Windletter #96 - Solar energy is losing market value, wind energy maintains it better

Also: the quality of European OEMs versus Chinese OEMs, EU Innovation Funds, offshore auction in France, and more.

Hello everyone and welcome to a new issue of Windletter. I'm Sergio Fernández Munguía (@Sergio_FerMun) and here we discuss the latest news in the wind power sector from a different perspective. If you enjoy the newsletter and are not subscribed, you can do so here.

Windletter is sponsored by:

🔹 Tetrace. Specialized services in operation and maintenance, engineering, supervision, inspection, technical assistance, and distribution of spare parts in the wind sector. More information here.

🔹 RenerCycle. Development and commercialization of solutions and specialized services in the circular economy for renewable energies, including comprehensive dismantling of wind farms and waste management, refurbishment and sale of components and wind turbines, management and recycling of blades and others. More information here.

Windletter está disponible en español aquí

🚀 We’re dangerously close to the 100th edition of Windletter news! If all goes well, we’ll reach it before the end of the year. Any ideas on how to celebrate?

The most-read topics from the last edition were: the website of the largest renewable project ever planned, the video of a ship built with recycled blade resin, and Entrion Wind’s tensioned monopile.

Now, let’s dive into this week’s news.

☀️ Solar energy is losing market value, wind energy maintains it better

In recent times, solar photovoltaic energy has experienced unprecedented growth in many countries. Spain is a particularly clear example, where more than 3 GW have been installed annually since 2019, with 5.5 GW installed last year (excluding self-consumption, which adds a significant contribution).

As a result, solar energy is becoming one of the key players in the electricity mix during many hours of the year. This is beginning to reduce the revenues solar energy earns in the market, a phenomenon known as price cannibalization.

👉 Price cannibalization in the electricity market occurs when an increase in renewable energy generation, particularly solar and wind, reduces electricity prices during periods of high production from these technologies. This happens because renewables have very low marginal costs, which displace more expensive technologies and exert downward pressure on prices during those times.

This phenomenon reduces the revenues solar producers earn for their energy, affecting their profitability, especially in markets with high solar penetration.

Meanwhile, wind energy, although also affected during episodes of strong winds, better maintains the captured price because its generation is "more distributed" throughout the day and overlaps less with solar generation due to the complementarity between the two technologies.

The phenomenon of cannibalization is occurring to varying degrees in all countries with significant renewable (especially solar) penetration. For instance, in Europe, countries like Spain, Germany, or Greece are experiencing this. Here is a chart for Spain.

Julien Jomaux explains (and visualizes) this very well in his newsletter GEM Energy Analytics, which I highly recommend if you want to better understand electricity markets. The chart above is his.

To give a specific example of this phenomenon, it is estimated that the capture rate in Germany for solar energy will be 66% by 2025, while for wind energy it will be 90% onshore and 92% offshore.

👉 The capture rate is the ratio between the average revenue obtained by a renewable plant in the market and the average electricity market price, reflecting the plant’s ability to capture revenue in relation to market behavior.

And of course, with lower expected revenues, expected profitability decreases, making it more complex to invest in new solar (especially) and wind plants (less so). This is reflected in the movements of the major players in these markets we’ve mentioned.

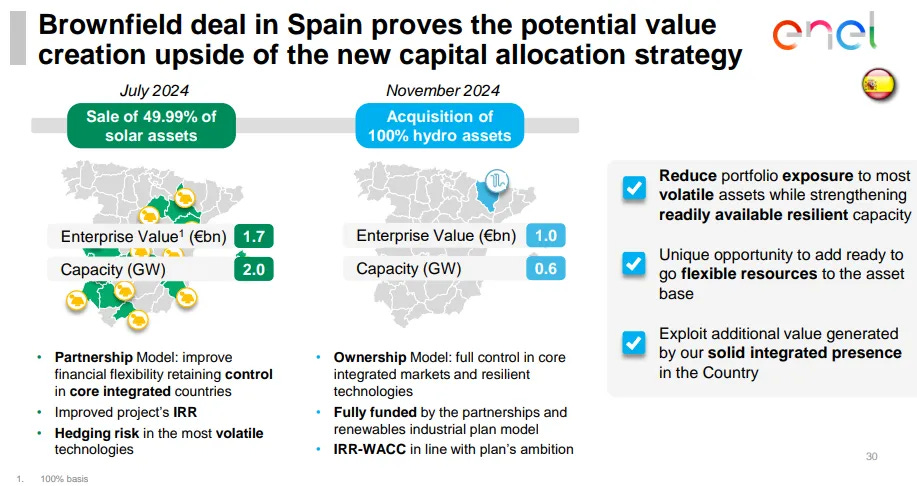

For example, the Italian giant Enel (main shareholder of Spanish Endesa) recently presented its strategic plan for the 2025-2027 horizon, highlighting its shift toward wind energy and "flexible" technologies, prioritizing these over solar.

