Windletter #94 - When geopolitics cancels the development of 32 GW offshore

Also: global orders by manufacturer in Q3, Vestas opens a blade manufacturing line for the V236 in Italy, an autonomous robot for bolt tightening, and more

Hello everyone and welcome to a new issue of Windletter. I'm Sergio Fernández Munguía (@Sergio_FerMun) and here we discuss the latest news in the wind power sector from a different perspective. If you are not subscribed, you can do so here.

Windletter is sponsored by:

🔹 Tetrace. Specialized services in operation and maintenance, engineering, supervision, inspection, technical assistance, and distribution of spare parts in the wind sector. More information here.

🔹 RenerCycle. Development and commercialization of solutions and specialized services in the circular economy for renewable energies, including comprehensive dismantling of wind farms and waste management, refurbishment and sale of components and wind turbines, management and recycling of blades and others. More information here.

Windletter está disponible en español aquí

The most read articles from the last edition were: Lars Bondo's post on the possibility of limiting the size of wind turbines, the article on turbines for very low wind, and the video on X1 Wind’s technology.

In addition, last week we published a Windstory edition with a report on the journey of DemoSATH, the floating prototype from Saitec Offshore Technologies, up to its first anniversary in operation. The report includes firsthand information from Saitec, I recommend checking it out 👇

That said, let's get to this week's news.

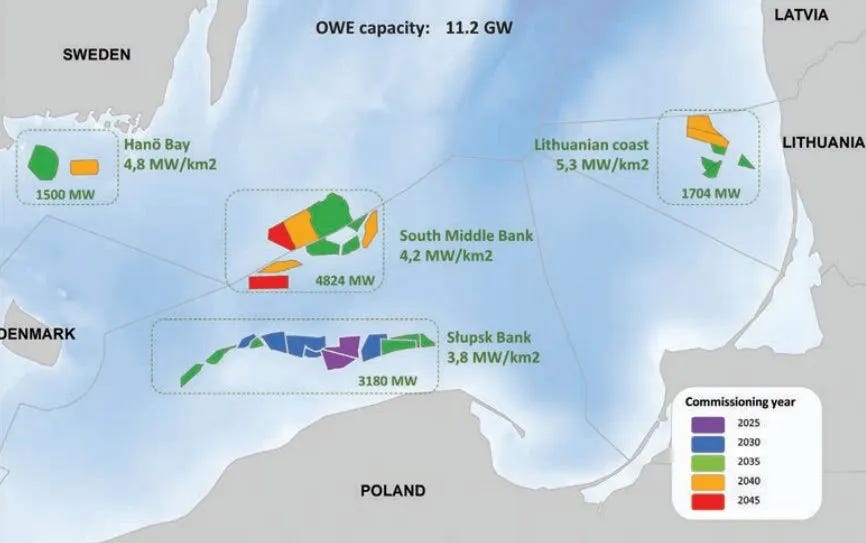

🚫 Sweden cancels 13 offshore projects due to potential Russian threat

On Monday, November 4, the Swedish government announced, to the surprise of many, the cancellation of 13 offshore projects with a total capacity of 32 GW, all located in the Baltic Sea.

Most of the projects were in an early development phase. Among the affected offshore wind developers are OX2, Eolus, Ørsted, RWE, Freja Offshore, Deep Wind Offshore, and Statkraft.

The reason for this cancellation, according to the government, is that installing these wind farms could have unacceptable consequences for Sweden's military defense, given its border with Russia across the Baltic Sea.

According to the Swedish Armed Forces, the wind farms could affect sensors and radars used by the military, making it difficult for the country to respond to any potential future attack from Russia.

Some media report that the Kaliningrad area is particularly sensitive. This is an isolated region of Russian territory bordered by Lithuania to the north and east and Poland to the south.

WindEurope claims that the Swedish military has been blocking offshore wind projects for years, and the government has not done enough to address this conflict.

It is indeed curious that other countries with access to the Baltic Sea and similar areas have not raised such objections. In fact, even Poland seems to see it as an opportunity to increase its surveillance systems, and it plans to equip offshore wind farms with sonar and radar systems in collaboration with its armed forces.

Moreover, given the offshore plans of countries like Poland and Lithuania, projects promoted by these countries should also be problematic for Sweden.

