Windletter #70 - Waiting for Spanish offshore wind

Also: 1 GW of onshore DD sales by Siemens Gamesa in Japan, the challenge of offshore wind in California, Aegir Insights closes an 8.5 million round, and more

Hello everyone and welcome to a new issue of Windletter. I'm Sergio Fernández Munguía (@Sergio_FerMun) and here we talk about the latest news in the wind power sector from a different perspective. If you are not subscribed to the newsletter you can do so here.

Today is a very special day for Windletter. We are very happy to announce that two leading companies in the wind sector have decided to sponsor the publication and join us on this journey. So, I take advantage of this first edition with them to make a brief introduction.

🔹 Tetrace. Tetrace Group is a company specialized in operation and maintenance, engineering, supervision, inspection, technical assistance, and distribution of spare parts in the wind sector.

Founded in 2010 and headquartered in Pamplona, Tetrace has more than 300 employees in 16 countries and is currently strengthening its international expansion. More information about Tetrace can be found here.

🔹 RenerCycle. Development and commercialization of solutions and services specialized in circular economy for renewable energies, including comprehensive dismantling of wind farms and waste management, refurbishment and sale of components and wind turbines, management and recycling of blades and others.

Founded in 2022 and headquartered in Pamplona, is constituted by 10 companies that have extensive experience in the entire value chain in the renewable sector. RenerCycle is currently in the process of starting up its operations, with the company already beginning industrial activities for the management of blades in wind farms and their transportation for recycling tests. More information about RenerCycle can be found here.

From here, I would like to thank Tetrace and RenerCycle for trusting in Windletter and for making the project grow and move forward.

_

The most read from the last edition has been: the presentation of the Super Compact Drivetrain by Aerodyn, Kiko Maza's analysis of offshore wind in the USA, and the presentation of results by Vestas.

_

Corrections

Before moving on to the news of the week, a clarification. Last week, when discussing the results of Nordex, I said that its EBIT was 0% and that it had "tied" and come out of the red numbers. However, as several of you have correctly pointed out (thank you very much, by the way), this is not correct.

The figure Nordex was referring to was EBITDA, which is very different from EBIT. For those unfamiliar with financial matters, like myself:

EBIT: Earnings Before Interest and Taxes

EBITDA: Earnings Before Interest, Taxes, Depreciation and Amortization

For an industrial company like Nordex, with significant investments in manufacturing plants, the difference between EBIT and EBITDA can be significant. So the EBIT will be negative and possibly in the range of -150 to -300 million euros, although this is yet to be seen. We will know on the 29th, when the company presents the official results.

_

Finally, after this long but very necessary introduction, let's move on to the news of the week.

The regulation on offshore wind power in Spain will go to public consultation in the coming weeks

The wheels of government turn slowly. But I didn't know they turned this slowly...

The Spanish offshore wind power sector continues to await regulatory framework and the announcement of auctions that were expected to occur during 2023, but of which nothing has been heard. However, there are some updates.

According to Sandra Acosta's article in El Periódico de la Energía, the regulations for the development of offshore wind power will be made public in the coming weeks. This was confirmed by Teresa Ribera, Minister for Ecological Transition and Demographic Challenge, in statements to Radio Televisión Canaria and has also been confirmed by El Periódico de la Energía citing sources from the Ministry.

