Windletter #105 - Breaking down Europe’s wind power numbers in 2024

Also: Summary of Western OEMs' results, Germany’s first offshore wind farm to be decommissioned, Modvion designs a wooden tower for 6.X turbines, and more.

Hello everyone and welcome to a new issue of Windletter. I'm Sergio Fernández Munguía (@Sergio_FerMun) and here we discuss the latest news in the wind power sector from a different perspective. If you're not subscribed to the newsletter, you can do so here.

Windletter is sponsored by:

🔹 Tetrace. Reference provider of O&M services, engineering, supervision, and spare parts in the renewable energy market. More information here.

🔹 RenerCycle. Development and commercialization of specialized circular economy solutions and services for renewable energies. More information here.

🔹 Nabrawind. Design, development, manufacturing, and commercialization of advanced wind technologies. More information here.

Windletter está disponible en español aquí

The most read in the latest edition: the EU Action Plan for Affordable Energy, the Agora Industry report on electrification, and the farewell post by Carlos Martin Rivals, CEO of BlueFloat Energy.

Today is a great day for Windletter.

We are very happy to announce that both Tetrace and RenerCycle have renewed their sponsorship agreement with us. This ensures the continuity of the agreement signed a year ago, further strengthening our relationship and the project.

But that's not all! If you’ve noticed the logo in the header, we have another big announcement: Nabrawind joins Windletter as a main sponsor. Nabrawind is a company we've talked about several times here, specializing in the development and commercialization of innovative technologies in the wind energy sector. You can read more about Nabrawind here.

I’d like to take this opportunity to publicly thank Tetrace, RenerCycle, and Nabrawind for supporting Windletter and making this project possible.

And now, after these exciting announcements, let’s move on to this week’s news.

📊 Wind energy in Europe: 2024 statistics and outlook to 2030

Annually, WindEurope, the wind energy industry association in Europe, publishes a report compiling data and statistics from the previous year, along with some forecasts for the future.

Personally, I love these reports, as they provide a general overview of wind energy in the old continent, showing which countries are performing better or worse, the challenges each one faces… and all from both the onshore and offshore perspectives. You can read the 2023 analysis here.

Let's go through the key highlights and some conclusions from the 2024 report.