In this regard, WindEurope collaborates with NATO (to which Sweden recently joined, precisely due to the Russian threat) and the European Defence Agency (EDA) to respond to concerns like those raised by the Swedish government and military. This includes the “Symbiosis” project, which aims to promote the coexistence of offshore wind with defense operations and systems.

Another interesting point raised by WindEurope is that this project cancellation reveals the weaknesses of Sweden's “open-door” development system, where developers can freely choose areas without prior government screening.

In most countries, administrations first identify certain areas that do not conflict with other activities such as defense, fishing, or environmental care. This approach provides legal certainty and avoids many “surprise” cancellations later on.

Despite having attractive maritime space and conditions, the reality is that Sweden currently has only 200 MW of installed offshore wind power—a modest figure considering its neighbor Denmark has 2.6 GW.

_

_

📊 Global wind turbine orders by manufacturer in Q3

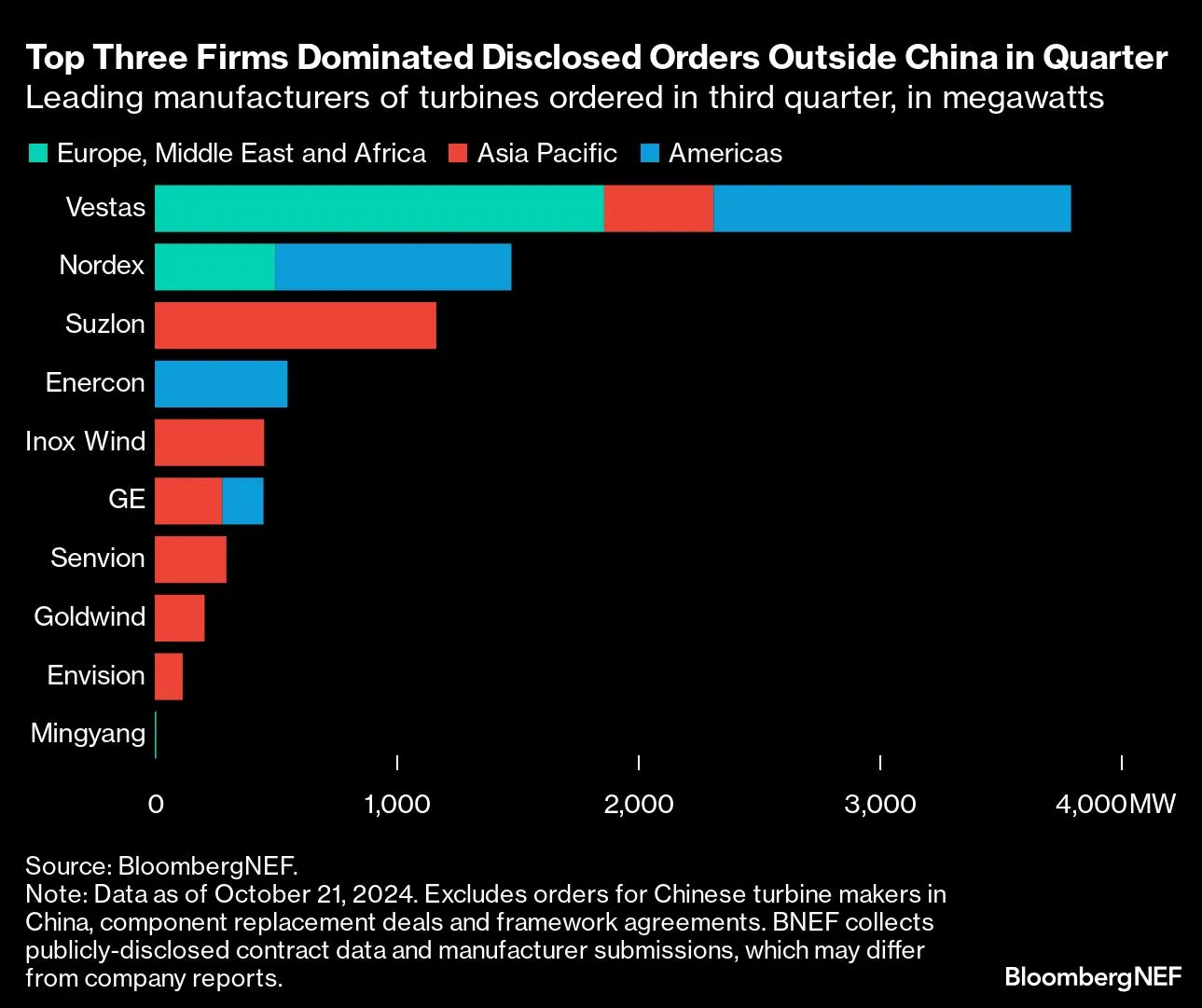

Cristian Bogdan Dinca, an analyst at BloombergNEF, shared on LinkedIn a chart detailing wind turbine orders by manufacturer in Q3 (excluding orders in the Chinese market).

