Windletter #106 - Top 10 wind turbine manufacturers in 2024

Also: SGRE announces a 500 MW order in Egypt, how much offshore wind turbines are going to grow, Enercon presents a new 100% steel hybrid tower, and more.

Hello everyone and welcome to a new issue of Windletter. I'm Sergio Fernández Munguía (@Sergio_FerMun) and here we discuss the latest news in the wind power sector from a different perspective. If you're not subscribed to the newsletter, you can do so here.

Windletter is sponsored by:

🔹 Tetrace. Reference provider of O&M services, engineering, supervision, and spare parts in the renewable energy market. More information here.

🔹 RenerCycle. Development and commercialization of specialized circular economy solutions and services for renewable energies. More information here.

🔹 Nabrawind. Design, development, manufacturing, and commercialization of advanced wind technologies. More information here.

Windletter está disponible en español aquí

The most read pieces from the latest edition were: WindEurope’s 2024 statistics report, the images of the Eolmed floating project, and Kiko Maza’s comparison of OEMs’ financial results.

By the way, I’d also recommend following the Windletter account on LinkedIn — it’s been performing very well lately and we also share industry news there.

Now, let’s get into this week’s news.

📈 Top 10 wind turbine manufacturers in 2024

As every year, the consulting firms BloombergNEF and Wood Mackenzie have published their respective reports analyzing the global market shares of wind turbine manufacturers.

This year, they released their figures just three days apart, allowing us to make a brief comparison between the data presented by each.

As we usually do, let’s go through the key highlights revealed by the data. The main takeaways are:

▶️ A total of 121.6 GW of wind capacity was commissioned worldwide last year, representing a 4% year-on-year growth, according to BNEF.

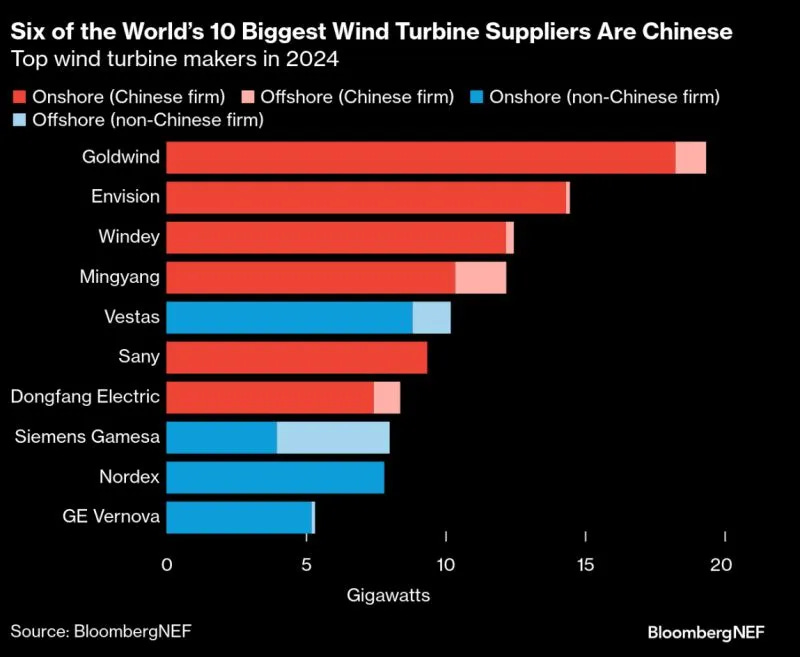

▶️ For the first time since BNEF started publishing this ranking in 2013, the top four positions are held by Chinese manufacturers, who also account for 6 of the top 10, according to BNEF data. Here, we’ll see some differences with Woodmac's numbers later on.

You can find the chart published on Cristian Bogdan Dinca’s account, analyst at BNEF. For those who want to see the specific GW figures, they are available here.

