Windstory #12 - Analyzing Chinese manufacturers' sales outside China in 2024

How many wind turbines have Chinese manufacturers sold outside their borders? Which countries do they export to the most? Which are the most international OEMs?

Hello everyone and welcome to a new issue of Windletter. I'm Sergio Fernández Munguía (@Sergio_FerMun) and here we discuss the latest news in the wind power sector from a different perspective. If you're not subscribed to the newsletter, you can do so here.

Windletter is sponsored by:

🔹 Tetrace. Reference provider of O&M services, engineering, supervision, and spare parts in the renewable energy market. More information here.

🔹 RenerCycle. Development and commercialization of specialized circular economy solutions and services for renewable energies. More information here.

🔹 Nabrawind. Design, development, manufacturing, and commercialization of advanced wind technologies. More information here.

Windletter está disponible en español aquí

Windstory is the articles section of Windletter, where we publish single-topic analyses and share interesting stories from the wind energy sector.

From time to time, without a set schedule, a new edition of Windstory will arrive in your inbox. You can read other Windstories here.

Today, we bring an analysis of Chinese manufacturers and their sales outside their local market after coming across some very interesting data.

📊 Sales of Chinese OEMs outside China in 2024

As we have mentioned several times in Windletter, Chinese manufacturers are more active than ever in their international expansion, gaining ground against Western competitors in several markets.

According to industry sources, this expansion of Chinese OEMs is driven by the need to seek profitability in new markets, due to the fierce competition in their local market, where margins are extremely tight.

Through LinkedIn, I found an interesting table from CWEA (Chinese Wind Energy Association), which breaks down the sales of Chinese OEMs in international markets during 2024.

Before moving on to the analysis, it is important to note that, according to Wood Mackenzie with data from 2022, Western manufacturers supplied 92% of all installed capacity outside of China. That figure has most likely decreased in 2023 and even more in 2024, although I have not yet found public data.

In total, Chinese manufacturers exported 904 wind turbines outside their borders, adding up to a total of 5,193.72 MW. This figure contrasts with the one published by BloombergNEF, which reports 1.2 GW of installations outside China. This difference may stem from comparing turbines that are installed, commissioned, or exported.

👉 According to industry sources, some Chinese manufacturers do not offer the full scope, but only provide supply and maritime transport, as they lack local installation capabilities. Therefore, for statistics recorded from China, it is easier and more logical to refer to exported wind turbines rather than installed or commissioned ones.

In the following table, you can see a breakdown by manufacturer, destination country, total capacity, market share, and the average capacity of the wind turbines, among other details.

From the table, we can highlight several key points:

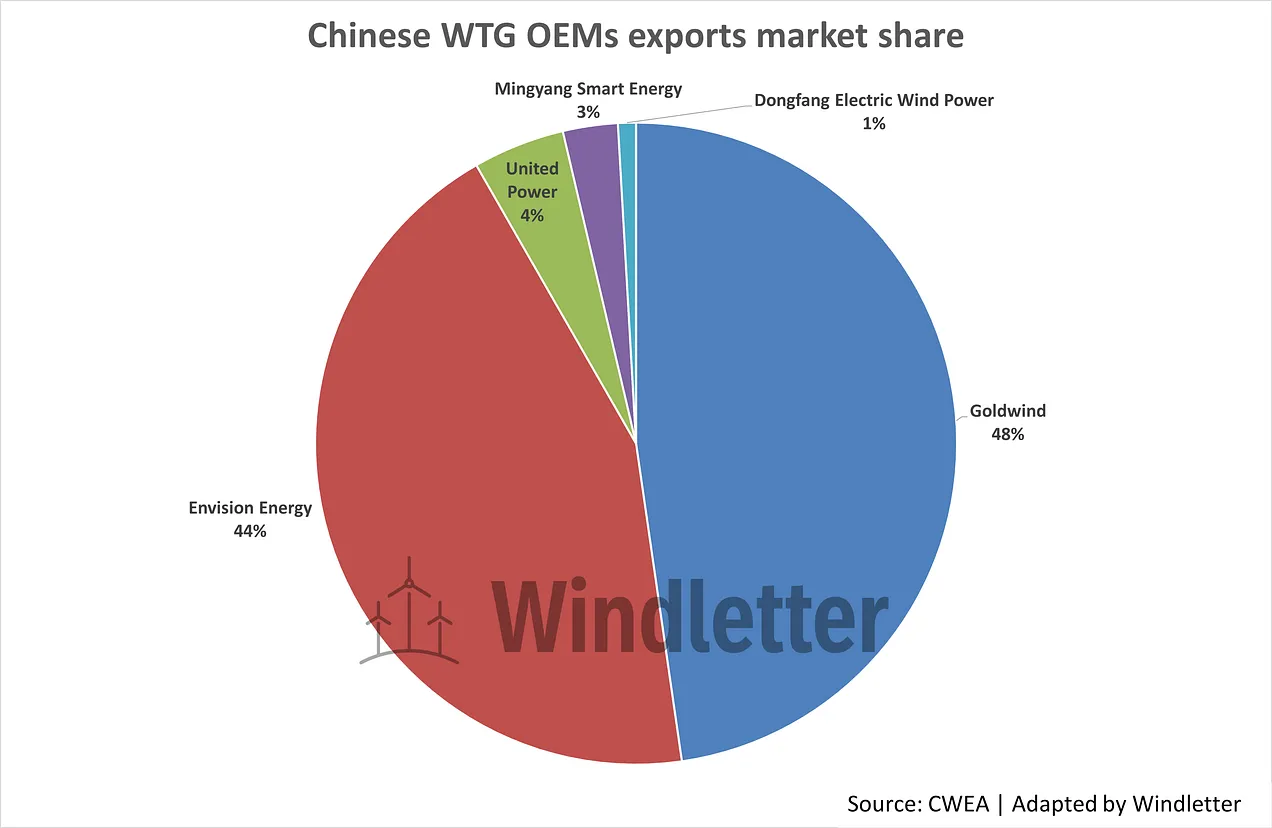

▶️ Goldwind leads exports with 450 units delivered and a total capacity of 2,478.42 MW, representing 47.72% of total exports. For many years, Goldwind has been the most international of the Chinese OEMs.

▶️ Goldwind’s presence in Brazil stands out, where it has delivered a total of 108 units (648 MW). This has undoubtedly been one of the reasons why Goldwind decided to open a nacelle factory there.

▶️ As a reference, according to market sources, Goldwind offers the following models outside China: GW136 4.8; GW155 4.8; GW165 6.0; GWH170 7.2; GWH175 7.8 and GWH182 with versions of 6.2, 7.5, and 8.0 MW.

▶️ Envision Energy follows closely, with 378 units delivered and a total capacity of 2,284.75 MW, accounting for 44% of total exports. Envision focuses its sales in fewer countries, while Goldwind has a much more diversified presence. Together, they account for more than 90% of all exports.

