Windletter #92 - Chinese manufacturers are already here, and WindEnergy Hamburg is the proof

Also: the end of the Gamesa brand, the OceanX and the Mingyang MySE18.X-292 are already in operation, a 15 MW onshore prototype, and more.

Hello everyone and welcome to a new issue of Windletter. I'm Sergio Fernández Munguía (@Sergio_FerMun) and here we discuss the latest news in the wind power sector from a different perspective. If you enjoy the newsletter and are not subscribed, you can do so here.

Windletter is sponsored by:

🔹 Tetrace. Specialized services in operation and maintenance, engineering, supervision, inspection, technical assistance, and distribution of spare parts in the wind sector. More information here.

🔹 RenerCycle. Development and commercialization of solutions and specialized services in the circular economy for renewable energies, including comprehensive dismantling of wind farms and waste management, refurbishment and sale of components and wind turbines, management and recycling of blades and others. More information here.

Windletter está disponible en español aquí

Here’s what was most read in the latest edition: the video of the first major corrective maintenance on a floating offshore wind turbine, the presentation video of the Nordex N175/6.X, and how deep we can take fixed-bottom offshore wind.

Last week, we had a very interesting #91 edition on floating wind maintenance, so check your inbox if you missed it.

That said, let's get to this week's news.

💨 Wind Energy Hamburg: Chinese OEMs are coming in full force

For those who don't know, Wind Energy Hamburg is the largest wind industry fair in Europe. It is held biennially, and unlike WindEurope fairs, it is organized in a way that we might consider more "independent."

This makes it a more open fair, where manufacturers and suppliers from all over the world actively participate, including the Chinese OEMs. And this edition of Wind Energy Hamburg has seen the highest presence and prominence of Chinese manufacturers in its history. The feeling is that their commitment to the European market is clear.

It’s not the first (nor the last) time we've talked here about Chinese manufacturers and their incursion into the European Union. And although much is said about the "Chinese threat", the reality is that Europe (and especially the EU) remains a territory where only a few contracts have been awarded so far (which we covered in Windletter #76). In fact, according to Wood Mackenzie, Chinese OEMs only represented 0.4% of installed capacity in the EU between 2013 and 2023.

That said, Wind Energy Hamburg has been a clear demonstration that the Chinese are already trying to enter the European market decisively and without hesitation.

Leading the Chinese advance has been Paulo Soares, with extensive management experience in leading OEMs, who is now Managing Director of Sany for Europe.

Soares made several remarks that did not go unnoticed, questioning "who subsidizes whom," referring to the multitude of components that European manufacturers buy from China. He has also been very active on social media lately, pointing out some of the weak points in the European discourse when it comes to protecting the local supply chain, such as Envision's arrival in Spain to manufacture batteries, Mingyang’s potential entry into Italy, or the agreement between Mingyang and Siemens China, the extent of which is still unknown.

Regarding product presentations, Sany introduced two models for the European market, with 7.8 MW and 175-meter rotors, and 8 MW and 185-meter rotors, respectively. These models are aimed directly at competing with the next generation of onshore turbines from Western OEMs, which will likely coincide with Sany's goal of installing series turbines in Germany by 2026.

Other announcements from Chinese manufacturers also included:

Mingyang continues showing its strength with offshore, with the OceanX, and the MySE 18.X-20-292 prototype.

Windey calling for competition and even cooperation as a way to continue improving. There are also rumors of a 25 MW prototype with a rotor diameter of over 300 meters using DFIG technology.

It's also interesting that Goldwind and Envision did not attend the fair, although I know they are also moving and hiring staff for their development in the European market.

You can read more about this from our friend Kiko Maza (who published first) with his excellent virtual visit to Wind Energy Hamburg, where he covers this and other very interesting topics.

_

_

🤔 Is the Gamesa brand coming to an End?

At Windletter, we don't like to fuel rumors or create controversies, but the truth is, this has been on my mind for a while, and lately, I've been seeing some signs. I thought it was worth bringing up.