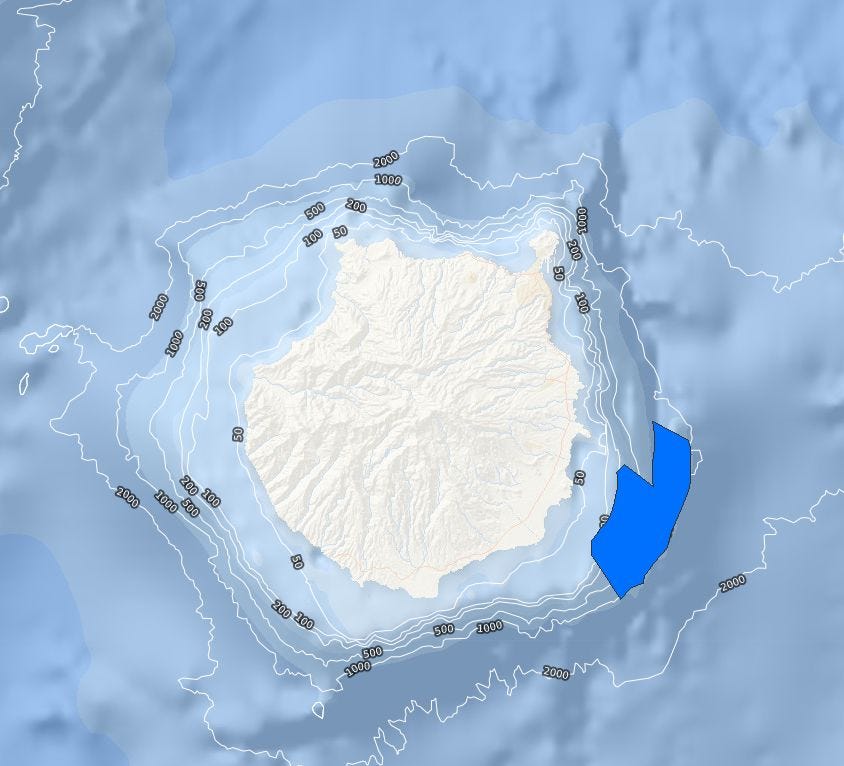

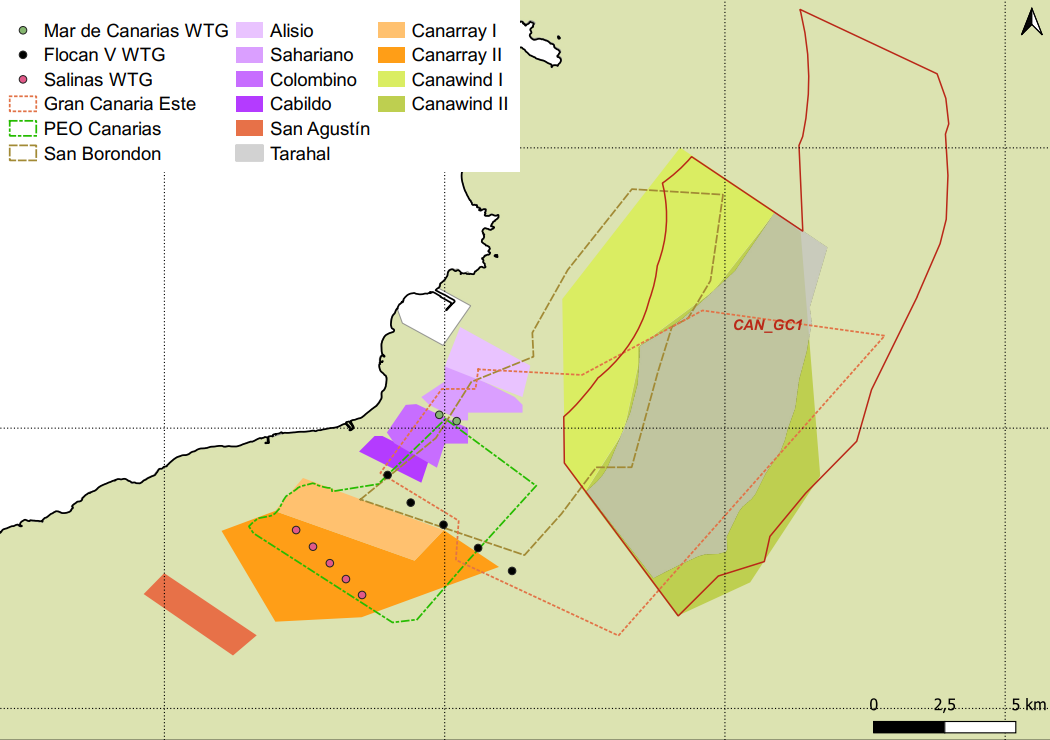

In those same statements (which you can listen to here using English subtitles), Teresa Ribera also highlighted the interest of the Gran Canaria City Council in expediting the procedures and holding public auctions for the installation of offshore wind power in the waters of the island, indicating that the intention is for the first auction to take place in Gran Canaria.

As we have previously discussed, it makes sense for the Canary Islands to be the first to install Spain's first offshore wind farm. Producing electricity is more expensive in the islands, so an offshore wind farm is more easily justifiable than on the mainland, where it could not compete with market prices.

