Windletter #102 - Market share forecasts for Western OEMs in 2024-2034. Who will sell the most?

Also: first Vestas V236-15.0 MW™ blades from the Taranto factory, Culzean Floating Wind, N175/6.X prototype with a 179-meter hybrid tower, and more.

Hello everyone and welcome to a new issue of Windletter. I'm Sergio Fernández Munguía (@Sergio_FerMun) and here we discuss the latest news in the wind power sector from a different perspective. If you enjoy the newsletter and are not subscribed, you can do so here.

Windletter is sponsored by:

🔹 Tetrace. Specialized services in operation and maintenance, engineering, supervision, inspection, technical assistance, and distribution of spare parts in the wind sector. More information here.

🔹 RenerCycle. Development and commercialization of solutions and specialized services in the circular economy for renewable energies, including comprehensive dismantling of wind farms and waste management, refurbishment and sale of components and wind turbines, management and recycling of blades and others. More information here.

Windletter está disponible en español aquí

The most-read articles from the last edition were: the interview with Ivar Knutsen, Senior VP of Technical and Supply Chain at Wind Catching Systems, the video of the DEC blade manufacturing process, and RenerCycle’s online store for second-life components and wind turbines.

Now, let’s dive into this week’s news.

🌍 Sales forecast by Western manufacturer for the period 2024-2034

The Danish consultancy Brinckmann has published a report with its market share forecasts by OEM for the 2024-2034 period. The report analyzes the wind market from the perspective of Western OEMs, examining their onshore and offshore sales across various countries and regions.

This is a client-only report, but they have shared an interesting preview on their LinkedIn account, which we will discuss here. Of course, for those interested in the full report, you can contact them through their website.