Enel’s strategy involves installing 5.7 GW of wind energy in the next three years compared to 3.2 GW of solar energy. It also plans to incorporate 2.3 GW of batteries and 0.7 GW of hydroelectric power.

Another clear indication of this change in strategy is that Endesa recently sold 49.99% of its solar assets to Masdar, retaining control of the projects but reducing its exposure to the aforementioned cannibalization. Shortly after, it purchased 626 MW of hydroelectric power from Acciona Energía.

Does this mean investment in solar energy will stop? Clearly not. But if nothing changes, it will become increasingly difficult to maintain the pace of recent years in some markets.

There are already ways to “partially sidestep” this cannibalization and uncertainty, such as long-term PPAs (though their price is also tied to the market price, of course).

👉 A PPA (Power Purchase Agreement) is a contract in which an energy producer agrees to sell electricity to a buyer (such as a company or utility) at a fixed price and for a specified period, providing stability for both the producer and the buyer.

Another solution could be CFDs awarded by governments through auctions, common in many European countries but not yet in Spain.

👉 A CFD (Contract for Difference) is a contract where the producer and buyer agree on a fixed price: if the market price is lower, the buyer pays the difference; if it is higher, the producer returns the surplus.

And of course, we also have storage and demand increases, which have the potential to raise prices during peak midday hours.

Interesting times lie ahead, without a doubt.

🌪️ Understanding how a wind turbine operates just by observing its blades

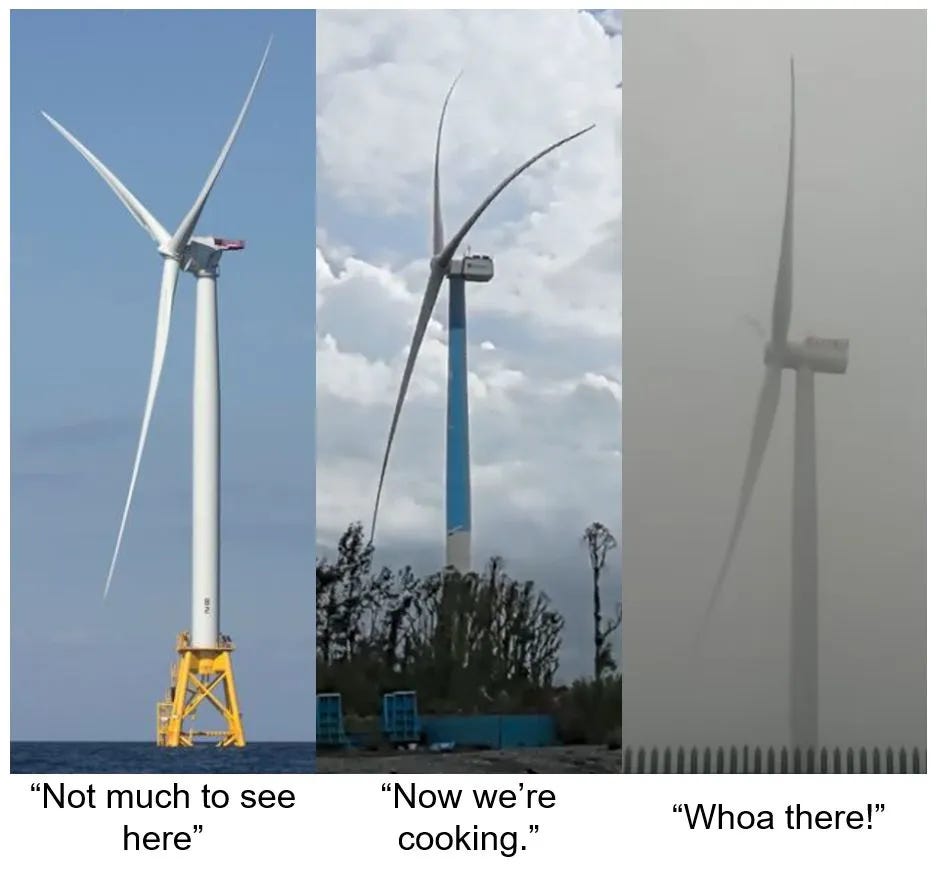

I really liked this LinkedIn post by Samuel Hawkins, where he teaches us how to interpret the operation of a wind turbine simply by observing the position and flexion of its blades.