As a reference, according to what I have been able to find, the average cost of producing a megawatt-hour with conventional power plants in Gran Canaria could be around €200/MWh (although with outdated data).

And how much does a MWh of floating wind cost? It is difficult to know. Especially after the supply chain turbulence of recent times.

As references, we have the €120/MWh that was mentioned in France in 2021 for an auction of 250 MW, the €240/MWh tariff of the Provence Grand Large pilot project (3 wind turbines, 25 MW), or the €168/MWh of the Portuguese WindFloat Atlantic pilot project (3 wind turbines, 25 MW). Also, as reported this week in El Periódico de la Energía citing industry sources, the price in Spain would be around €170-175/MWh.

Of course, the POEM has an area identified in Gran Canaria, and more than 3,000 megawatts are proposed in projects on Gran Canaria alone, which will have to compete for a much smaller auction volume, as peak demand on the island is usually between 500 and 600 MW, with around 300 MW of base load.

Regarding the characteristics of the auction, what is known is that it will grant an economic regime (tariff, CfD, or similar), connection point, and maritime space, all in one. Other countries make these awards separately, but in Spain, it seems that they will go for everything at once.

I can think of two reasons for doing the auction this way:

There is not enough available maritime space for developers to bid first for the maritime space and then for the connection point and/or the tariff. The best way to have real competition among developers is to award everything at once.

Do everything faster. If Spain is already quite delayed with respect to its offshore wind power plans (between 1 and 3 GW by 2030), making the awards in stages would only delay the plans with probably little benefit.

And how much capacity will be auctioned? Good question, but if I had to bet money, I would say it will be around 200 or 300 megawatts; I would be surprised if it were much more. In the end, integrating a wind farm of that size into an islanded electrical network will have its challenges, although by then, the Chira Soria pumping station will probably be up and running.

In short, many uncertainties still. We will be attentive to the next steps, so if you don't want to miss it, subscribe.

By the way, from here, I want to thank Marcial (@P_Renovable) for helping me better understand the electrical system of Gran Canaria.

_

The SWT-4.3-120/130 DD onshore from Siemens Gamesa reaches 1 GW in sales in Japan

After the merger between Siemens Wind Power and Gamesa back in 2017 and after some transition time, the company decided that Gamesa technology would stay as onshore technology, while Siemens technology would stay for offshore.

Gamesa had doubly fed technology (DFIG), while Siemens' flagship in those days was Direct Drive, which it used in both onshore and offshore.

However, during all these years, the Direct Drive onshore hasn't disappeared from the Siemens Gamesa portfolio, but it has continued to fit well in some markets, especially in Japan, where it is still available for sale.

In fact, as the company has just announced, 1 GW of orders for this platform have been reached in Japan, which is not bad at all. Specifically, these are orders for the SWT-4.3-120 and SWT-4.3-130 models.

And what's special about these models? Well, mainly that they are typhoon-certified, i.e., they are certified against typhoons, which is necessary in the Japanese market. Also, Siemens Gamesa itself assures that the 800 MW it has in maintenance in Japan has an availability of 98%, an exceptional figure.

Personally, I think it's a very elegant machine, very beautiful. A matter of taste, of course:

_

California's ambitious goals for floating wind seem unreachable

California's plan to install offshore wind farms along its coasts before 2035 may be more difficult than it seems, according to Bloomberg New Energy Finance.

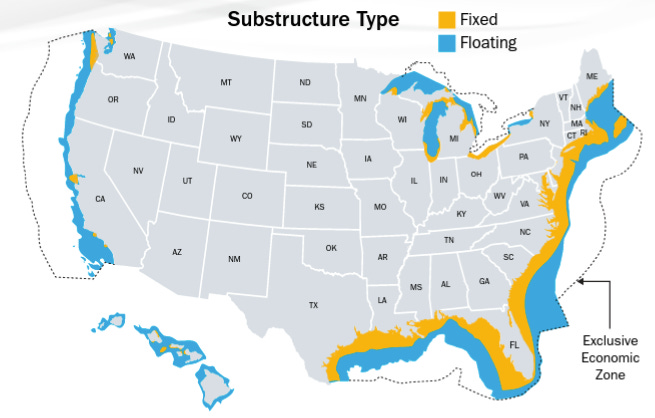

The problems and challenges faced by offshore wind in the United States are well known. And that is happening even considering that all the projects that are in advanced stages of permitting process are fixed bottom technology and located on the east coast. If we go to the west coast, where everything is to be done, the challenges are even greater, since the need for floating wind arises.