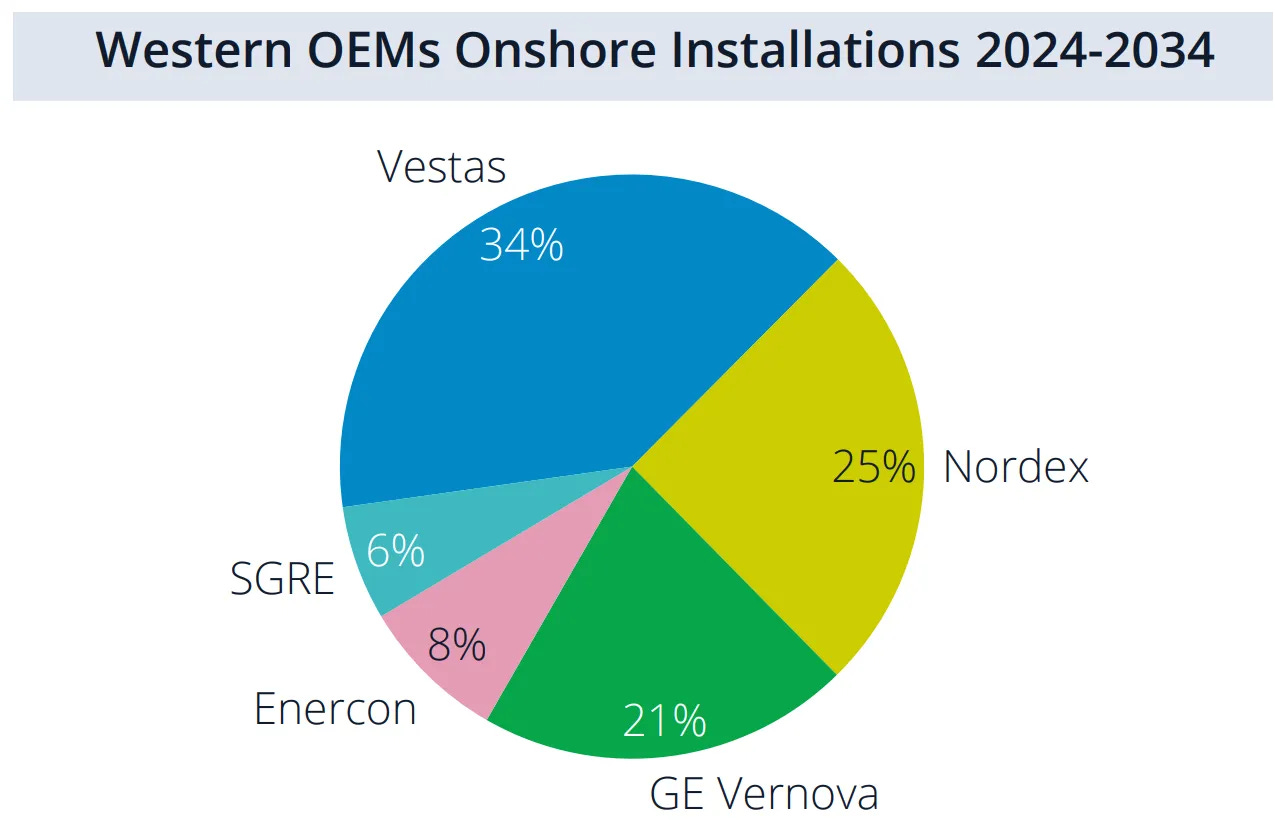

📈 Onshore installations by Western OEM 2024-2034

The first chart is quite surprising. Let’s break it down:

Vestas will dominate the market with a 34% share of installations outside China. This figure is not surprising, as Vestas has just announced its best results in a long time, with a record order backlog, the most geographically diversified distribution among Western OEMs, and its own development pipeline, which will help boost sales.

Nordex takes second place with an impressive 25% market share. Nordex has grown significantly in the past two years, especially capitalizing on Siemens Gamesa’s struggles with its 4.X and 5.X platforms, taking over its market share—particularly in Europe. In fact, in 2024, Nordex reached a record 8.3 GW in orders.

GE Vernova ranks third, securing a significant 21% share, likely thanks to its dominant position in the U.S. market. The return of Trump could change this outlook, but the impact on onshore is expected to be less significant than in offshore.

Enercon remains in fourth place with an 8% market share, keeping its position in line with recent years. The German OEM continues to hold its ground with a differentiated business model and product, remaining the only major OEM not publicly traded. It focuses on specific markets (such as Germany and Turkey) and carefully selected contracts.

Finally, SGRE is the biggest surprise, as Brinckmann forecasts only a 6% market share. Given that the report covers 2024-2034, and considering its 4.X and 5.X platform issues, SGRE has already lost 2-3 crucial years. However, this would still be a major decline for a company that has historically been a market leader. According to Siemens Energy’s latest updates, the 4.X is back on sale, while efforts continue to restore the 5.X. Will SGRE struggle to regain customer confidence?