Low speeds or limited operation: If the turbine is not producing (standstill mode) or the wind is weak, the blades barely flex. This is common in promotional images or photos celebrating the energization of a project (see left image).

Low or medium winds (3-12 m/s): In this case, the blades maintain an optimal angle of attack (pitch) to maximize torque. As torque increases, so do drag forces, causing slight flexion of the blades toward the wind (see center image).

High winds (12-25+ m/s): Here, the blades maintain a suboptimal angle of attack to avoid excessive power and drag forces. In extreme wind conditions, the blades may even flex away from the tower (see right image).

As you can imagine, as rotor sizes increase, these challenges become more complex.

🌊 Siemens Gamesa and Iberdrola sign 64 SG14-236 DD turbines for East Anglia 2

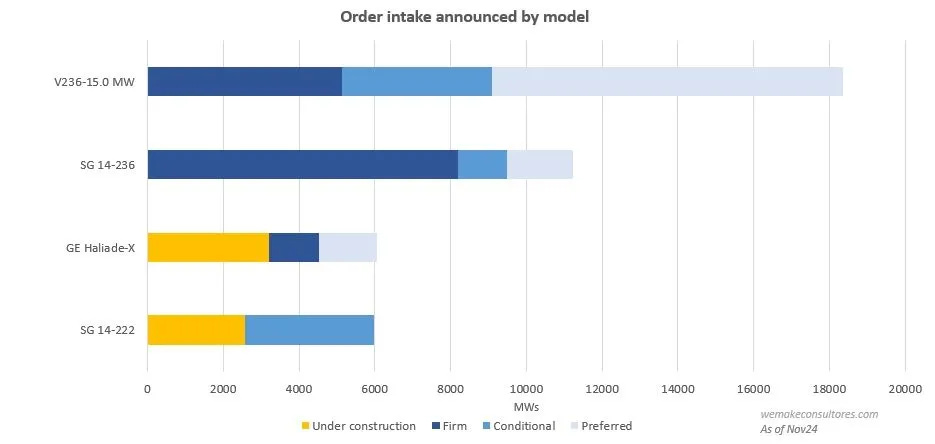

Siemens Gamesa and Iberdrola have signed a contract for 64 SG14-236 DD turbines for the East Anglia 2 wind farm, with a capacity of 960 MW.

East Anglia TWO will be the third wind farm built by Scottish Power in the so-called East Anglia Hub, with East Anglia ONE (714 MW) operating since July 2020 and East Anglia THREE (1,400 MW), the company’s largest wind farm, currently under construction.

The Siemens Gamesa SG 14-236 DD has a rotor diameter of 236 meters and a power capacity of up to 15 MW with its Power Boost technology.

With the latest offshore developments, the ranking, which our friend Kiko Maza regularly updates, now shows the V236-15.0 MW by Vestas as the leading model with over 18 GW in firm orders, conditional orders, and preferred agreements, though no commercial projects are yet under construction.

Interestingly, in the comments section of Kiko's post, there’s talk that if agreements between developers and manufacturers not yet publicly disclosed were considered, the picture would change. Speculation even mentions “turbines not yet certified but already selected for future projects.” Could they be referring to the hypothetical SG 21-276 DD? Chinese OEMs, apparently not…

🤔 Neoen's CEO questions the quality of Western OEMs

The French developer Neoen, one of the key players in the Australian market, is considering purchasing turbines from Chinese OEMs due to concerns over pricing, quality, and maintenance from Western manufacturers.

According to statements by its CEO, Xavier Barbaro, during a results presentation, Neoen might choose turbines from a Chinese OEM for some of its future Australian projects, expressing dissatisfaction with the Western offerings.

As reported by RenewEconomy, Neoen sees “certain similarities in the quality of Western and Chinese turbines, with the latter offering more competitive prices.” Barbaro also added, “Without a doubt, in the near future, we will start using Chinese turbines. This will first happen in Australia, but I’m sure it could eventually happen in Europe as well, and we’ll see.”

