Windletter #75 - Top 10 wind turbine manufacturers in 2023

Also: an order for a single V236, a plane transporting wind turbine components, redesigning offshore auctions, and more.

Hello everyone and welcome to a new issue of Windletter. I'm Sergio Fernández Munguía (@Sergio_FerMun) and here we discuss the latest news in the wind power sector from a different perspective. If you enjoy the newsletter and are not subscribed, you can do so here.

Windletter is sponsored by:

🔹 Tetrace. Specialized services in operation and maintenance, engineering, supervision, inspection, technical assistance, and distribution of spare parts in the wind sector. More information here.

🔹 RenerCycle. Development and commercialization of solutions and specialized services in the circular economy for renewable energies, including comprehensive dismantling of wind farms and waste management, refurbishment and sale of components and wind turbines, management and recycling of blades and others. More information here.

Windletter está disponible en español aquí

In the last edition, I published a personal summary of the most relevant aspects of the Wind Europe fair, but I hadn't provided you with the links to the most read articles from issue #73, so I'll leave them here now: the video of kayaking under a Samsung wind turbine, the article about the escape room in a wind turbine, and Kiko Maza's article on the state of the European wind sector.

Now, wishing you had a good Easter break, let's move on to the news of the week. With the Wind Europe event, many topics have piled up... and I even left several out.

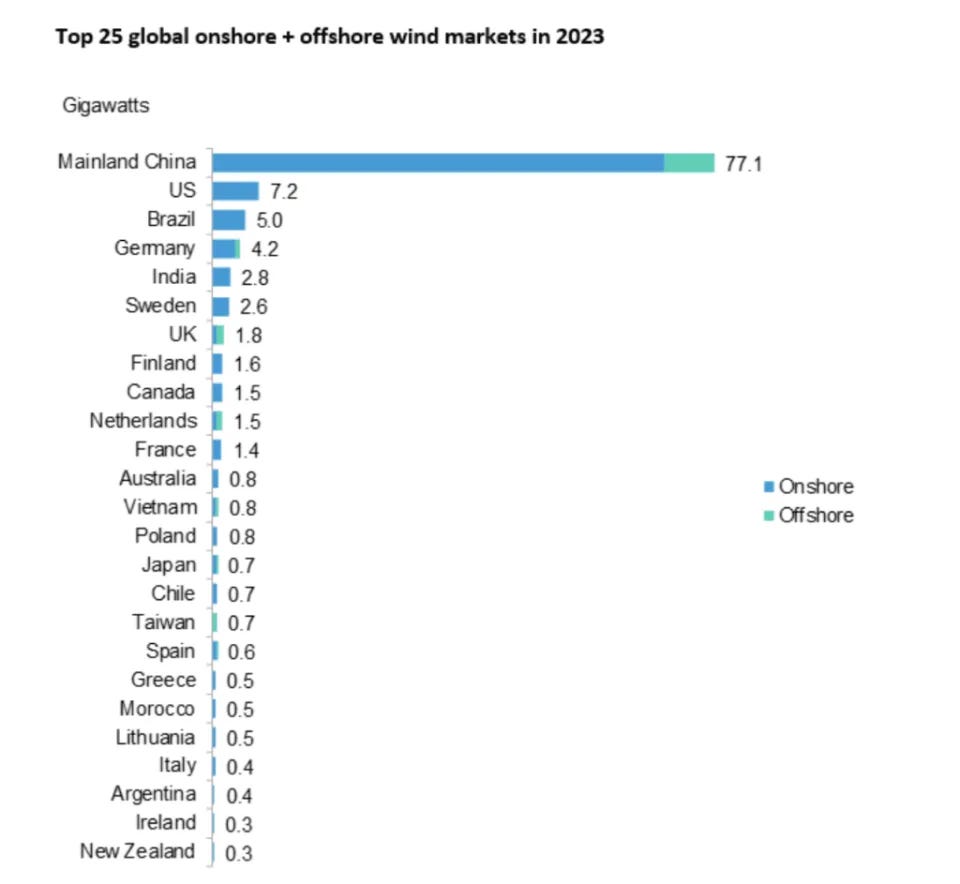

📈 Wind Turbine Manufacturers' Market Share in 2023, by BNEF

As every year, BloombergNEF has released its report "2023 Global Wind Turbine Market Shares" detailing the installation figures of wind turbines worldwide by manufacturer and their corresponding market shares. Please note, the figures refer to installations (indeed, they refer to commissioned turbines, i.e., those put into operation) and not orders. Just to clarify.

Here are some highlights, some of which are reported in the press, others are self-collected, and others are from this LinkedIn post by Cristian Bogdan, one of the analysts who participated in the study.

▶ Global wind power installation in 2023 reached a new record with 118 GW. This was mainly due to significant growth in China.

▶ China accounted for two-thirds of the installations, while the United States was the second country with 7.2 GW installed.

▶ The Chinese domestic market is the largest but also the most fragmented, with over 12 local manufacturers and strong price competition.

▶ According to Bloomberg, the price of wind turbines from Chinese manufacturers in markets outside China is 20% lower than those from Western manufacturers.