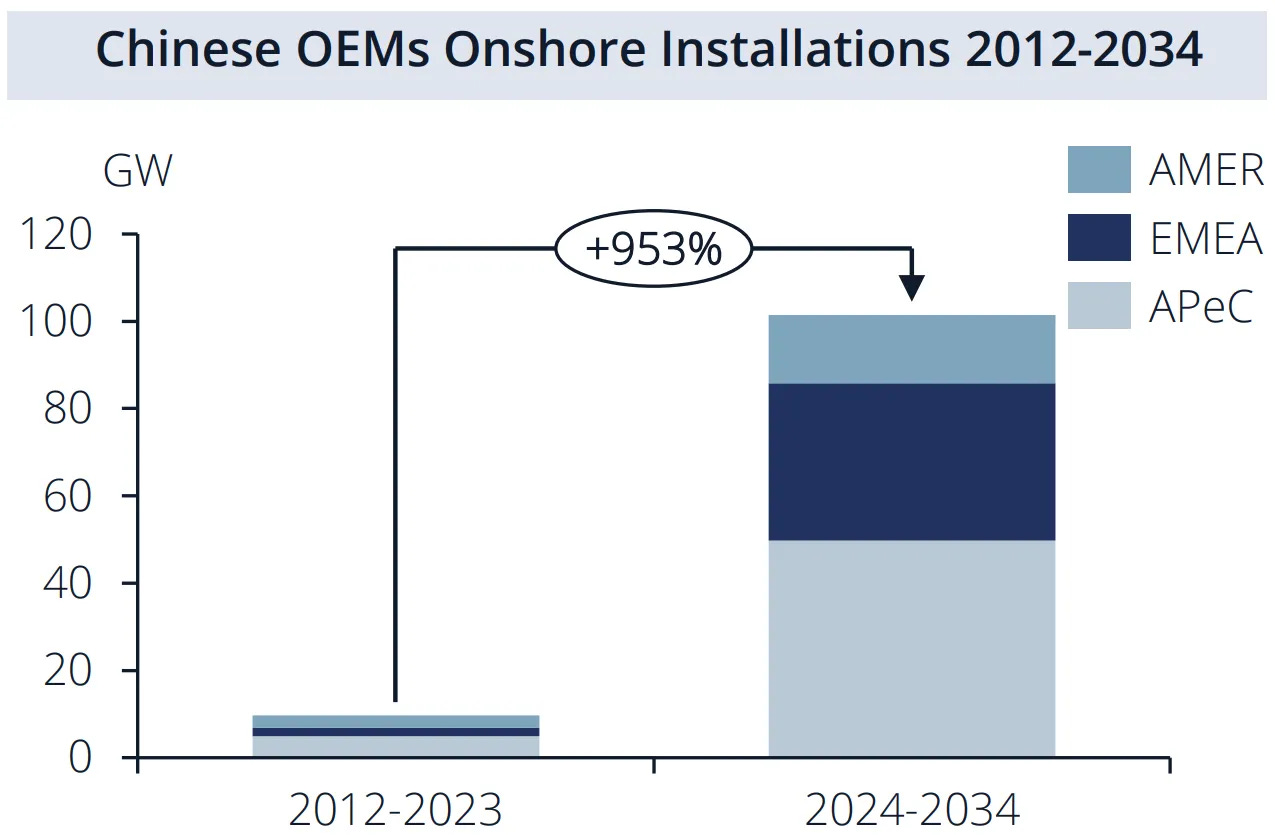

📊 Chinese OEMs ramp up exports

Another hot topic in the wind market is the expansion of Chinese manufacturers beyond their domestic market.

According to Brinckmann’s forecast, Chinese OEM exports will grow from less than 10 GW in the past 12 years to more than 100 GW in the next decade. However, this expansion will primarily occur in Asia, the Middle East, and Africa, where Chinese OEMs are already gaining a significant presence.

In Europe, their market entry is not expected to be as significant, although the chart does not provide granular data for the EMEA region (Europe, Middle East, Africa). The same applies to the United States.

One notable insight is that Goldwind and Envision are expected to dominate Chinese OEM exports between 2024 and 2034, accounting for nearly 90% of total exports. This is surprising, considering the efforts of Sany, Windey, and Mingyang to expand internationally.