▶️ Goldwind remains the world’s largest wind turbine manufacturer, with 19.3 GW of new capacity installed in 2024. Envision ranks second with 14.5 GW, and Windey comes third with 12.5 GW.

▶️ Vestas ranks fifth with 10.2 GW, consolidating its position as the largest manufacturer outside of China and capturing nearly one third of that market.

▶️ Siemens Gamesa continues to demonstrate a strong presence in offshore, being the manufacturer with the highest installed capacity in 2024, and showing a nearly 50/50 split between the onshore business (where it still faces challenges) and the offshore segment.

▶️ Despite their global expansion efforts, Chinese manufacturers installed 98.6% of their capacity within their borders. This means they exported only around 1.2 GW. According to data accessed by Windletter, that figure could be significantly higher, though the discrepancy may stem from differences in how installed / commissioned / exported turbines are accounted for.

▶️ Approximately 90% of global new wind energy additions were onshore (109.9 GW), while 11.7 GW were offshore.

▶️ According to BNEF data, the top five wind markets remain stable, with China leading (79.5 GW onshore, 6.1 GW offshore), followed by the United States (5.4 GW), Brazil (4.2 GW), Germany (3.9 GW), and India (3.3 GW).

▶️ Nordex surpasses GE Vernova and comes very close to Siemens Gamesa, something that may have never happened before and is even more relevant considering that it only competes in the onshore segment.

▶️ Enercon does not appear in the ranking, but according to publicly available information, it installed 2.8 GW in 2024.

We now move on to Woodmac’s data, which is similar but with some differences, and we include some of the highlights they published.

▶️ Woodmac reports differences in the third, fourth, and fifth positions, with Mingyang, Vestas, and Windey respectively. We don’t know where these differences come from.

▶️ A very relevant data point highlighted by Woodmac is that installations outside of China decreased by 9% year-on-year, affecting the ranking position of Western manufacturers.

▶️ Despite record installations and orders, according to Woodmac, Chinese manufacturers have experienced a drop in profitability due to intense competition and component oversupply.

Is there any other relevant data I might have missed that caught your attention?

I can also tell you that next week we will be publishing an analysis of Chinese manufacturers’ sales outside of China in 2024, broken down by manufacturer and export country, including data and graphs. If you don’t want to miss it, make sure to subscribe.

🇪🇬 Siemens Gamesa announces a 500 MW order in Egypt

The problems Siemens Gamesa has faced in the onshore segment — specifically with its 4.X and 5.X platforms — are well known. These issues led the company to freeze sales of both platforms for several months.

There is still no news regarding the 5.X, other than the fact that a redesign is underway and it could return to the market this year. As for the 4.X, last September SGRE announced to shareholders that it was putting the platform back on sale, although only in selected markets.

Since then, the company has kept a low profile, and although sales may have taken place, to the best of my knowledge, no new contract has been officially announced for the 4.X platform.

However, this week news broke that SGRE has signed a 500 MW contract in Egypt with the Egyptian Electricity Transmission Company (EETC), the country’s state-owned utility.

The announcement did not disclose the turbine model to be installed, but according to industry sources, it could be 100 units of the SG5.0-132 — that is, turbines from the 4.X platform with a “small” rotor designed for high wind speeds like those in the Gulf of Suez.

This is a unique project, as reported in the media, where Siemens Gamesa will be responsible for the development, turbine supply, financing, and operation of the wind farm. It would make sense for this to serve as a flagship project for the platform’s return to the market.

🚢 How much will offshore wind turbines grow?