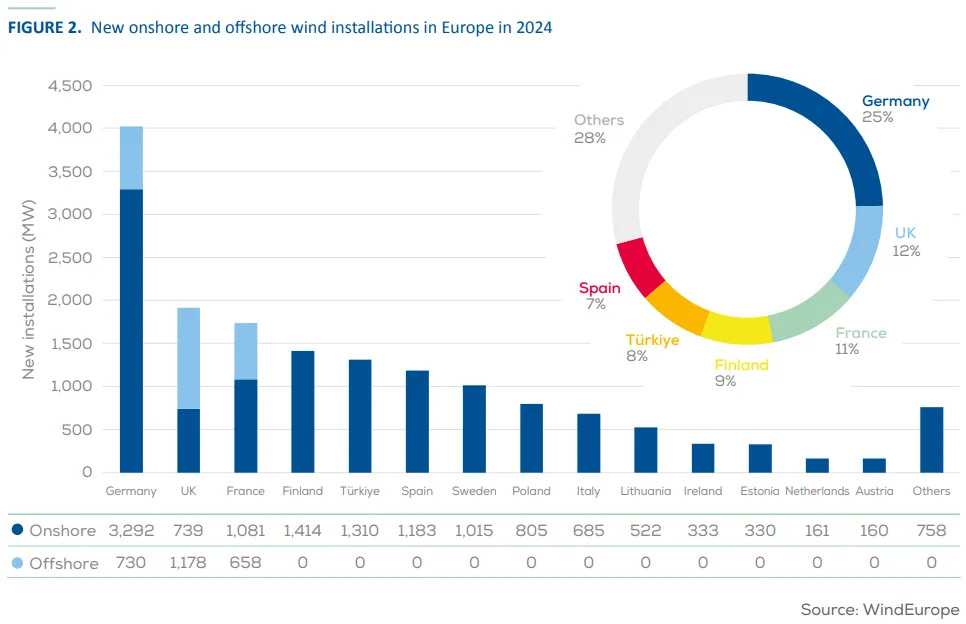

▶ Installations

Europe installed a total of 16.4 GW of new wind power capacity in 2024, of which 84% (13.8 GW) was onshore and the remaining 16% (2.6 GW) was offshore. This represents a decline from last year's 18.3 GW (14.5 GW onshore and 3.8 GW offshore).

If we consider only EU-27, 12.9 GW were installed: 11.5 GW onshore and 1.4 GW offshore, below last year's record of 16.1 GW, when 13.3 GW onshore and 2.8 GW offshore were installed.

The countries that installed the most wind power were:

🇩🇪 Germany: 3,292 MW Onshore / 730 MW Offshore

🇬🇧 United Kingdom: 739 MW Onshore / 1,178 MW Offshore

🇫🇷 France: 1,081 MW Onshore / 658 MW Offshore

🇫🇮 Finland: 1,414 MW Onshore / 0 MW Offshore

🇹🇷 Turkey: 1,310 MW Onshore / 0 MW Offshore

🇪🇸 Spain: 1,183 MW Onshore / 0 MW Offshore

🇸🇪 Sweden: 1,015 MW Onshore / 0 MW Offshore

🇵🇱 Poland: 805 MW Onshore / 0 MW Offshore

🇮🇹 Italy: 685 MW Onshore / 0 MW Offshore

🇱🇹 Lithuania: 522 MW Onshore / 0 MW Offshore

Germany remains Europe's driving force in new installations, with 4.0 GW installed (82% onshore). These figures are undoubtedly driven by improvements in permitting and the tendering of large auction volumes.

The United Kingdom (1.9 GW, strongly boosted by offshore), France (1.7 GW), Finland (1.4 GW), Turkey (1.3 GW), Spain (1.2 GW), and Sweden (1.0 GW) followed in the rankings.

The complete picture of installed capacity is as follows:

▶ Average turbine capacity

One of my favorite charts is the average capacity of installed wind turbines by country.

The average capacity of onshore wind turbines installed in Europe in 2024 was 4.6 MW, showing a slight increase from 4.5 MW in 2023. It seems that the trend is slowing down.

By country, the largest onshore turbines were installed in Lithuania and Romania, with an average capacity of 6.3 MW, followed by Sweden (6.2 MW), Estonia and Finland (6.0 MW). Spain stands at 5.2 MW.

France (2.8 MW) stands out, as it installs the smallest turbines among countries with significant volume. Height restrictions in the country limit the capacity of installed wind turbines, preventing the adoption of the latest models. However, as a trade-off, they often install turbines with a stronger track record, though at a higher cost.

In 2024, the average capacity of offshore wind turbines connected to the grid was 10.1 MW, showing a slight increase from 9.7 MW in 2023.

The UK connected the largest turbines on average (12.7 MW) and also the largest individual turbines in the Moray West wind farm (SG 14-222 DD, 14.7 MW). France lags behind in offshore turbine size, with an average of 7.6 MW.

▶ Electricity generation

Wind energy generated 19% of total electricity in the EU, with a total production of 475 TWh, roughly twice Spain’s annual electricity consumption.

Denmark and Ireland had the highest share of wind energy in their electricity mix, with 56% and 33%, respectively.

Wind energy covered more than a quarter of electricity demand in seven other countries: Sweden (31%), Germany (30%), United Kingdom (30%), Netherlands (29%), Portugal (28%), Lithuania (27%), Spain (25%).

Two interesting facts:

The record for daily wind power generation was set on November 24, reaching 2,995 GWh, equivalent to an average power output of 125 GW, about 60% of the total wind fleet running at full capacity all day.

