Windletter #85 - Mingyang enters the European offshore wind sector

Also: Vestas sells 2.8 GW in Q2, GE to install a 15.5 MW prototype in Norway, X1 Wind gests funds to develop their 6 MW version and more.

Hello everyone and welcome to a new issue of Windletter. I'm Sergio Fernández Munguía (@Sergio_FerMun) and here we discuss the latest news in the wind power sector from a different perspective. If you enjoy the newsletter and are not subscribed, you can do so here.

Windletter is sponsored by:

🔹 Tetrace. Specialized services in operation and maintenance, engineering, supervision, inspection, technical assistance, and distribution of spare parts in the wind sector. More information here.

🔹 RenerCycle. Development and commercialization of solutions and specialized services in the circular economy for renewable energies, including comprehensive dismantling of wind farms and waste management, refurbishment and sale of components and wind turbines, management and recycling of blades and others. More information here.

Windletter está disponible en español aquí

How's everything going? I suppose some are already on vacation and others are looking forward to taking them 🌴. In my case, I have already been able to enjoy a week in June and now counting the days to take, this time, 3 weeks in a row.

Just like last year, Windletter will also go on vacation for a while to recharge batteries for the new course. I will let you know here and I will surely also make an edition with data and personal reflections before the summer.

That said, let's now go with the most read of the latest edition: the video of the curious parachute with drone, the hydraulic-wind hybridization of Iberdrola in Portugal, and the double rotor wind turbine from CSSC.

Furthermore, this week we also had Luis González-Pinto as a guest writer, who talked to us about the hype (and dramas) that have been experienced lately around floating wind energy.

Now, let's get on with this week's news.

🌬️ Mingyang's foray into the European offshore wind sector begins

Bombshell in the European wind sector: Mingyang, with its 18.5 MW and 260 m rotor wind turbine, has been chosen as the preferred supplier by developer Luxcara for a 296 MW offshore wind farm in Germany (16 units in total). If realized, this would be the first offshore contract in Europe with Chinese XXL turbines.

As our friend Kiko Maza says: it was only a matter of time.

Although it is not yet a firm order, there is no doubt that Mingyang and Luxcara have begun to negotiate seriously and exclusively for this project (at least that's what being the preferred bidder usually means).

Several points that may have led Luxcara to opt for Mingyang:

Economic: faced with rising prices in the supply chain and recent news of several project cancellations and/or delays due to profitability issues, Luxcara may have had to turn to Mingyang to save the project. And not just because the cost per MW might be lower, but also because of savings in infrastructure and "manpower" (fewer monopiles, fewer ship hours for assembly, potentially lower maintenance costs due to fewer units...).

Financing: one of the key points Kiko Maza mentioned on LinkedIn is that it would be interesting to know if the project is financed by Western banks or comes from Chinese banks through Mingyang.

Permitting: the agreed model is the MySE 18.5-260, a power and rotor diameter that no Western OEM can currently offer. I am unaware of how permitting works in Germany and how flexible it is, but Luxcara might have been left without much room to maneuver if it initially developed the wind farm with turbines of this power/size in the hope that one of the Western OEMs would have a model of these characteristics by now. Maybe some of you can tell me more about this 🙂.

According to Luxcara, Mingyang's wind turbines were selected following an international tender launched at the end of 2023 and after a due diligence exercise supported by DNV and KPMG that covered the supply chain, ESG compliance with the EU taxonomy, and cybersecurity.

Interesting to see that it was not one of the major European developers who took the first step to (potentially) incorporate a Chinese supplier into their projects. It makes sense, as the big ones have higher entry barriers: historical relationship with Western OEMs, political (and lobbying) pressures, and certain reputational risk.

Although it is true that the big ones are also making some approaches. Specifically, this announcement coincided with RWE's visit to Mingyang's facilities and its OceanX floating prototype these days as well. And they have not done it discreetly, on the contrary, the Offshore CEO and their Director of Engineering have publicized it on LinkedIn with great fanfare.

It also seems very relevant to me that Luxcara and Mingyang have decided to make this pre-agreement public when they could have continued negotiations confidentially. For Mingyang, it is undoubtedly a "goal" in its strategy to enter the European market, but I don't see the advantages for Luxcara beyond "stirring the hornet's nest" and seeing the reactions.

Maybe that's precisely what it is looking for because the German Government has already reacted by saying it will "closely scrutinize the agreement" while Luxcara has stated that "the management, operation, and control of the Waterkant wind farm will remain entirely in the hands of an independent German company."

I find it surprising that the first serious incursion of a Chinese OEM into the West is through an offshore wind farm rather than onshore, where the figures and risks are lower and it would be presumably simpler (although in the EU there are a few projects with Chinese turbines onshore, they are still anecdotal).

And of course, all this commotion is happening even as the EU announced last April that it would investigate Chinese manufacturers.