▶ According to Bloomberg, European Union countries installed 15.3 GW, which is 0.8 GW less than the figure reported by Wind Europe (16.1 GW). You can find an analysis of the European market figures here.

▶ Around 98% of the installed capacity by Chinese manufacturers was in their domestic market, indicating that their international business is still minimal.

▶ Nevertheless, according to Bloomberg, Chinese OEMs commissioned 1.7 GW in 20 foreign markets, including five EU member states.

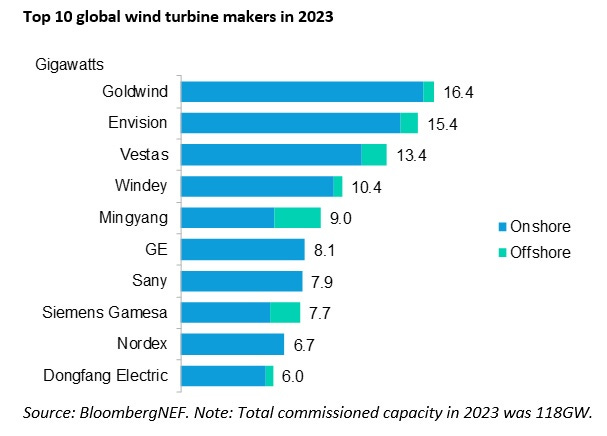

▶ Goldwind repeated as the manufacturer with the highest number of installed GWs, reaching 16.4 GW, of which 95% were in China.

▶ Envision has surpassed Vestas to claim the second position with 15.4 GW, primarily driven by growth in its domestic market.

▶ Vestas holds the third position with 13.4 GW and is the only European manufacturer among the top 5. This Danish manufacturer is the only European company in the Top 5.

▶ General Electric, which was third in 2022, falls to sixth place, mainly due to reduced installations in the United States, where it remains the number one supplier.

▶ Windey, perhaps one of the lesser-known Chinese OEMs in the West in terms of impact, ranks fourth with 10.4 GW.

▶ Nordex surpasses Siemens Gamesa in onshore installations, likely the first time this has happened since their respective mergers (Siemens-Gamesa and Nordex-Acciona).

▶ Of the total installations, 90% were onshore and 11 GW were offshore, of which 7.6 GW were in China. Mingyang installed 3 GW offshore, thus becoming the top player in offshore wind, a position typically held by Siemens Gamesa.

_

🇩🇰 Vestas will sell a single unit of the V236-15.0 MW to be installed at the port of Thyborøn, Denmark

Vestas has received an order for a single unit of its offshore turbine V236-15.0 MW to be installed at the port of Thyborøn, in northwest Denmark.

Truth be told, this news has surprised me, as it's very uncommon for a contract to be made for a single machine of these characteristics.

Moreover, this contract is also special because the turbine has been funded by 2,800 local shareholders, who also expect to turn it into a tourist attraction. Doing a rough calculation, it comes out to 7,000-10,000 euros per shareholder to have the turbine operational.

In summary, some Danes have chipped in to buy a V236. Quite an interesting move 🤣.

The order, in addition to the wind turbine, includes a 20-year maintenance contract and an agreement allowing Vestas to use that turbine for testing and verification purposes. Vestas itself states on its website that this unit will assist in the final verification campaign before starting serial production and the installation of the first offshore projects, expected in 2025.

Delivery of the turbine is expected to begin in the first quarter of 2024, with final commissioning scheduled for the second quarter of 2024.

This is undoubtedly a significant move by Vestas, which can surely include many lessons learned from the Østerild prototype and test them before starting to deliver 100% commercial units. Additionally, instead of having to pay for a new prototype entirely, it has secured a customer to cover the costs.

This project/contract format somewhat reminds me of the N155/5.X prototype that Nordex has in Navarra and is owned by the German company RWE.

Another very interesting aspect is that the permitting process for the project by the municipality took only 264 days. Additionally, the local support from the citizens of Thyborøn has been overwhelmingly positive.

We'll closely monitor the project, so if you don't want to miss out, subscribe.