The lowest daily wind power generation was recorded on August 5, with just 401 GWh, covering only 6% of the EU’s electricity demand that day.

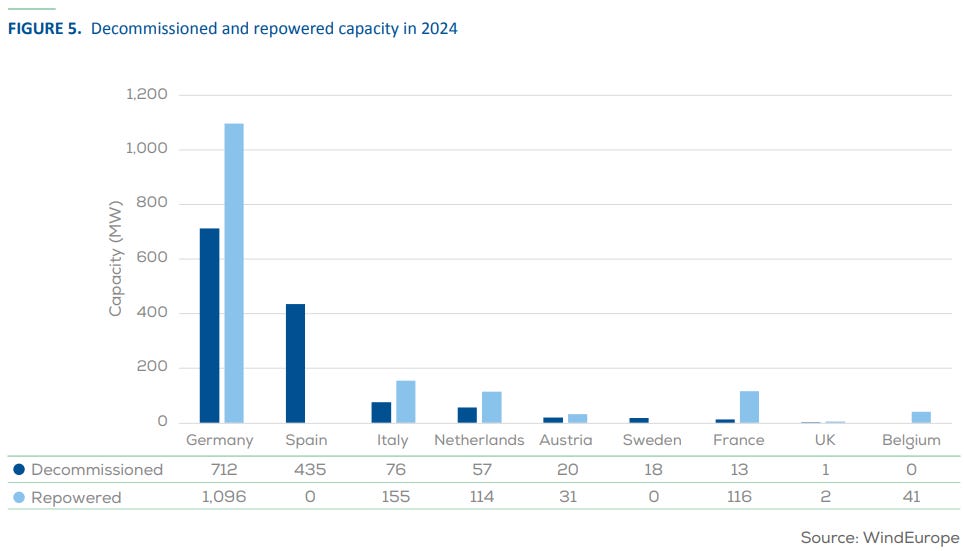

▶ Repowering

The European wind turbine fleet is aging, which is why repowering is playing an increasingly important role in WindEurope’s report.

If Germany is the driving force of Europe in new installations, it is also leading in repowering. Spain, on the other hand, ranks second in Europe in terms of dismantling but has not carried out a single repowering project. This data surprised me quite a bit, although perhaps it is because these are already dismantled wind farms that are still awaiting repowering.

Let's not forget that Spain has the oldest fleet in Europe, with an average age of 14.2 years, followed by Germany (11.8 GW) and the United Kingdom (10.6 GW).

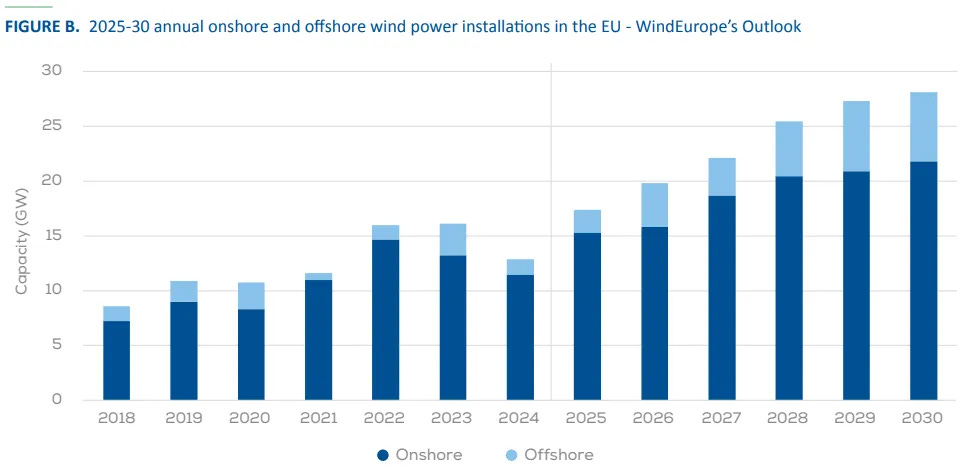

▶ Forecasts

WindEurope expects 2024 to be a turning point, a year that serves to gain momentum toward a 2025-2030 horizon where installations will continue to grow without stopping, surpassing the record each year.