Finally, according to S&P Global (it's worth reading the article), Mingyang's arrival in Europe could reignite the European race to offer ever larger wind turbines.

Mingyang's 18.5 MW and 260 m are far ahead of Siemens Gamesa and Vestas' 15 MW and 236 m, and even further from General Electric's 14.7 MW and 220 meters. In fact, General Electric even halted its plans to go up to 17-18 MWs to settle for 15.5 MW in its next development.

But if this project between Luxcara and Mingyang succeeds, Western OEMs may be forced to match the 18-19 MW range. Siemens Gamesa, at least, is known to be developing a 21 MW turbine.

_

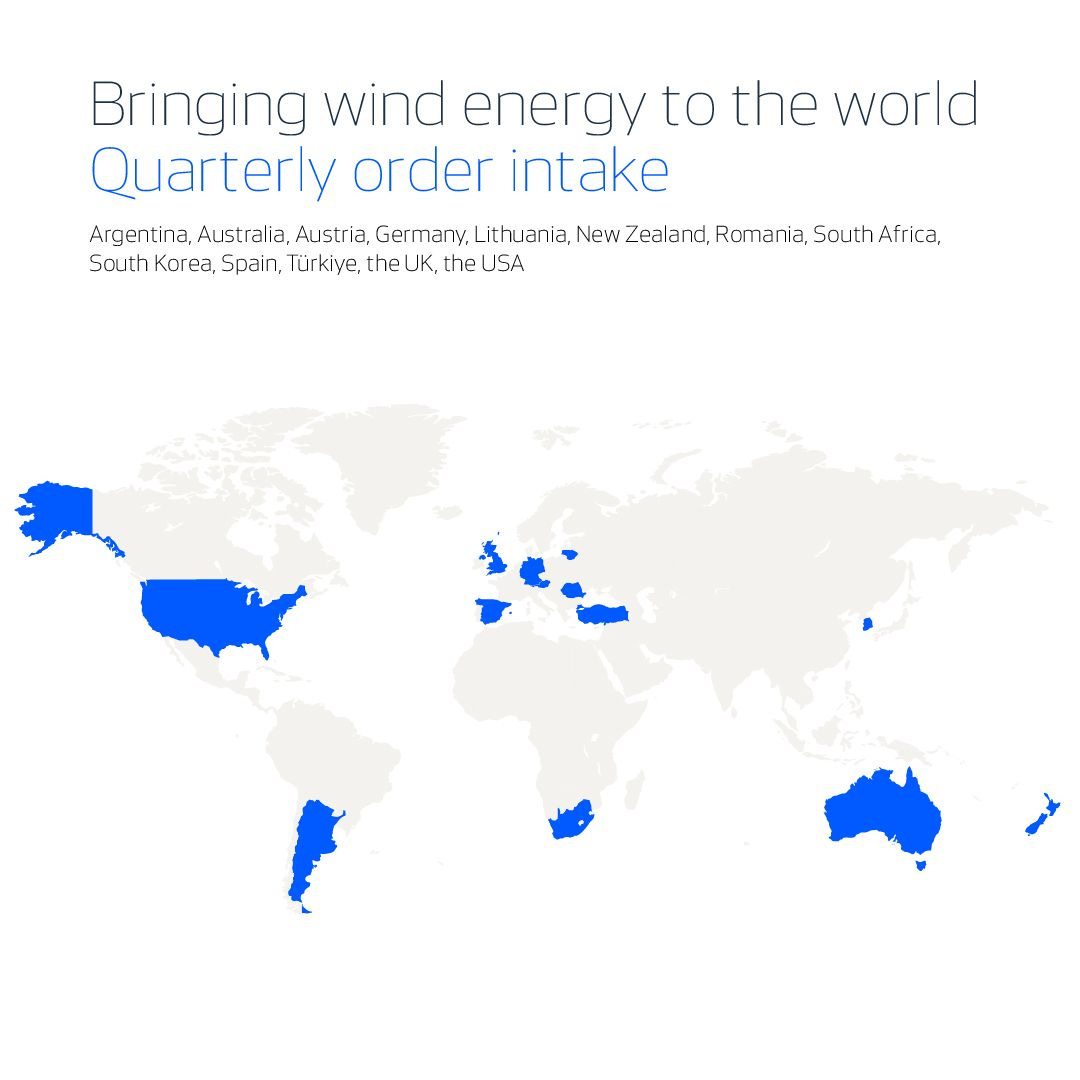

🌍 Vestas sells 2.8 GW in 13 countries in the second quarter

Vestas continues to strengthen its position as a leading OEM in the market. And it does so by closing Q2 with very good figures.

In total, Vestas has closed a total of 19 orders in 13 different countries in this Q2. They may not seem like many, but they have been enough to reach 2.8 GW (including onshore and offshore).