Since Siemens Energy acquired 100% of Siemens Gamesa’s shares, a gradual integration process has been underway. This is logical and normal.

In the case of public events, it’s becoming increasingly common for them to be held under the Siemens Energy brand, or at least with joint stands (as was the case at Wind Energy Hamburg). This makes sense, as in most cases, interests, customers, and complementary products are shared.

But the truth is, I increasingly see the Gamesa brand being relegated to the background, and I've even seen several posts on social media (although not officially yet) referring to "Siemens Energy Wind Power".

A clear sign that this could be the future brand of Siemens Energy's wind division. If this were to happen, it would undoubtedly be sad for the nostalgic among us.

However, it's also true, and I know this firsthand, that in informal conversations in markets where Gamesa had a strong influence, its name is still used to refer to Siemens Gamesa.

We’ll keep an eye on the developments.

_

🌊 The OceanX and the Mingyang MySE18.X-292 are now operational

Continuing with the brief but interesting LinkedIn posts by Qiying Zhang, President of MingYang Smart Energy, this time he posted a couple of videos showcasing the company's latest updates.

The first one is of the MySE18.X-292 prototype, which is now operational after surviving the devastating Typhoon Yagi.

The second one features the MySE18.X-292 already in operation:

There’s even another video where the prototype can be seen working at 6 m/s, which, according to Zhang himself, equates to about 4 MW of power.

_

🇰🇷 Unison develops South Korea’s most powerful offshore wind turbine with 10 MW

A couple of weeks ago, we discussed how the South Korean manufacturer Doosan Enerbility is developing a 10 MW wind turbine, despite being a company with barely 300 MW of track record in the sector.

Now, through Phillip Totaro, we’ve learned that Unison, another manufacturer from the same country, has developed a direct drive turbine of the same power, having built two prototypes that it plans to test soon.

The company's goal is to conduct a testing period and begin commercialization in the first half of 2026. They seem to understand that the testing phase is essential.

On their somewhat outdated website (no press releases since 2021), only the 2 MW and 4 MW platforms are listed.

I wonder if these machines will be able to compete with established companies with much larger volumes in the South Korean market.

_

🏗️ Sany successfully installs the prototype of a 15 MW onshore wind turbine

Sany has successfully installed the first prototype of its SI-270150 platform. An onshore machine with an impressive 15 MW of power—no small feat. According to Sany, it has a design lifespan that can be extended up to 30 years, a rotor diameter of 270 meters, and a blade length of 131 meters.

The prototype will undergo more than a year of operational testing at an experimental wind farm to thoroughly verify the reliability of its components and the entire system under real conditions.

Honestly, this race toward infinity by the Chinese OEMs has me puzzled, especially in the onshore sector. It’s clear that these machines are aimed at their local market and specific locations, as I find it virtually impossible to install such a large wind turbine in Europe at present or in the short term.

No developer currently has a wind turbine of these dimensions included in their environmental and administrative permits, and I don’t see any sense in adding one in the short term either.

Moreover, except in very rare cases, transporting such a machine by land in many European countries is literally impossible.

If I had to bet, I think it will still be many, many years before we see such a wind turbine in Europe (if we ever do).