Barbaro didn’t name specific OEMs, but Neoen’s portfolio in Australia includes turbines from Vestas, General Electric, and Siemens Gamesa.

He also mentioned that the company has visited Goldwind and Envision and plans to visit Minyang. Notably, Australia is Goldwind’s largest market outside China, with approximately 1 GW installed.

Months ago, we discussed how Neoen was awaiting bank approval to proceed with purchasing Chinese turbines.

💡 EU innovation funds: wind sector projects

A portion of the funds raised by the European Union through greenhouse gas emission allowances is invested in the so-called Innovation Funds.

These funds are allocated to research projects related to “clean technologies”, which include solar, wind, batteries, hydrogen, synthetic fuels, and more.

I reviewed the list on the official website and extracted the wind sector projects (though I might have missed a few).

Some that particularly caught my attention are:

CASTRO: Developed by Vestas, aiming to design, build, and validate a wind turbine with a new tensioned rotor design. Vestas even has a prototype. Do you see a future for this concept?

NEMO: Described as “next-generation European Union manufacturing for offshore wind,” managed by Siemens Gamesa, though details are sparse.

PIVOT: Focused on “testing, validating, and optimizing manufacturing and assembly processes for three key components: blades, nacelle, and tower for offshore wind energy.” It appears related to the prototype of the hypothetical SG 21-276 DD.

WINDPL: Managed by Spanish company Windar, it’s described as a “sustainable manufacturing facility for XXL offshore wind towers” in Poland, a booming offshore market.

Curiously, there are also two projects related to Airborne Wind Energy technology, which uses autonomous kites or unmanned aircraft tethered to the ground to generate electricity from wind. I’d love to write an in-depth report on this topic someday. If you don’t want to miss it, subscribe for free.

🇫🇷 France prepares for its next offshore wind auction (AO9), prequalifying 12 participants

France has prequalified 12 participants for the AO9 offshore auction, which will award four new sites for offshore wind development.

This auction, totaling up to 2.9 GW, includes:

A floating wind farm of 400–550 MW south of Brittany.

Two floating wind farms of 400–550 MW in the Mediterranean.

A wind farm of 1,000–1,250 MW in the South Atlantic, which may be either floating or fixed-bottom.

The South Brittany project is adjacent to the 250 MW floating wind farm awarded in the A05 auction, which closed at an impressive €86/MWh (with some caveats, as noted by WindEurope).

The prequalified participants are:

EDF Renewables and Maple Power

Plenitude and Qair Group

It’s interesting to see that many major players are absent from this auction (Ørsted, BlueFloat, Equinor, Vattenfall, etc.), both for fixed-bottom and floating projects.

For those interested in investing in floating wind, it’s hard to think of a better place to invest right now than France—a country with strong legal security and significant auction volumes.

The auction winners will be announced in October 2025, with projects expected to begin commercial operation between 2032 and 2034. There’s a lot of anticipation for commercial-scale floating projects to come online, but we’ll have to wait. Hopefully, we’ll be reporting on it in Windletter, it would certainly be a good sign.

This auction is part of France’s plan to have 18 GW of offshore wind in operation by 2035.

🛡️ “Get Up Safe”: Ørsted enhances safety standards in offshore projects

Safety in offshore projects is critical, with technician transfers from crew transfer vessels (CTVs) to turbines being one of the most delicate maneuvers.

Typically, this transfer is done as shown in the following video. The CTV “bumps” and “accelerates” against the monopile, reducing the relative motion between the vessel and the ladder.

This maneuver becomes highly challenging with significant waves, making it difficult and dangerous to climb or descend the ladder and attach/detach the safety line.

To address this, Ørsted, in collaboration with Pict Offshore, has developed a solution that allows technicians to ascend and descend to the platform of the transition piece using a hoist system, eliminating the need for a ladder. In fact, the transition piece in the video below doesn’t even have a ladder.

The solution has been implemented at Hornsea 2, with over 10,000 transfers completed so far. However, the comment section has sparked debate about the safety of this system.

Thank you very much for reading Windletter and many thanks to Tetrace and RenerCycle, our main sponsors, for making it possible. If you liked it:

Give it a ❤️

Share it on WhatsApp with this link

And if you feel like it, recommend Windletter to help me grow 🚀

See you next time!

Disclaimer: The opinions presented in Windletter are mine and do not necessarily reflect the views of my employer.