Key highlights:

Vestas had a strong performance, selling nearly 4 GW, almost double that of second-ranked Nordex.

Suzlon ranks third, a manufacturer whose orders, if I’m not mistaken, are entirely located in India.

Enercon is fourth with its orders 100% destined for the Americas region, which is curious for a manufacturer traditionally focused on the European market. Recently, they energized a 140-turbine wind farm in Chile.

The position of Inox Wind is also noteworthy; an Indian manufacturer relatively unknown in these regions ranks fifth, driven by its local market.

Absence of Siemens Gamesa, which did not sell a single megawatt in the entire quarter. The company continues to face challenges in onshore (although the SG4.X is back on the market) and has not closed any offshore contracts.

_

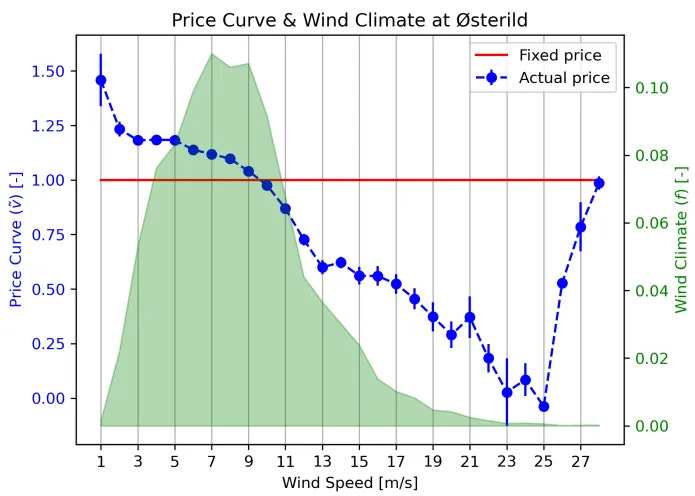

⚡ Would it make sense to design wind projects based on energy prices?

A fascinating article by Kiko Maza analyzes the possibility of designing wind farms with the goal of maximizing captured revenue in the electricity market rather than maximizing generated energy.

In other words, challenging the traditional model of maximizing AEP (Annual Energy Production) with a new model that maximizes AEV (Annual Energy Value).

The article stems from a study by DTU, which also introduces the concept of AEV for the first time, demonstrating that in markets with high wind penetration, turbines optimized for low wind speeds (low power density) are the best option. You can check the study paper here.

Regarding turbines optimized for very low winds, it is worth revisiting this article.

But it’s best to read Kiko’s article on LinkedIn and also check out the comments section, as it has sparked much debate.

_

🤝 Siemens Gamesa and Doosan Enerbility sign an agreement to manufacture SG15.0-236 DD nacelles