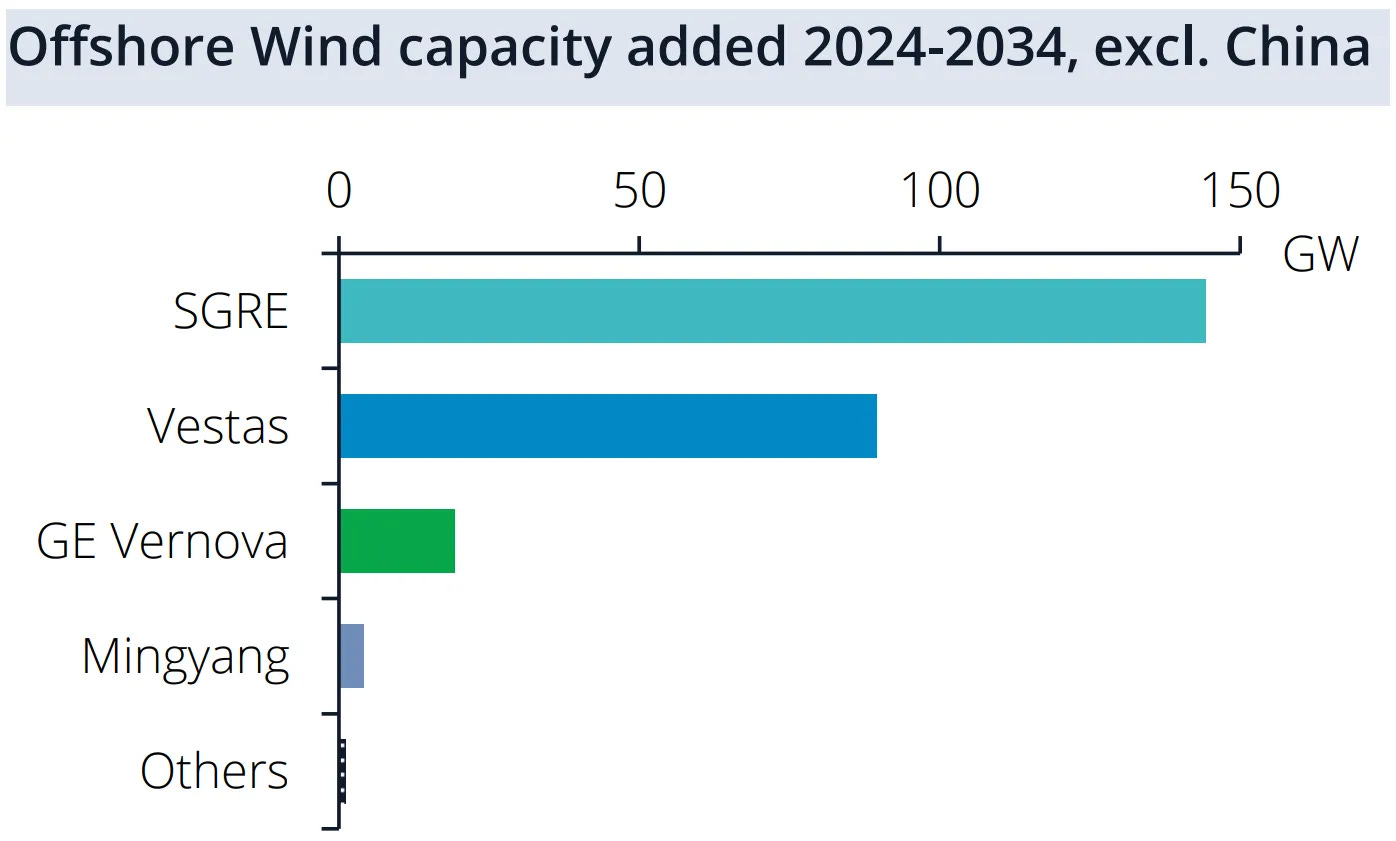

🌊 Offshore market share by manufacturer 2024-2034 (excluding China)

Now moving to offshore wind, where SGRE is expected to maintain its leadership outside China, holding more than 50% of the market share.

Vestas’ offshore installations are projected to rise significantly, driven by its V236 model, which already has a substantial order backlog (over 14 GW, including firm, conditional, and preferred supplier agreements).

SGRE, as the first Western OEM to install a 20+ MW offshore wind prototype, is expected to set the benchmark for competitors, forcing them to follow suit to secure market share after 2030. However, this contrasts with recent statements from Vestas, which sees demand for the V236 beyond 2030.

GE Vernova’s offshore market share remains an open question. Brinckmann forecasts low installation volumes in the short term, but potential market recovery around 2030, contingent on launching a competitive new product.

Lastly, Mingyang’s entry into the European offshore market remains limited. According to Brinckmann, only a few contracts (estimated around 5 GW) are expected. While this is not an insignificant figure, it is far from being a major disruption. These contracts are likely linked to floating wind, where Western OEMs have shown limited interest so far.

You can read the full preview of Brinckmann’s report in this LinkedIn post.

