Windletter #86 - The challenge of grid access

Also: Vestas installs the prototype of the V172-7.2MW™, analysis of the capacity factor of renewable energies, the day LM Wind Power transported blades on an Antonov 225 plane, and more.

Hello everyone and welcome to a new issue of Windletter. I'm Sergio Fernández Munguía (@Sergio_FerMun) and here we discuss the latest news in the wind power sector from a different perspective. If you enjoy the newsletter and are not subscribed, you can do so here.

Windletter is sponsored by:

🔹 Tetrace. Specialized services in operation and maintenance, engineering, supervision, inspection, technical assistance, and distribution of spare parts in the wind sector. More information here.

🔹 RenerCycle. Development and commercialization of solutions and specialized services in the circular economy for renewable energies, including comprehensive dismantling of wind farms and waste management, refurbishment and sale of components and wind turbines, management and recycling of blades and others. More information here.

Windletter está disponible en español aquí

The most read from the latest edition has been: the video of the installation of the CSSC Haizhuang H260-18MW prototype, the news of Mingyang being chosen as the preferred bidder in a European offshore project, and the post of the RWE CEO visiting Mingyang's dual-rotor prototype.

That said, let's move on to the news of the week.

⚡ The challenge of grid acces

Obtaining access to the electrical grid is currently one of the main bottlenecks hindering the deployment of more renewable megawatts in Europe.

And when I say grid access, I mean that the Transmission System Operator (TSO) of the corresponding country tells you how many megawatts and at which point of the grid you can connect your plant.

For example, in the case of Spain, it would be Red Eléctrica de España responsible for granting these accesses.

The fact is that across the old continent there are hundreds of gigawatts waiting to be connected to the grid. There is administrative overload, and this causes the permitting timelines to stretch much longer than desired.

However, it is also true that this is not the only bottleneck. Environmental impact statements, for example, are also a bottleneck in many European countries. Each country really has its own particular story, as the project processing procedure is different (at least in some parts) in each of them.

With the aim of shedding a bit more light on this issue, WindEurope has published a detailed report “Grid access challenges for wind farms in Europe”, which breaks down the intricacies of grid access in Europe and also describes the different peculiarities between countries, which are numerous.

The following map offers an overview of the wind power queued waiting for connection to the grid. It is a very enlightening map, although it must be interpreted properly, as the particularities of the permitting process in each country are very relevant to understanding the figures. That is, they are not directly comparable (there is a lot of fine print).

In some countries, grid access is one of the first milestones granted to plants, while in others, it is one of the last. For example, of the 191 GW of wind power in Italy, many projects will clearly never be built because they will not be able to overcome other administrative milestones of the process (environmental impact, for example).

WindEurope report focuses on four main points: planning and development of new connections, costs of electrical infrastructure, curtailment, and hybridizations.

Planning and development of new connections. Main factors delaying grid connection:

Costs of electrical infrastructure. Connecting plants to the grid has two main expenses: those associated with connecting the installation itself and those associated with the general reinforcement of the electrical grid. Depending on the country, developers participate more or less in the costs:

Super-shallow: costs are socialized among all consumers through the tariff.

Shallow: the developer pays the costs associated with the project's connection but not the costs associated with the general reinforcement of the grid.

Deep: the developer pays the costs associated with the project's connection and the costs associated with the general reinforcement of the grid.

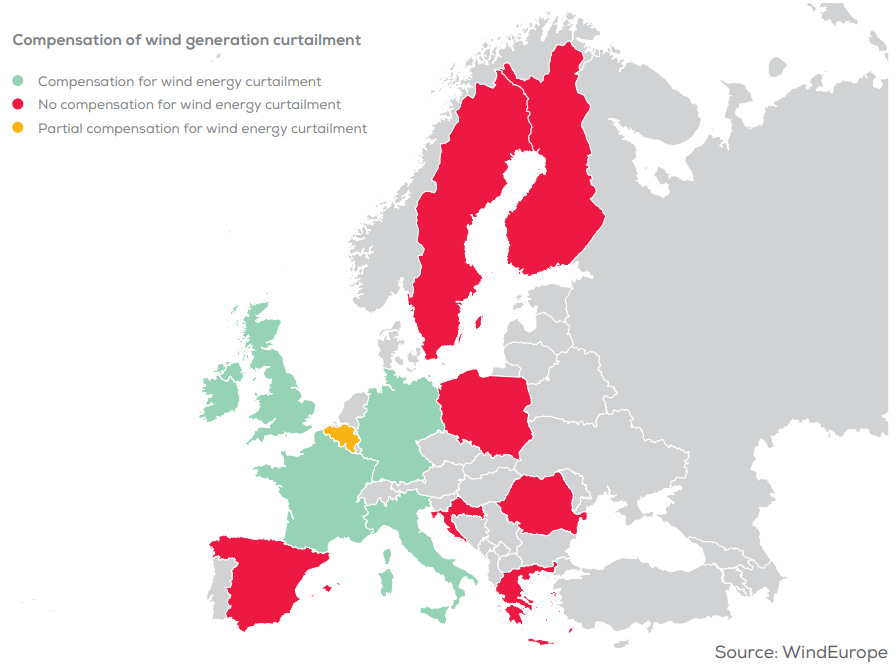

Curtailment and compensation. Curtailment involves a plant having to reduce its production because the electrical grid, for whatever reason (lack of demand, lack of capacity in transmission lines), is unable to absorb it.