Although offshore takes a large share of the spotlight, 75% of all new installations until 2030 are expected to be onshore.

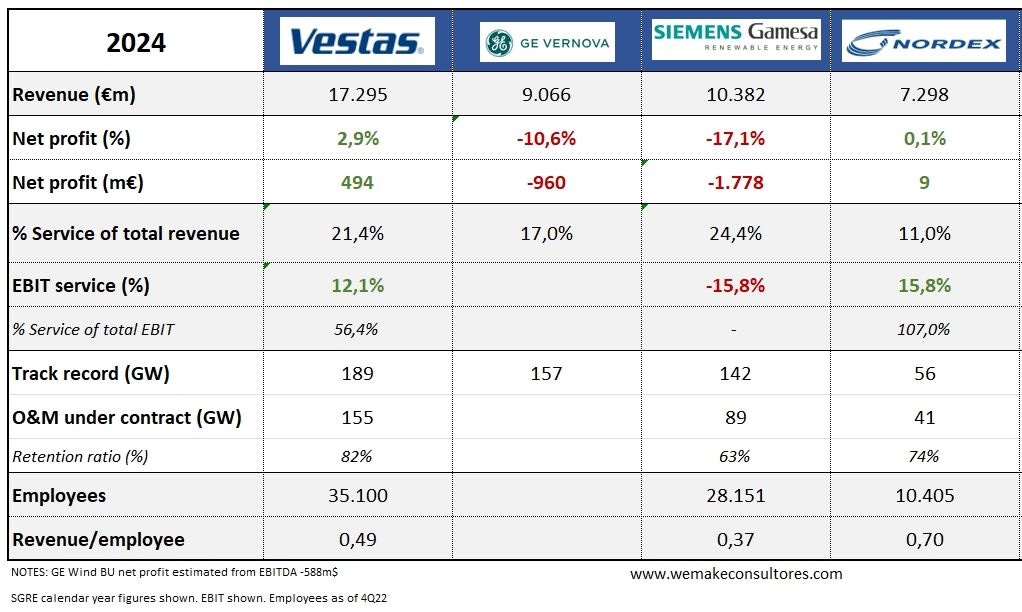

📈 Summary of the financial results of wind turbine manufacturers in 2024

Our friend Kiko Maza has published his usual summary table of the Western OEMs' results, giving us a headline for each one's situation:

Vestas is going full speed ahead 💹. Financial report.

GE Vernova is still burdened by offshore 💸. Financial report.

SGRE can't catch a break 📉. Financial report.

Nordex takes the MVP of the year 🏆. Financial report.

Several people commented on his post that they missed Enercon in that table. Honestly, I did too, but it makes sense: Enercon is not a publicly traded company that has to report to its shareholders in a public and detailed manner.

It's worth reading Kiko's full insights on LinkedIn.

⚡Alpha Ventus, Germany's first offshore wind farm, could be decommissioned after just 15 years of operation

Germany's first offshore wind farm, located off the coast of Borkum, could be nearing the end of its operational life after 15 years. The operators (EWE, RWE, and Vattenfall) are evaluating options and will make a decision in 2025. Thus, Alpha Ventus could become the first offshore wind farm in the North Sea to be decommissioned.

The 60 MW wind farm, which can be considered more of a pilot/prototype project than a commercial wind farm, consists of 12 turbines from two different manufacturers:

6 x Multibrid M5000 (5 MW) (later renamed Adwen AD 5-116)

6 x REpower 5M (5 MW) (later known as Senvion)

Although it may seem surprising, there are valid reasons for considering its decommissioning, as several factors have converged:

On one hand, in 2024, the €154/MWh tariff that the farm benefited from expired. Now, it must secure its revenue from the market, which means significantly lower income.