In December 2022, the results of the first auction for maritime space for offshore wind farms in California were published. The awarded areas have the potential to install at least 4.6 GW, but they face a major challenge: in those areas, the depth of the sea is between 500 and 1,200 meters, which increases both the costs and the risk of the projects. And we already know that floating wind may not be as easy as it seems.

So California now faces a horizon with regulatory risk, great depths, higher costs, and the lack of a local supply chain, which is barely developed in the United States (and even less for floating wind).

California aims to have between 2 and 5 GW of floating wind by 2030 and 25 GW by 2045. More information on offshore wind in California can be found at this link.

_

Ingeteam develops a system to power the yaw of offshore wind turbines

The wind energy division of the Spanish electrical equipment manufacturer Ingeteam has developed a system that allows powering the yaw system of offshore wind turbines in emergency situations.

In extremely strong wind conditions, combined with a loss of the electrical grid due to weather-related reasons (a "blackout"), it may be necessary to properly orient the nacelle to avoid unwanted mechanical loads on the wind turbine. This becomes increasingly critical as turbine size increases.

However, the wind turbine cannot orient itself if it is not connected to the grid, as it has no energy source to power the orientation motors. This is where Ingeteam's design comes in, which consists of a frequency converter and a battery system capable of powering the yaw system.

According to Ingeteam, a project located in the United Kingdom has already received and installed the first 15 units.

It is not a particularly innovative system in itself, as many modern offshore wind turbines already come equipped with similar systems. Now, Ingeteam is entering the market to compete in this area and will likely also offer it as a retrofit for machines that do not have it. More information is available on Ingeteam's website and in the white paper they have published.

_

Aegir Insights closes a round of financing of 8.5 million euros

I really like to follow the startup world closely in general, although the truth is that in the wind and/or renewable sector, the ecosystem is not too large and the movements are rather timid. And specifically in the wind sector, the barriers to entry are much larger than in other sectors.

In this sense, software companies have a lot of advantage, since they have relatively low development costs (only "labor") and very good scalability (you can sell the same software to many customers). This is the case of Aegir Insights.

For those of you who don't know it, Aegir Insights offers "Offshore Wind Intelligence", that is, it provides updated and high-value data to its customers so that they can make better decisions in the offshore wind sector. Their customers are large developers, but also governments or investment funds.

The company, headquartered in Copenhagen, has just received a Series A financing round of 8.5 million euros led by Seaya Andromeda and Climentun Capital, both funds specialized in Climate Tech. Even the people from Seaya (Borja Rosales and Pablo Pedrejon) have published an article explaining why they have invested in Aegir Insights.

I take this opportunity to ask: which startups in the sector that we have never discussed here are worth following?

_

The Edda Goelo departs from Astilleros Balenciaga in Zumaia

Astilleros Balenziaga, located in the Basque town of Zumaia, has been responsible for building a SOV (Service Operations Vessel) to service the Saint Brieuc offshore wind farm in France. The wind farm is owned by Iberdrola and both the wind turbines and maintenance are provided by Siemens Gamesa.

The video of the launch circulated months ago (by the way, experiencing this firsthand must be very exciting) and it went quite viral due to a few little problems.

But it wasn't until now that the vessel set sail towards its final destination, as shared by Edda Wind on its LinkedIn account. Now, with all the necessary auxiliary equipment for which it was built: to provide O&M services to an offshore wind farm.

Saint Brieuc consists of 62 SG 8.0-167 DD turbines, with a total capacity of 496 MW.

Thank you very much for reading Windletter and many thanks to Tetrace and RenerCycle, our main sponsors, for making it possible. If you liked it:

Give it a ❤️

Share it on WhatsApp with this link

And if you feel like it, recommend Windletter to help me grow 🚀

See you in the next one!

Disclaimer: The opinions presented in Windletter are mine and do not necessarily reflect the views of my employer.