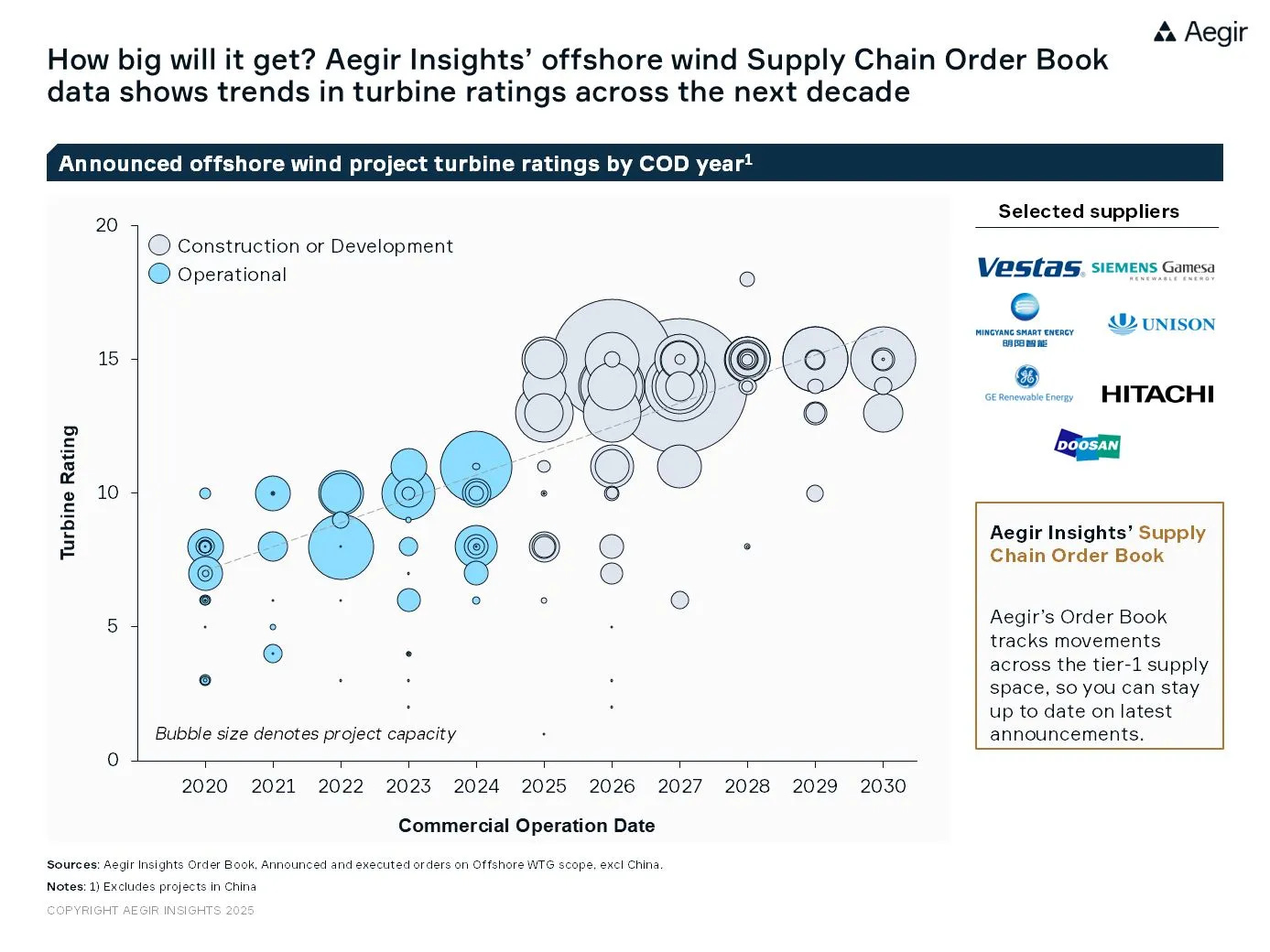

The team at Aegir Insights has published an interesting chart showing the trends in turbine power ratings across markets outside of China.

The chart includes both announced and executed orders from Vestas, SGRE, GE Vernova, as well as Mingyang, Unison, Hitachi, and Doosan Enerbility.

As expected, the chart highlights the strong growth in turbine capacity over the past years, although it also shows that forecasts toward 2030 suggest a plateau or slowdown in this growth.