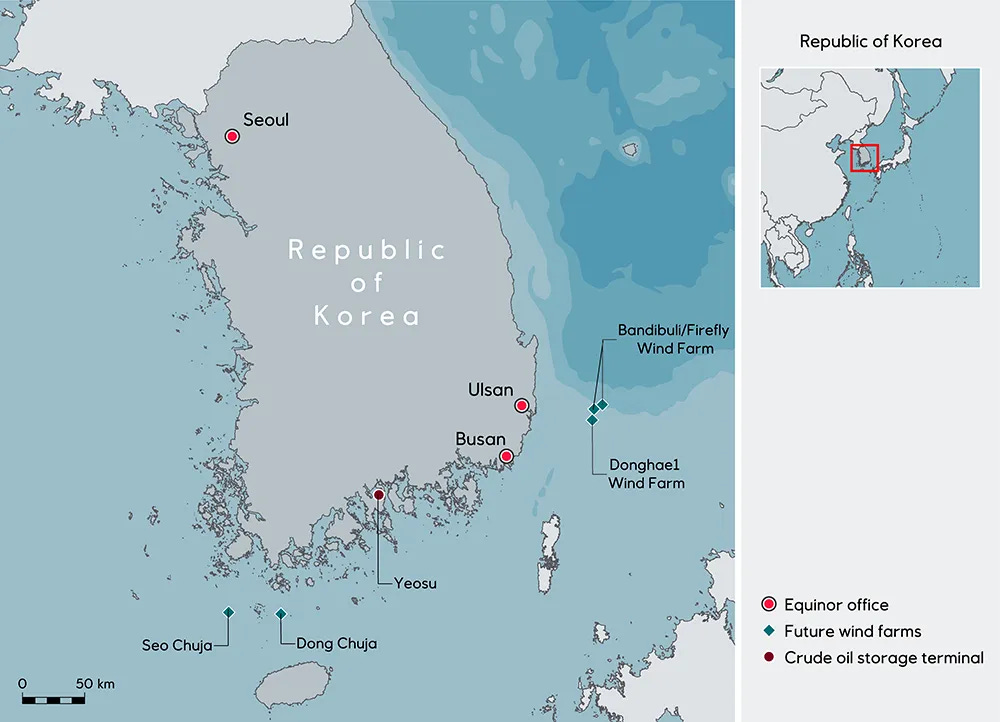

We recently discussed Doosan Enerbility, the South Korean manufacturer, in Windletter and wondered how a niche manufacturer with just 300 MW installed could be profitable or remain active in the sector, considering the competition and narrow margins.

Well, Siemens Gamesa and Doosan Enerbility have just signed an MoU (Memorandum of Understanding) through which Doosan would manufacture the SG14.0-236 DD nacelles at their South Korean plant in Changwon.

This agreement has also been signed by Equinor, the developer of the 750 MW Bandibuli/Firefly Floating Offshore Wind Farm project, located off the coast of Ulsan. This would be the project equipped with these nacelles.

This is a very interesting move, allowing Siemens Gamesa to enter new markets without making large investments in factories and with an important local industrial partner.

Localizing component manufacturing in these markets is often challenging and can significantly increase turbine prices. Relying on a local industrial partner can make things much easier.

Equinor is preparing to participate in upcoming auctions for offshore wind energy in the country. South Korea recently granted grid connections for 6 GW of floating wind spread across 7 parks.

_

🏭 Vestas inaugurates V236-15.0 blade manufacturing line in Taranto, Italy

Vestas has inaugurated a new production line for the V236-15.0 MW blades at its plant in Taranto, Italy. This is an interesting move, as the blade molds were developed at Vestas’ Lem factory, and the first 115.5 m prototypes were manufactured at Vestas’ offshore blade factory in Nakskov.

As a result of this new production line in Taranto, the factory has increased its workforce over the past year from 700 to 1,600 employees, generating a significant impact on the local economy. Additionally, the company expects to reach 2,000 employees at the plant in the coming months, around 1,300 of whom will work on the V236.

Considering how labor-intensive blade manufacturing is, Italy’s labor cost has likely been attractive compared to costs in Denmark.

Vestas also took the opportunity to emphasize “Made in Europe and Made by Europe”.

Apart from the Taranto line, Vestas also plans another blade factory in Poland, where the V236-15.0 MW model has been well received.

Remember that Vestas has over 14 GW of orders for this model, including firm, conditional, and preferred supplier contracts.

_

🤖 An autonomous robot for bolt tightening

The Dutch company IntoMachines B.V. has introduced what it calls the Autonomous Bolting Machine (ABM), an autonomous machine that can tighten bolts used in the wind industry in an automated and precise manner.

According to the company, this robot can work with various bolts used in several turbine components, such as:

Anchor bolts between nacelle beams in the factory

Connections between tower sections

Blade-to-hub connections

Yaw system bearing installation

Below is a video of the system in action. Important to note that the video is in fast-forward mode, and the robot takes 45 seconds to tighten a bolt and move to the next one.

This is a patented design by the company, developed with the support of the Netherlands Enterprise Agency (RVO) | Partner in Sustainable Development, TKI Offshore Energy, and in collaboration with Nordex Group.

_

Thank you very much for reading Windletter and many thanks to Tetrace and RenerCycle, our main sponsors, for making it possible. If you liked it:

Give it a ❤️

Share it on WhatsApp with this link

And if you feel like it, recommend Windletter to help me grow 🚀

See you next time!

Disclaimer: The opinions presented in Windletter are mine and do not necessarily reflect the views of my employer.