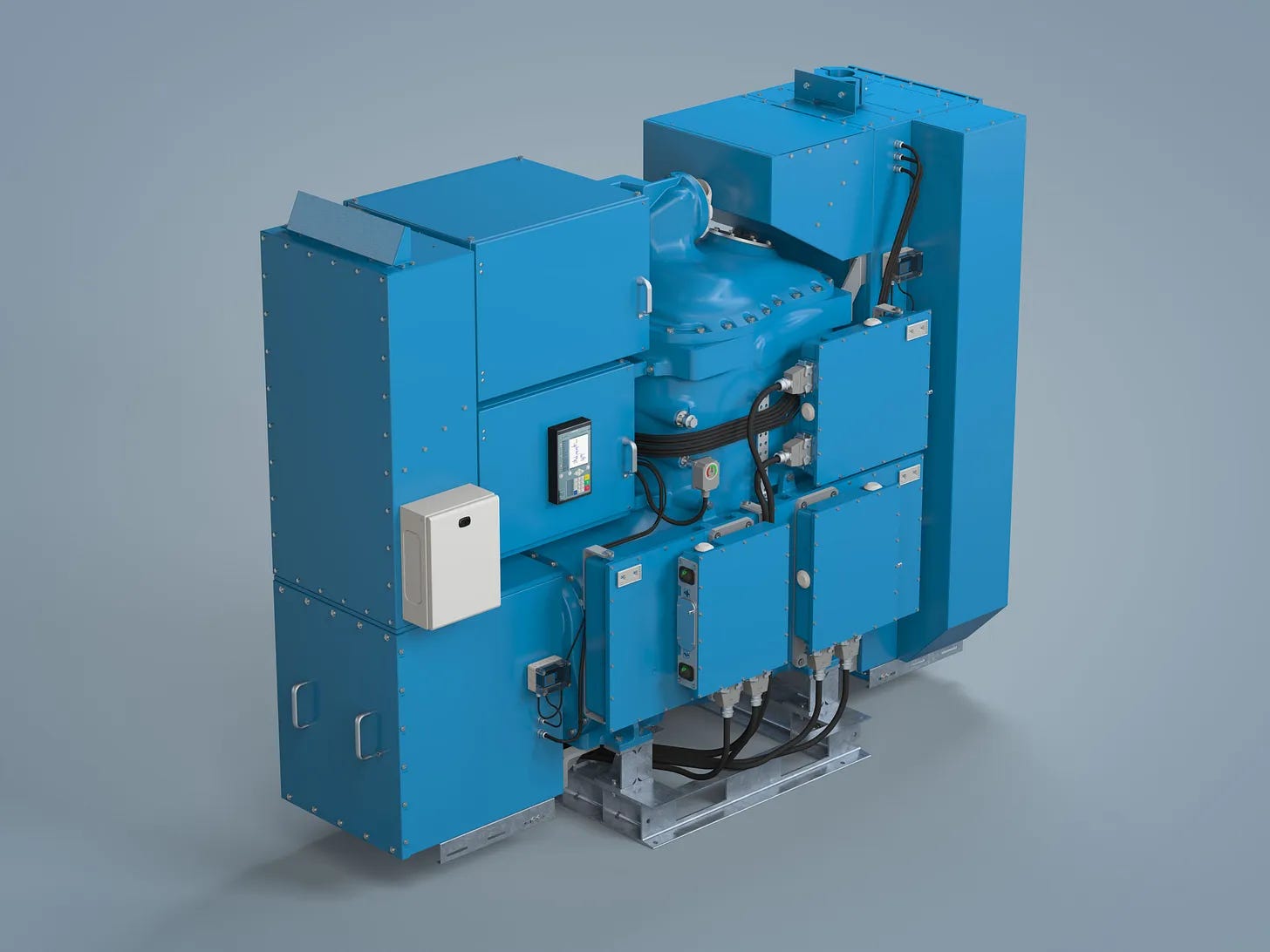

⚡ Siemens’ 72.5 kV GIS Clean Air for offshore wind now has 1,000 units in operation

Here’s an electricity-related news item that caught my attention, given my background in electrical engineering 🙂

All wind turbines, whether onshore or offshore, have a switchgear as the interface between the turbine and the external grid. In this switchgear, the following connections are made:

The cable coming from the turbine’s transformer.

The cable from the adjacent wind turbine that is part of the same electrical circuit.

The cable leading to the next turbine in the circuit or, if it is the last one, to the substation.

Additionally, the switchgear provides protection functions, allowing the turbine to disconnect from the rest of the grid in case of an emergency (such as a short circuit or fire). You can see an electrical diagram here.

Historically, wind turbine transformer output voltages have ranged between 20 and 35 kV (depending on the country) for both onshore and offshore applications. However, in offshore wind, as turbine power increased, voltage levels jumped to 66 kV, and the next-generation turbines are expected to reach 132 kV.

To contain such high voltages in compact spaces, the insulation medium is not atmospheric air but a gas with superior electrical properties. Traditionally, this gas was SF₆ (sulfur hexafluoride), but it has a global warming potential (GWP) 23,500 times greater than CO₂.

For this reason, environmental regulations have pushed electrical equipment manufacturers to develop switchgear solutions using alternative gases. One such example is Siemens Energy’s Blue GIS solutions.

Siemens Energy has just announced that 1,000 units of its Blue GIS 8VM1 (72.5 kV for 66 kV) are now in operation worldwide, with a total of 2,000 units delivered throughout its history. This is a significant milestone, considering that most of these units are likely installed in SGRE offshore wind turbines, though many may also be in competitor turbines.

This product has grown alongside Siemens Gamesa’s offshore expansion and faces little competition in the market due to its highly specialized nature.

For those interested in learning more about SF₆ gas usage in the offshore sector, this EPA (Environmental Protection Agency) report from the United States is very insightful.

🇰🇷 Doosan Enerbility and its 10 MW wind turbine for the South Korean market

A few months ago, we talked about Doosan Enerbility, a South Korean industrial giant with a wind turbine manufacturing division.

Specifically, Doosan Enerbility has a portfolio of 3 MW, 5.5 MW, and 8 MW wind turbines, with rotor diameters ranging from 134 to 205 meters. Its track record in wind energy is rather modest, with 339.5 MW installed across onshore and offshore projects.