The main conclusion is that most of the projects and installed GW up to 2030 are expected to be equipped with 13–15 MW turbines. Higher-capacity turbines, with a few specific exceptions, will likely have to wait until the 2030–2035 period at the earliest.

🌬️ United Kingdom launches study to analyse wake effects between offshore wind farms

Energy is neither created nor destroyed, only transformed. That’s why, when wind passes through a wind turbine, it loses part of its energy and slows down. If there’s another turbine right behind it, it will receive this slower, weaker wind. And if there’s a third one, it will receive even less energy. This is called the wake effect.

This effect is taken into account when conducting wind resource studies before installing a wind farm. Moreover, not only the turbines planned for that specific project are considered, but also those from nearby wind farms that already exist or could be built in the future.

The impact of wakes between neighbouring parks developed by different developers is starting to become a source of conflict, as it affects energy production and therefore revenue. Offshore, it has been proven that these wakes can travel for kilometres.

The UK Government is now seeking the most effective way to consider these effects in its planning system, with the aim of reducing conflicts between wind projects.

The University of Manchester has secured funding from the Engineering and Physical Sciences Research Council (EPSRC), a UK government agency, to lead a 12-month research project focused on modelling wind wake effects in British waters. The study will use advanced prediction models to analyse both operational wind farms and those expected to be online by 2030.

For those interested in learning more about wake effects in offshore wind, here are a few useful links to a webinar, presentation, and whitepaper from DNV and RWE on the topic:

📣 Webinar: https://lnkd.in/dWPDc6tT

📣 Presentation: https://lnkd.in/e6B3qsGx

📣 WhitePaper: https://lnkd.in/eZyqQPeM

🗼 Enercon announces a hybrid tower made of modular and tubular steel

An interesting move by Enercon, which has just introduced to the market a tower that, if I’m not mistaken, is a new concept that has not been installed by anyone before.

This is the Hybrid Steel Tower (HST), a 100% steel hybrid tower that combines a first section of modular segmented steel (composed of bolted steel plates), while the upper section is conventional tubular steel.

The objective of this new tower is to reach very high hub heights, similar to those achieved with hybrid concrete-steel towers, without the limitations of conventional tubular steel.

Conventional tubular steel towers require very large diameters in their lower sections (difficult to transport), as well as steel thicknesses that make the designs more expensive.

As a first step, Enercon will offer this tower in its largest models with the following hub heights:

162m for E-175 EP5 E1/E2

175m for E-175 EP5 E2

166m for E-160 EP5 E3

These new HST towers will be available starting in 2026.

🌊 Sany signs its first offshore wind turbine supply contract

The Chinese company Guangdong Energy Group has awarded SANY a contract for the supply of turbines for the Jieyang Shibeishan offshore wind project, with a capacity of 200.4 MW.

The wind farm will include the installation of fourteen 13.6 MW offshore wind turbines and one additional 10 MW unit. This “unusual” turbine combination is due to the project being capped at 200 MW.

The specific turbine model has not been disclosed, but logic suggests it is likely the SI270-13.6MW, SANY’s flagship model.

Something that really surprised me is that, according to SANY’s own LinkedIn post, this contract marks the company’s first order for high-power offshore wind turbines, marking its debut in the offshore sector.

Interestingly, according to expert Shashi Barla, SANY's entry into the offshore market makes it the eleventh manufacturer to offer offshore turbines commercially in China. Quite a bit of competition, right?

Thank you very much for reading Windletter and many thanks to Tetrace, RenerCycle and Nabrawind our main sponsors, for making it possible. If you liked it:

Give it a ❤️

Share it on WhatsApp with this link

And if you feel like it, recommend Windletter to help me grow 🚀

See you next time!

Disclaimer: The opinions presented in Windletter are mine and do not necessarily reflect the views of my employer.