Windletter #76 - The EU investigates Chinese manufacturers

Also: Goldwind's results, agreement between Tetrace and Anecto, Siemens Energy and GE Vernova, and more.

Hello everyone and welcome to a new issue of Windletter. I'm Sergio Fernández Munguía (@Sergio_FerMun) and here we discuss the latest news in the wind power sector from a different perspective. If you enjoy the newsletter and are not subscribed, you can do so here.

Windletter is sponsored by:

🔹 Tetrace. Specialized services in operation and maintenance, engineering, supervision, inspection, technical assistance, and distribution of spare parts in the wind sector. More information here.

🔹 RenerCycle. Development and commercialization of solutions and specialized services in the circular economy for renewable energies, including comprehensive dismantling of wind farms and waste management, refurbishment and sale of components and wind turbines, management and recycling of blades and others. More information here.

Windletter está disponible en español aquí

The most read in the latest edition has been: the video of the wind turbine collapsing in Tarifa, the Bloomberg article about the top manufacturers, Kees Van de Leurn's train journey from Utrecht to Bilbao.

Additionally, the latest dispatch was a new installment of Windstory, the feature section of Windletter. A story about the first Ecotècnia 12/15 wind turbine, a pioneering Spanish wind turbine manufacturer. It's not for me to say, but it's worth taking a look. It has even been published in the Spanish news site El Periódico de la Energía 🙂

Now, let's move on to the news of the week.

🔍 The EU investigates Chinese manufacturers while Scotland prioritizes a Mingyang factory

We continue with the information about Chinese manufacturers and their foray into the European Union, a territory in which they have entered very timidly so far.

In the last edition, we talked about the installation figures of wind turbines worldwide by manufacturer and their corresponding market shares. One of the highlights was that Chinese OEMs commissioned 1.7 GW in 20 foreign markets, including five EU member states. Although I haven't been able to find out which states specifically.

The fact is that now the EU has opened an investigation into Chinese wind turbine manufacturers, currently focusing on five markets: Spain, France, Greece, Bulgaria, and Romania.

The reality is that, as we have previously discussed here and as reported in El Periódico de la Energía, the presence of Chinese OEMs in the EU remains very low. Doing some quick searches:

Spain: As far as we know, in Spain, we have the La Loma wind farm, the first in Spain to install Sinovel wind turbines in 2013 (it was another era). Additionally, we have those installed by Cuerva under the Vensys brand, but they are still Goldwind turbines.

France: Envision has several parks that, if I understood correctly, it developed itself, including its own wind turbines, and then sold them to a third party. This method is undoubtedly simpler commercially.

Greece: Goldwind recently announced on LinkedIn that several of its projects in the country are progressing well.

Romania: As we recently discussed in Windletter, the European Bank for Reconstruction and Development (EBRD) recently financed a wind farm with Goldwind turbines. Something that has not been well received by Wind Europe and may have been the germ of this investigation.

Bulgaria: In Bulgaria, I could only find a contract for 125 MW with Mingyang, but from 2012.

Where there is the most movement is in Eastern Europe, probably because these markets are less mature. Specifically in Serbia, there have been news of some contracts from Windey, including one for 854 MW with 7.7 MW turbines.

I have no idea how this will end, nor do I have knowledge of European legislation. There are opinions for all tastes. What seems clear is that the mere publication of this news will serve as a deterrent for any developer considering buying Chinese wind turbines.

What is very curious is that, at the same time all this is happening, the Scottish Offshore Wind Energy Council (although Scotland is not part of the EU) has considered it strategic for Mingyang to open a factory in the country. Regarding this topic, this LinkedIn post is interesting.

And this opens another debate: Should the origin of the OEM be taken into account? Or where the turbine is assembled? Or where each component comes from? As Kiko Maza mentioned, is it better to have a Chinese turbine assembled in Europe with local components than one from a European manufacturer but with all Chinese components? It seems that assembly is only 5% of the total cost of the turbine...