In some European countries, this is starting to become a point of uncertainty when making investments. Additionally, depending on the country, curtailment is either compensated economically or not compensated.

Hybridizations. One way to maximize the use of the existing electrical grid, delay new investments, and reduce curtailment is to hybridize different renewable generation technologies (with or without batteries) so that they share the same grid access point. For example: connecting 50 megawatts of wind power and 30 megawatts of solar power at the same 50 megawatt grid access point.

However, most countries do not include this possibility in their legislation. In fact, Spain and Portugal are the most advanced in this regard, which has led to the emergence of such installations.

As you can see, each country has its own particularities and problems.

The European Union wants to increase the installed wind power capacity from the current 220 GW to 425 GW by 2030 and 1,300 GW by 2050. But it will not be easy.

_

Greencities & S-Moving, urban intelligence and smart mobility

Access to the electrical grid is key to continuing to electrify (and decarbonize) our energy consumption. Increasing renewable generation is essential for a sustainable future in our cities and for intelligent, electrified mobility.

That is why, for the past 15 years, the Greencities & S-Moving forum has promoted a sustainable future and smart mobility by connecting public and private actors. It is the most prominent annual event for cities and territories in Spain, and it returns to Málaga on September 24 and 25, 2024, at FYCMA.

The 2024 edition will offer renewed content and spaces, focusing on sustainability, with a technological and innovative staging that will showcase live examples of the urban future.

The program will address key topics such as water management, modernization of public services, alternative fuels, mobility, and energy efficiency. In addition, it will foster networking and business opportunities, bringing together global experts to share emerging trends and technologies in urban management and sustainable mobility.

All Windletter subscribers can get a 100% discount by registering through this link.

_

🌬️ Vestas installs the prototype of the V172-7.2MW™, its most powerful onshore turbine

OEMs continue working on the next generation of their onshore products, now in the 7.X MW range.

Vestas has announced on LinkedIn that it has completed the installation of the prototype of its V172-7.2MW™, the largest and most powerful in its onshore portfolio and based on the EnVentus platform.

As usual, the prototype has been installed at the Østerild test center in Denmark, and it will undergo numerous tests before the start of its serial production.

This version increases the AEP by 12% in low-medium wind conditions compared to the V162-6.2 MW variant. The tower height of the prototype is 150 meters, while Vestas has announced towers ranging from 114 to 175 meters in its portfolio.

As you already know, this turbine is based on the modularity concept of the EnVentus platform, which we briefly analyzed in edition #14 (it's been a while since then), taking advantage of the prototype nacelle of the V236-15.0 MW.

_

🌀 Enercon advances with the prototype of the E-175 EP5

In parallel with Vestas, although a bit behind, Enercon is also working on the E-175 EP5 prototype. This time, Enercon has published a photo of the 86-meter blade with which it is conducting some tests. For this purpose, this pre-series blade has been equipped with measurement technologies to enable subsequent evaluations.

Note, if I am not mistaken, this blade corresponds to the prototype of the E-175 EP5 E1, with a power range of 6 to 6.3 MW and an internal rotor permanent magnet generator.

Next will come the E-175 EP5 E2, with an external rotor, which will reach 7 MW of power "in its standard configuration" and is based on a segmented generator concept (divided into two pieces).

We talked about the E-175 EP5 E2 in Windletter #73, and Enercon has an article with many details that you can read here.

_

🏛️ The Labour Government lifts the ban on onshore wind in England

The new Labour Government of the United Kingdom has removed the de facto prohibition on building onshore wind farms in England just days after taking power. This ban had been in place since 2015.

Rachel Reeves, the new Chancellor, stated that they will discuss whether large wind farms should be considered national infrastructure projects. This would mean that they would be approved by the Secretary of Energy, rather than local councils.

To be honest, I'm not familiar with the details, but it seems quite unusual that such a veto existed for so many years.

You can find the official government statement at this link.

_

🏭 The dependence of U.S. offshore wind on large European components

I found this article from Empire Energy Partners on the dependence of the United States on European components very interesting, especially when it comes to large metal components like monopiles, transition pieces, and towers.

As an example, it mentions that the Dutch company Sif Group will supply both the monopiles and transition pieces for the Empire Wind 1 offshore wind farm, located off the coast of New York and developed by Equinor and bp.