On the other hand, as a pilot project with a mix of now-obsolete turbines, maintenance has likely become complex and expensive. In fact, according to industry sources, these turbines have experienced prototype-related issues, and even the turbines from the same manufacturer are not identical.

A quick search suggests that there are about 126 Adwen AD 5-116 turbines in operation, while only 55 REpower 5M units exist—many of them in single-unit or two-unit wind farms that appear to be pre-commercial.

Honestly, this makes me want to write a #Windstory about the history of this wind farm and the reasons behind its possible decommissioning… What do you think?

🌊 Spectacular photos of the assembly of the Eolmed floating project structures

Eolmed is a pilot floating wind project that we have discussed several times here. Located in Occitania (France), it consists of three Vestas V164-10.0 MW units mounted on a barge-type floater by BW Ideol.

The project is currently in the platform assembly phase, and some truly spectacular photos are circulating on LinkedIn—definitely worth seeing. Recently, the transition pieces have been installed, leaving us with images like the one below.

In the end, this is a one-of-a-kind project, so the photos reveal details never seen before. The staging and assembly area at the port is truly impressive.

For those who want to see more images, you can click on the following links: 1, 2, 3, 4.

Let’s remember that the EDF and Maple Power consortium, which won 250 MW in one of the latest French auctions, is highly likely to use these BW Ideol structures.

🌲Modvion designs a wooden tower for 6.X wind turbines

We have talked several times about Modvion, the Swedish startup aiming to popularize wooden towers for wind turbines.

Back in November 2023, we discussed how Modvion installed its first prototype with a Vestas V90-2MW mounted on a 105-meter tower—making it the tallest wooden tower in the world.

Since then, Modvion has continued developing its product range, aiming for a commercial tower design that aligns with the current sizes of onshore wind turbines.

And that is precisely what they have just announced: a tower design based on the Vestas EnVentus V162-6.4 MW platform—which, by the way, Vestas itself is a shareholder of the Swedish startup.

The tower has been evaluated and approved by TÜV SÜD, receiving a declaration of conformity with IECRE OD-501 and OD-501-3 standards. Modvion also announces a 35-year lifespan, making it compatible with projects that plan for lifetime extensions from day one.

The current design stands at 119 meters, but the commercial version is expected to reach between 160 and 180 meters, with a prototype planned for 2027. They haven’t officially announced prototypes yet, but honestly, I hope they do.

For this design, Modvion uses laminated veneer lumber (LVL). The company claims this material offers higher strength-to-weight ratio and better strength per unit cost than steel, enabling lighter tower construction.

❄️ The icy assembly of a Goldwind GW7.5-182 HH110

We wrap up this edition with a video showing the assembly of a Goldwind GW7.5-182 HH110. The installation takes place in an icy and snowy environment, but it allows us to see some interesting details of this turbine.

This turbine is actually ahead of its time for markets outside China, where the most common configurations currently feature 160-175 meter rotors and 6-7 MW power ratings. In fact, the Goldwind turbines exported outside China tend to be smaller models, such as the GW165-6.0MW or the GWH171-6.25MW.

Some curious details seen in the video:

Despite having a 182-meter rotor, Goldwind continues to use full-rotor assembly. This could be problematic in complex terrains, although I’m not sure if a single-blade installation option exists.

One of the workers applies a silicone-like substance to the joint between the blade and the hub. It’s the first time I’ve seen this, and I’m unsure if it’s a common practice.

I’m not an occupational health and safety expert, but the handling of suspended loads while technicians are working doesn’t seem ideal.

Thank you very much for reading Windletter and many thanks to Tetrace, RenerCycle and Nabrawind our main sponsors, for making it possible. If you liked it:

Give it a ❤️

Share it on WhatsApp with this link

And if you feel like it, recommend Windletter to help me grow 🚀

See you next time!

Disclaimer: The opinions presented in Windletter are mine and do not necessarily reflect the views of my employer.