And you, how do you see it? I'm reading your thoughts 👀

_

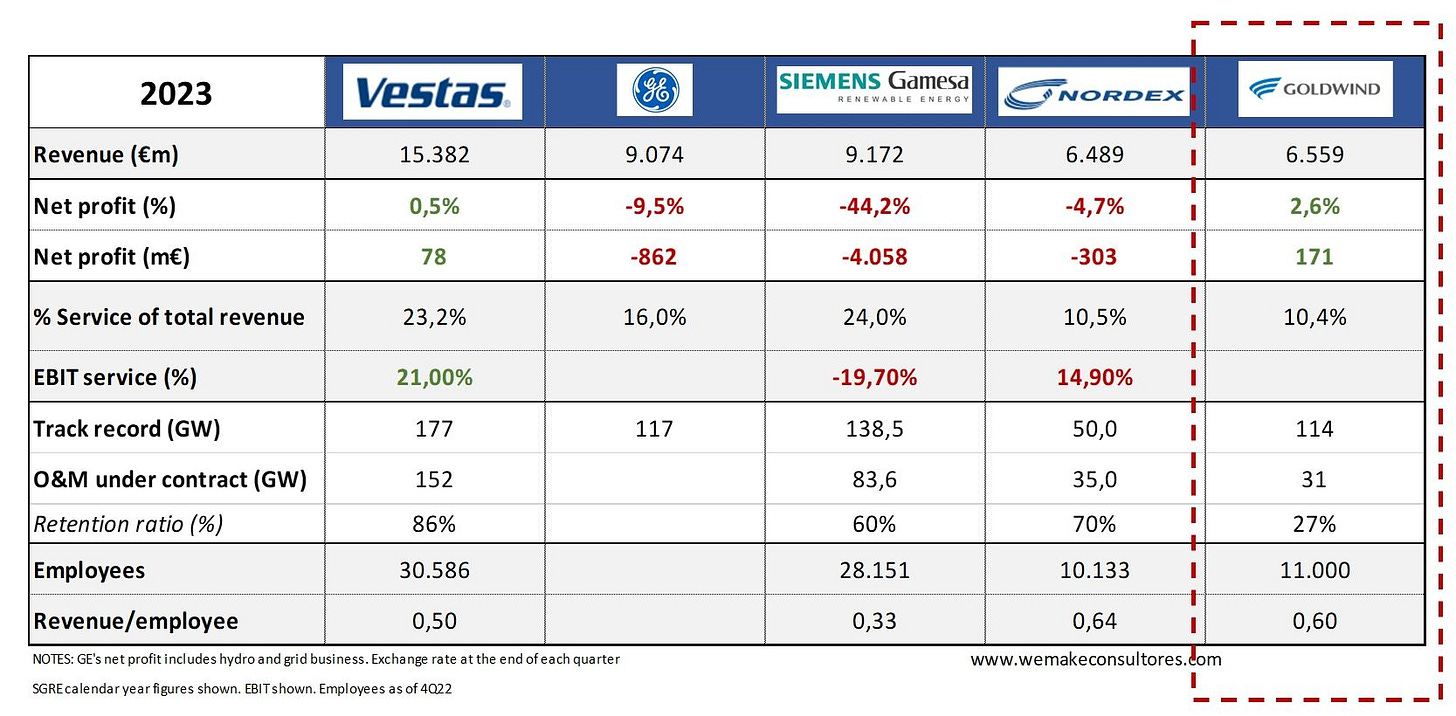

📊 Goldwind presents results and margins continue to narrow

Continuing with Chinese OEMs, Goldwind has released its 2023 results. And as we discussed in Windletter #49, perhaps Chinese manufacturers are not doing as well as it seems.

The conclusions are somewhat similar to those of last August:

Profits are narrowing.

The turbine sales business is in the red.

The park development business (basically acting as a developer) is undoubtedly the one that works best for them, but it cannot really be considered the core business of OEMs.

The services business is far below what is customary for Western OEMs.

More information in Goldwind's presentation. I also leave you with the table that Kiko Maza shared comparing the different OEMs, where Goldwind and its results have been added.

Recently, an executive from Envision commented in Recharge that the "brutal" competition among Chinese OEMs would take several of them down. Will we see a merger process like in Europe?