It's logical in part because Europe has the experience and factories necessary, while the U.S. offshore market remains a nascent sector.

The article discusses the benefits of developing a local manufacturing chain and what would be needed to make it happen.

_

📝 Analysis of the capacity factor of renewable energies

In his monthly article, Kiko Maza delves into the world of capacity factor, discussing how it is calculated and all the details that must be considered to compare apples to apples.

It's a very interesting article that also includes data published by different operators such as Acciona, RWE, Ørsted, and Brookfield.

As a highlight, I can tell you that Acciona has an onshore wind farm with a capacity factor above 50%.

I'll let you discover the specific wind farm and turbine model by reading the full article yourself.

_

🔧 C1 Wedge Connection™: Major players in the offshore sector collaborate on developing an alternative to foundations-tower connections

As wind turbines grow larger, some historically used solutions and technologies become obsolete.

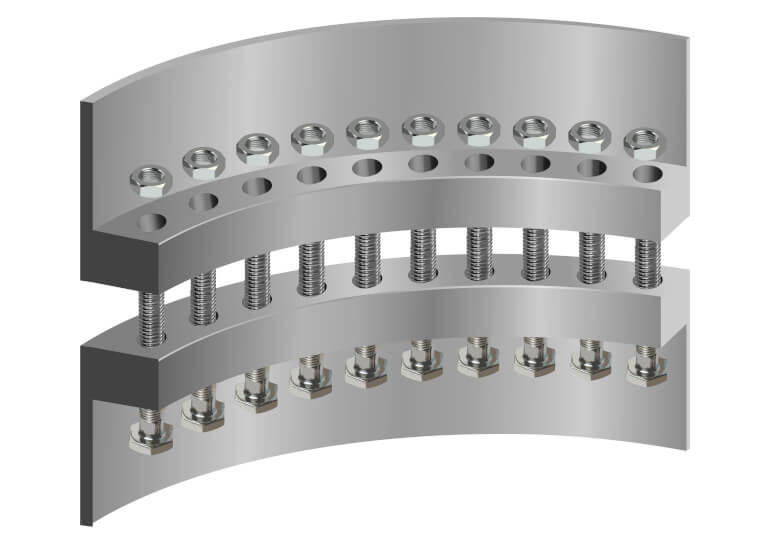

One such example is the bolted connections between foundations and towers, involving dozens of bolts inserted into the tower flange and secured with nuts.

Now, a consortium comprising some of the world's leading developers of offshore wind energy and OEMs is working on a new type of connection.

The goal is to commercially implement the C1 Wedge Connection solution in offshore wind projects, for both monopile to transition piece connections and foundation to tower connections.

The Wedge Connection consortium includes BP, TotalEnergies, RWE, Vattenfall, EnBW, Iberdrola, Ocean Winds, Ørsted, Equinor, Siemens Gamesa Renewable Energy, Vestas, GE Vernova, and C1 Connections itself.

For those interested in technical details, here's a link to a paper where results indicate very high fatigue resistance.

_

⚖️ For or against larger Chinese OEM's? A cornelian choice

I found very interesting an article published by Bruno G. Geschier, Chief Sales & Marketing Officer of BW Ideol, whom we have previously cited in Windletter for his insightful reflections.

In the article, Bruno reflects on the pros and cons of involving Chinese OEMs in the development of offshore wind energy. He also considers whether to include them or not in much-needed prototypes for floating wind:

Can such a young yet enormously promising new industry afford to solely depend on the usual top-tier Western OEM’s or should the industry put more new concepts equipped with second- and third-tier Chinese turbines in the water at a risk of collecting performance data that might not entiretly satisfy lenders and insurers or worse, at a risk of exhibiting poor production performance and availabilty which could reflect negatively on the entire industry?

You can read the full article at this link.

_

🛫 The day LM Wind Power transported blades on an Antonov 225

A few weeks ago, I posted some reflections on LinkedIn about the WindRunner, a design proposed by Radia for the world's largest aircraft aimed at transporting large wind turbine components, especially blades.

Radia's idea with the WindRunner is spectacular and promising on paper, but as I mentioned in the post, it comes with its own set of challenges.

The discussion in the comments section was quite lively, and one comment from Andrés González reminded us that LM had previously transported 42-meter blades by plane. These were smaller compared to the >80-meter blades used in onshore wind projects today.

The transport, which you can watch in a YouTube video linked below, was conducted using the iconic Antonov 225 aircraft in June 2010, from China to Denmark.

I love coming across (and you sharing with me) this kind of curiosities 🙂

Thank you very much for reading Windletter and many thanks to Tetrace and RenerCycle, our main sponsors, for making it possible. If you liked it:

Give it a ❤️

Share it on WhatsApp with this link

And if you feel like it, recommend Windletter to help me grow 🚀

See you next time!

Disclaimer: The opinions presented in Windletter are mine and do not necessarily reflect the views of my employer.