As milestones, Vestas highlights the order of 660 MW for its V236-15.0 MW turbines for the German offshore wind farm "Nordseecluster A" and also a 577 MW EPC order in Australia for its V162-6.2 MW from the EnVentus platform, which is gaining traction. By the way, the first EnVentus turbines in Spain are currently being installed.

Of particular relevance is that Vestas continues to sell many MWs outside Europe and the United States, markets where the rest of the Western OEMs are heading.

_

🌊 Mingyang completes the installation of OceanX, its double-rotor floating platform

We return with Mingyang to announce that it has completed the assembly of its double-rotor platform OceanX, equipped with two MySE 8.3-180 turbines.

Several videos are circulating online about the assembly process that are truly worth watching.

Personally, I love that there are manufacturers who dare to continue innovating and proposing these types of disruptive designs. Designs full of challenges, but that delight the most passionate enthusiasts in the sector.

In the last edition, we conducted an in-depth analysis of this Mingyang prototype. If you missed it, click below 👇

_

🏗️ General Electric will install a prototype of its new Haliade X 15.5 MW in Norway

Enova, a Norwegian state-owned company under the Ministry of Climate and Environment, has funded €29 million for the next prototype of General Electric's Haliade X.

This prototype will validate the design of the announced 15.5 MW-250 version on which GE is pinning its hopes for the offshore market. In fact, GE has dubbed it their "workhorse" product.

This announcement comes after it has been reported in several media that GE had halted the development of its 18 MW turbine to focus on this 15.5 MW version.

The prototype is expected to be operational by 2025 and will undergo tests and trials over a period of 5 years. Afterward, the turbine is scheduled to remain in the same location for another 25 years generating electricity.

Interestingly, despite being installed onshore (specifically in the municipality of Gulen, Norway), it's been reported in the press that it will help reduce the cost of floating wind. What I'm not clear on is how, beyond increasing the turbine's size itself.

_

🚀 X1 Wind secures €13 million in funding for a 6 MW floating prototype

The NextFloat+ project led by the Barcelona-based startup X1 Wind has secured €13.4 million in funding from European Innovation Funds to advance the industrialization and scalability of its floating wind platform, PivotBuoy.

The company's next step is to develop a pre-commercial prototype based on the X90 platform, capable of hosting turbines ranging from 6 to 8 MW with a rotor diameter between 140 and 180 meters. This prototype will have a capacity of 6 MW and will be installed at a test site in the Mediterranean Sea.

This would be a precursor to the X150, which would accommodate the sizes currently envisioned for projects in the 2030 horizon (220-240 meters and 14-16 MW). Although the company is already mentioning the need to reach up to 20 MW.

X1 Wind's platform features a Single Point Mooring (SPM) anchoring system and is of Tension Leg Platform (TLP) type.

It will be interesting to follow the project, so if you don't want to miss out, subscribe.

NextFloat+ is a project led by a consortium formed by X1 Wind (project coordinator), Technip Energies, and NextFloat Plus SAS.

_

🎥 Spectacular video of the assembly of the CSSC Haizhuang H260-18MW prototype

Recently, the Chinese state-owned company CSSC has installed the first prototype of its H260-18MW.

This prototype has directly propelled them into the top 3 largest turbines in the world alongside Mingyang with their MySE 18-260 and Goldwind with their GWH252-16 MW.

Now, a video has circulated on the internet showing the entire process of transportation, construction, and assembly, allowing viewers to appreciate some details and get an idea of the magnitude of this turbine.

_

🌬️ Video of the Vensys 3.8-126 wind turbine by Innovent with the Nabrabase foundation

Although excessively short, I found this video interesting of the wind turbine installed by the French developer Innovent in collaboration with Nabrawind.

What's interesting about this project is:

On one hand, Nabrawind's work with the 102-meter tall tower solution and the Nabrabase foundation, which reduces the use of concrete by 300 m3 and avoids execution problems in complex terrain like this natural spit.

On the other hand, the Vensys 3.8-126 wind turbine, which although German, has been 70% owned by Goldwind since 2008, and the wind turbines they market essentially have the same technology. It's not a very common turbine in these latitudes.

Also interesting is the wooden hut seen at the base of the tower, acting as the ground basement where most likely the transformer, medium voltage switchgear, converter (I believe the Vensys/Goldwind design has all these components at the base, hence the "compact" nacelle), and some low-voltage cabinets are located.

Thank you very much for reading Windletter and many thanks to Tetrace and RenerCycle, our main sponsors, for making it possible. If you liked it:

Give it a ❤️

Share it on WhatsApp with this link

And if you feel like it, recommend Windletter to help me grow 🚀

See you next time!

Disclaimer: The opinions presented in Windletter are mine and do not necessarily reflect the views of my employer.