_

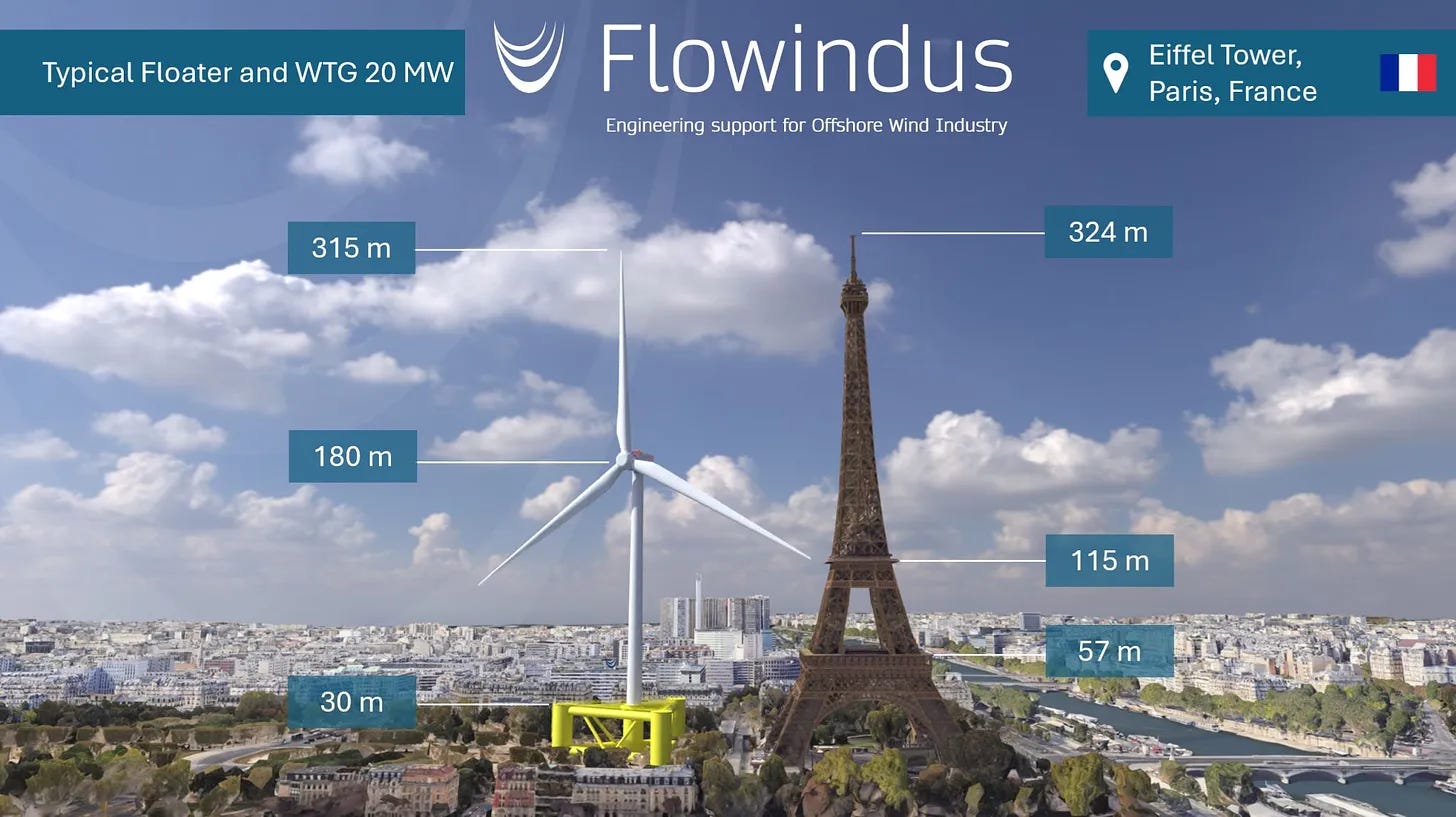

⚡The impressive size of a 20 MW floating wind turbine

I loved these 3D renders I found on LinkedIn, shared by Pierre Vuillemin, CEO, and co-founder of Flowindus.

A quick and clear way to get a sense of the true size of a 20 MW floating wind turbine, including the platform.

Because a picture is worth a thousand words. You can see more renders like this one here and here.

Thank you very much for reading Windletter and many thanks to Tetrace and RenerCycle, our main sponsors, for making it possible. If you liked it:

Give it a ❤️

Share it on WhatsApp with this link

And if you feel like it, recommend Windletter to help me grow 🚀

See you next time!

Disclaimer: The opinions presented in Windletter are mine and do not necessarily reflect the views of my employer.