The company recently announced that it is developing a 10 MW model, essentially scaling up its 8 MW turbine, for which it has already installed a prototype. Below is a video showing the installation of the DS205-8MW model and the announcement of the 10 MW version, which features the same rotor.

As can be seen, this model features Direct Drive technology and, in fact, physically resembles the Siemens Gamesa SG14.0-236 DD.

Interestingly, Siemens Gamesa and Doosan Enerbility recently signed an MoU (Memorandum of Understanding) under which Doosan would manufacture nacelles for the SG14.0-236 DD at its Changwon factory in South Korea.

There’s something I don’t quite understand in this story—on one hand, Doosan Enerbility seems to be carving its own path as a wind turbine OEM in South Korea, but on the other, it is willing to collaborate closely with SGRE on local manufacturing.

Let’s not forget that South Korea recently held an offshore wind auction, awarding a total of 1,886 MW, of which 750 MW correspond to a single floating wind project.

🚛 The first blades of the Vestas V236-15.0 MW™ start rolling out from the Taranto factory

A few months ago, Vestas inaugurated a new production line at its Taranto, Italy, factory for the V236-15.0 MW™ blades, where the company expects to have 1,300 people dedicated to their manufacturing.

Now, thanks to a LinkedIn post by Matteo Fino, we can see the first blades starting to leave the factory.

As seen, the blades are transported using SPMT (Self-Propelled Modular Transporters). Maneuvering these giants must be a complex, delicate, and impressive task to watch.

Recently, Vestas has also released corporate videos announcing the ramp-up of blade manufacturing in Taranto (video 1 and video 2).

Let’s remember that the Vestas V236-15.0 MW™ is Vestas' flagship bet for offshore wind, with over 14 GW of orders, including firm, conditional, and preferred supplier agreements.

🌊 The Culzean Floating Wind project by TotalEnergies is progressing well

Culzean Floating Wind is a project that had completely gone under my radar. It is an initiative by TotalEnergies, consisting of the installation of a single floating wind turbine to provide electricity to one of its gas platforms of the same name.

The project is located 222 km east of Aberdeen, UK, where the oil company will install a V112-3MW—small by today’s standards, but certainly a good way for TotalEnergies to start gaining experience with floating wind technology.

The export cable to the floating platform is 2 km long, and according to their website, the floating structure will be based on a "new semisubmersible platform concept."

Thanks to a post by Charles Howorth, the project manager, we know that progress is going well, with the nacelle assembly underway. Interestingly, we can see that the hub appears to be pre-installed at the factory.

On TotalEnergies' website, you can find more information about the project, including links to the environmental impact assessment and other permitting documents. This specific document provides a detailed description of the project. Commissioning is planned for this year.

Some of you may find this concept familiar, as it follows the same approach as Norway’s Equinor in Hywind Tampen, though on a much larger scale. In Equinor’s case, 11 wind turbines of 8 MW supply power to multiple oil platforms. In fact, it is the largest floating wind farm in the world.

🏗️ Nordex installs the N175/6.X prototype with a 179-meter hybrid tower

Nordex has installed the prototype of its 179-meter hybrid tower in Santow, Germany. This design was developed in-house by Nordex, leveraging the company’s 15+ years of experience in concrete tower development.

Key milestones achieved by this turbine:

Tallest wind turbine in Germany, with a hub height of 179 m and a total height of 266.5 m (surpassing this unique tower by Max Bögl).

First hybrid tower developed internally by Nordex.

Tallest wind turbine ever installed by Nordex.

Second prototype of the N175/6.X. The first prototype was installed with a 112-meter steel tubular tower in the summer of 2024.

The 179-meter hybrid tower is aimed at the German market and other northern European markets, where such hub heights are much more common due to wind conditions.

Nordex provides the N175/6.X with steel tubular towers at hub heights of 112, 117.5, 142, and 162 meters, as well as hybrid towers with a 179-meter hub height and, in the future, up to 199 meters.

Interestingly, Vestas also has a 199-meter hub height option in its catalog for the V172-7.2MW, but in this case, it is achieved through a cooperation agreement with Max Bögl.

Thank you very much for reading Windletter and many thanks to Tetrace and RenerCycle, our main sponsors, for making it possible. If you liked it:

Give it a ❤️

Share it on WhatsApp with this link

And if you feel like it, recommend Windletter to help me grow 🚀

See you next time!

Disclaimer: The opinions presented in Windletter are mine and do not necessarily reflect the views of my employer.