn't it RWE who made the change afterward? It seems like the sales agreement was conditioned to this turbine change.

Different interpretations can be drawn from this news. On one hand, SGRE does not seem willing to adjust prices recklessly, to the extent that they let go of 4.2 GW. This seems to demonstrate a certain price discipline to avoid loss-making contracts. On the other hand, it could also be a clear sign that Vestas is more competitive than SGRE in offshore.

_

Record Wind Generation in Germany

On December 21st, a new record for daily onshore wind generation was set in Germany. An impressive 1,008 GWh was generated, marking the first time the 1 TWh barrier for onshore wind was surpassed.

Considering that there are 60.6 GW of onshore wind installed in Germany, this represents a capacity factor of 69.3% over 24 hours.

Regarding power, records were also broken. Peak wind power reached 53,013 MW at 11 a.m., surpassing the previous record of 50,802 MW.

Furthermore, the average power was 47.6 GW throughout the day, and wind alone supplied 85% of the demand.

The data can be found in this link.

_

WEG and Statkraft Reach Agreement to Install AGW172/7.X Prototype in Brazil

Several times we have discussed here WEG, the Brazilian industrial conglomerate that has decided to compete in the wind sector as a wind turbine manufacturer. A surprising move, as being an Original Equipment Manufacturer (OEM) in this sector at this time is not exactly a guaranteed success.

In any case, we have already seen WEG install a prototype of 4.2 MW power and a 147-meter rotor diameter in India. Moreover, a wind farm in Brazil with the same model has been put into operation.

But it didn't stop there; recently, they signed an agreement with Petrobras worth 24.5 million euros for the joint development of a 7 MW onshore wind turbine.

Now, this agreement is coming to life in the form of a prototype. WEG will build this prototype in collaboration with the Norwegian company Statkraft. The collaboration between the companies will facilitate the installation of the AGW172/7.X wind turbine and the type certification of this platform. Once constructed, it will become the largest wind turbine designed and manufactured in Brazil. The forecast is that the wind turbine will be operational by the end of the first half of 2024.

_

Wind Power in Albacete Nearing 40 Years

An interesting article published in La Tribuna de Albacete discusses the nearly 40 years of wind power in the province.

Specifically, in 1984, the Agricultural Services of the Provincial Council (currently ITAP) received a curious request from the Ministry of Industry of the Regional Government. The manufacturer Ecotecnia wanted to test one of its first models in the Llanos de Albacete.

It was an Ecotecnia 12/15 wind turbine (with a rotor diameter of 12 meters and a power of 15 kilowatts) and was installed at the ITAP Experimental Farm in Las Tiesas, between Barrax and Albacete.

Moreover, as La Tribuna de Albacete reports, Ecotecnia also chose the province to test its next 30 kW model. It established the first wind farm in the province in 1987, known as the Ontalafia wind farm, consisting of 10 units located in the Sierra de Enmedio (the remains of which can be seen on maps).

The wind turbines were installed on a 14-meter high tubular tripod tower, with some of them featuring 5-meter blades and others with 6-meter blades.

The investors in the wind farm were the Ministry of Industry, the Institute for Energy Diversification and Saving (IDAE), and Hidroeléctrica Española, which is now Iberdrola. The project was co-financed with European funds.

Thank you very much to Pep Puig for the photos and reviewing the data.

_

The prototype of Modvion with a 100-meter wooden tower is now operational.

We have talked here several times about Modvion's prototype of a wooden wind turbine tower. For those who may not be familiar, Modvion is a startup dedicated to designing and manufacturing wooden wind turbine towers.

Well, Modvion has now completed the installation of its first full-scale prototype, a Vestas V90 mounted on a 105-meter tower. And they have shared this wonderful image:

This milestone has brought them into the spotlight, featured in an interesting report by the BBC and also in the Financial Times with this video explaining the reasons behind developing wooden towers.

_

A lamp made from a recycled wind turbine blade.

The curiosity of this edition comes from Mike Hodgson on LinkedIn, who shares a photo of a lamp made from a section of a recycled wind turbine blade. Mike works at the company WTG Offshore & WTG Blades Inc.

The lamp, quite beautiful by the way, is made from a section of the "central spar" of the wind turbine blade, which is the main beam providing structural rigidity. Specifically, this beam belonged to a Vestas V80 from the North Hoyle Wind Farm, one of the first offshore wind farms to be decommissioned in the United Kingdom.

While exploring the LinkedIn page of this company, I also came across this unique desk. The ideas emerging for creating products with recycled wind turbine blades are truly impressive.

Thank you very much for reading Windletter. If you enjoyed it, I invite you to subscribe, leave a ❤️, forward it by email, share it on social media, or recommend it to others.

You can follow Windletter's profiles on Twitter and LinkedIn. Also, if you enjoy reading about energy, check out Windletter's Library.

You can also contact me through my Twitter or LinkedIn profiles.

See you in the next one!

Disclaimer: The opinions presented in Windletter are mine and do not necessarily reflect the views of my employer.