_

🔧 Tetrace signs a repair agreement for electronic cards with the Irish company Anecto

Our main sponsor, Tetrace, has reached an agreement with the Irish company Anecto Power Electronics to jointly offer a service for repairing electronic cards for wind turbine converters and solar inverters.

Through this agreement, Tetrace will be able to offer its customers, as part of its spare parts and repair business, electronic cards refurbished by Anecto, maintaining a rotating stock. In other words, Tetrace replaces its customers' damaged cards with repaired ones (with warranty) available in stock and sends the faulty cards to Anecto for repair, testing, and then receives them back from Anecto.

Component repair is a growing activity within wind turbine maintenance, both for cost reduction and for circularity commitments.

The reality is that not all spare parts have to be new; they can be reconditioned in specialized workshops and operate again for many years. The key, in addition to repair knowledge, is testing to certify that reconditioned components function as if they were newly manufactured.

The official signing took place at the Irish stand during the last WindEurope fair.

By the way, on another note, Tetrace has also recently carried out some logo placement work on operating turbines that is really worth seeing. As you can imagine, efforts are usually made to have the logo on the nacelle from the factory. But when this is not possible, or when turbines have new owners, this type of work is carried out.

The VERBUND Green Power Iberia account has shared some photos, which are truly impressive.

The park is Loma De Los Pinos (Seville), and the wind turbine appears to be a first-generation GE 5.X-158 Cypress.

💡 When Siemens Energy congratulates GE Vernova on its "energy independence"

As you know, recently GE Vernova has become a separate and publicly traded company from the historic giant General Electric.

GE Vernova includes businesses in conventional generation, wind, and what we could call grid solutions. It's a move almost identical to what Siemens did with Siemens Energy, and quite similar to ABB's move when it sold its electrical business to Hitachi.

The point is that Siemens Energy has publicly and jokingly congratulated GE Vernova on its new "energy independence":

In an industry like ours, let's be honest, a bit dull with these things, honestly, it's appreciated. Based on the comments and reactions on LinkedIn, it seems to have been well-received 🙂

_

🌬️ X1 Wind used one of the turbines from Vestas' multi-rotor

I found this comment on LinkedIn by Santiago Canedo, Mechanical Engineering Manager at X1 Wind, very interesting.

It turns out that the floating prototype X30 from X1 Wind is equipped with one of the turbines that were used in Vestas' multi-rotor prototype. This Vestas prototype is already a part of wind energy history due to the groundbreaking concept, which featured 4 units of the V29 225 kW turbines on a single structure.

Well, one of those rotors from the photo has been installed later on the X30 by X1 Wind. It's common for these types of prototypes to use reused turbines, which reduces the purchase cost and, therefore, the development cost of the prototype. For example, Saitec Offshore's turbine is also a refurbished Senvion MM82 2MW for offshore.

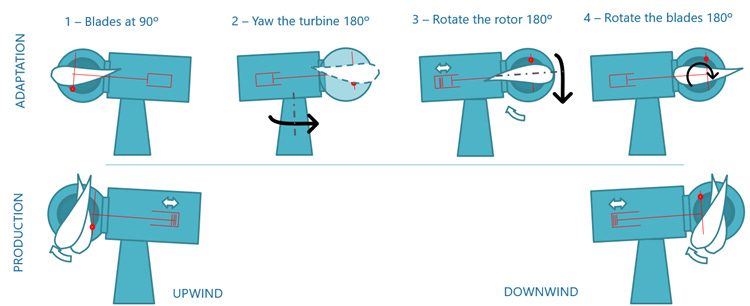

What's interesting is that, given the design of the X1 Wind platform, this V29 had to be modified to operate downwind. They explain the adaptation process very well on their website.

Previously in Windletter, we have discussed multi-rotor wind turbines and their potential for the future.

Thank you very much for reading Windletter and many thanks to Tetrace and RenerCycle, our main sponsors, for making it possible. If you liked it:

Give it a ❤️

Share it on WhatsApp with this link

And if you feel like it, recommend Windletter to help me grow 🚀

See you next time!

Disclaimer: The opinions presented in Windletter are mine and do not necessarily reflect the views of my employer.