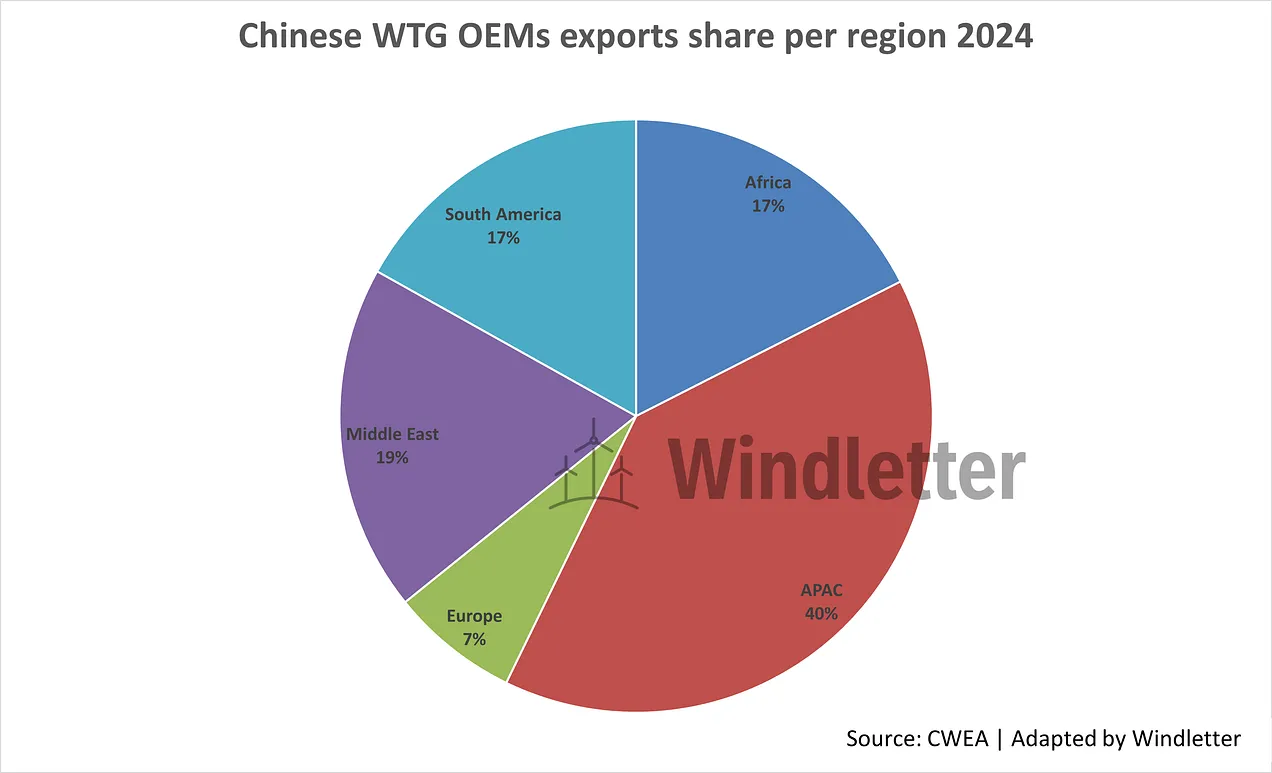

▶️ By region, APAC accounts for 40% of exports. Meanwhile, Africa (17.5%), the Middle East (18.9%), and South America (16.9%) receive similar volumes. Europe receives only 7% of exports.

▶️ In South America, apart from Brazil with 648 MW, there is Argentina with 102 MW and Chile with 126 MW, all of them from Goldwind.

▶️ The United States does not appear in the table, nor do Canada or Mexico. Likewise, the largest and most mature European markets are absent, except for France (with a negligible volume from in-house developments) and Greece, a country with just 5 GW of installed capacity. Chinese OEMs are still struggling to penetrate these markets, although it is well known in the industry that they are actively trying.

▶️ Saudi Arabia is the country that has received the most MWs, with 780 MW, all from Envision. In fact, Envision even formed a joint venture with Saudi Arabia’s Public Investment Fund (PIF) and Vision Industries to establish a factory in the country.

▶️ As expected, all exported wind turbines so far are onshore.

▶️ The average capacity per wind turbine is 5.75 MW, with manufacturers like United Power and Envision Energy reaching turbines of up to 7.7 MW in some projects. For reference, onshore wind turbines installed in Europe in 2024 have an average capacity of 4.5 MW.

▶️ Serbia, Greece, Romania, and Bulgaria consolidate the expansion of Chinese wind turbines in Europe, exceeding 300 MW installed in 2024. France also appears on the list, thanks to Envision, likely through its own developments.

▶️ Something doesn’t quite add up with India, as it is well known that both Envision and Sany have received significant orders in the country, yet they do not appear in this table. Perhaps they were accounted for in 2023 or scheduled for 2025, but not in 2024.

Soon, we will analyze the sales of Chinese OEMs in their domestic market. If you don’t want to miss it, subscribe.

Thank you very much for reading Windletter and many thanks to Tetrace, RenerCycle and Nabrawind our main sponsors, for making it possible. If you liked it:

Give it a ❤️

Share it on WhatsApp with this link

And if you feel like it, recommend Windletter to help me grow 🚀

See you next time!

Disclaimer: The opinions presented in Windletter are mine and do not necessarily reflect the views of my employer.