_

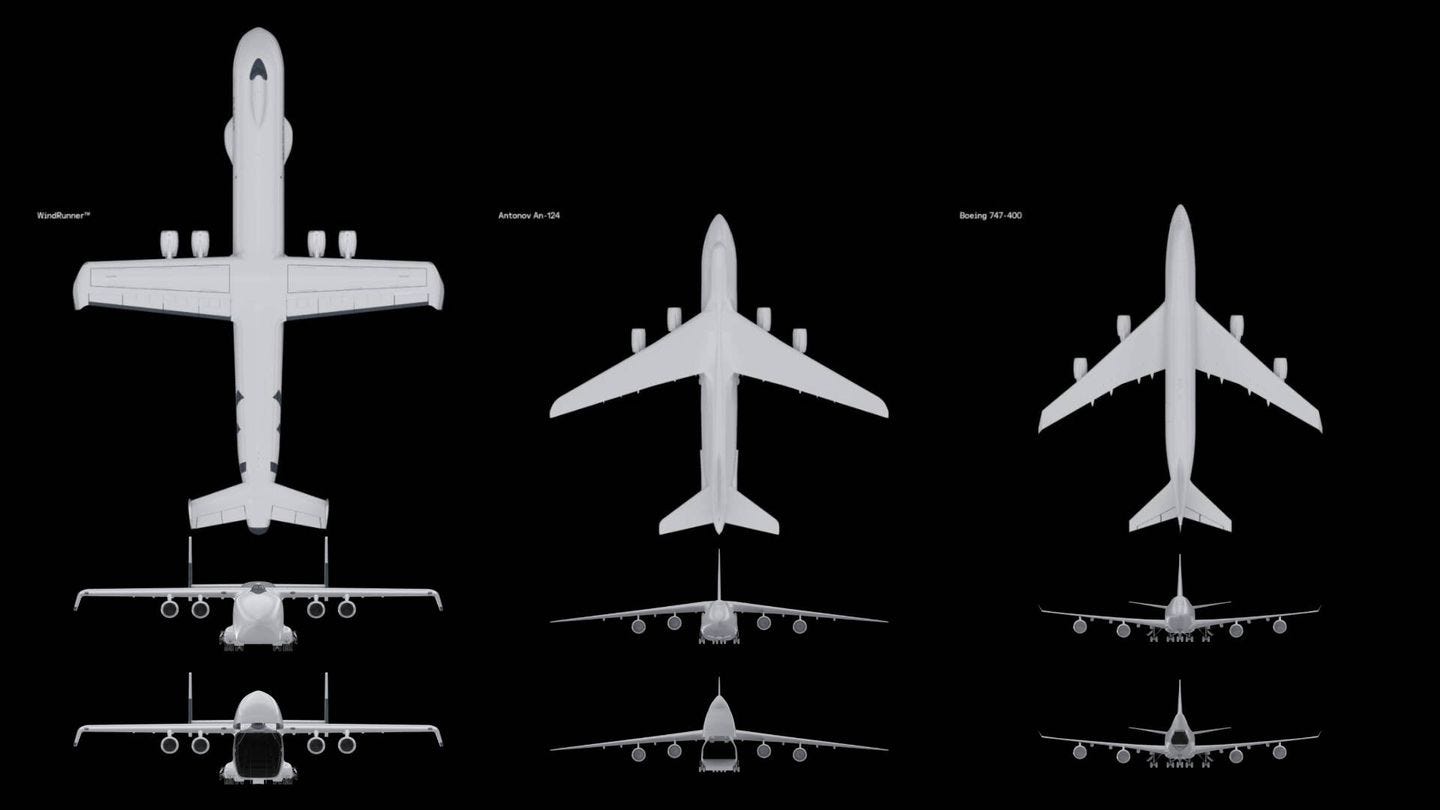

✈️ WindRunner: An Aircraft Capable of Transporting Wind Turbine Components

A few days ago, news spread across the internet about an aircraft capable of transporting wind turbine components, specifically blades. When I saw it in different media outlets, I thought it was pure clickbait, but I took it a bit more seriously when I saw that they had published a report in the Wall Street Journal (behind a paywall).

Radia, a startup based in Colorado, has a proposal to solve logistical issues onshore: to design the world's largest aircraft.

Being honest, personally, I don't see much future in this solution. The aircraft requires the construction of a temporary airstrip in the park area for landing and takeoff. This is literally impossible in complex terrains, which is precisely where logistics are most problematic and where the use of air transportation would make the most sense.

Additionally, with the assistance of blade lifters, blades are not always the most critical component. Many times it's one of the tower sections, although there are other solutions for towers as well.

Furthermore, there's the cost of constructing the temporary airstrip added to the cost of moving the aircraft itself. I understand it might make sense in large parks and remote areas with difficult road access, but flat ones. But of course, in the park area, you'll also need a truck to transport the blades from the airstrip to each position. Although you could always carry the truck inside the aircraft 😅.

In short, without delving too deeply, I see many gaps in the solution, although I hope I'm wrong. What I don't doubt, of course, is the potential viability of designing what would be the world's largest aircraft, which already seems like a monumental challenge. And that it might succeed in other applications beyond wind energy, of course.

This news reminded me of some words I heard several years ago while discussing the optimization of BOP (Balance of Plant) for projects: "the ultimate utopian goal should be to create wind farms that don't require BOP." After all, the BOP doesn't generate electricity, but it's a necessary (and essential) evil for the wind farm to deliver power.

It's worth spending some time browsing through Radia's website because it's tastefully done, and they have good renders of the Windrunner.

_

🤝 RWE and Nordex sign a framework contract for 800 MW

One of the major announcements from the recent Wind Europe edition was the framework contract signed by Nordex and RWE for a whopping 800 MW.

This means that over the next 2.5 years, RWE will purchase around 120 Nordex wind turbines for its projects in Europe. The relationship between the two companies goes way back, as RWE currently operates 53 parks in 7 different countries with Nordex turbines.

It's not very common for such high-megawatt framework agreements to be closed for various onshore projects. The most recent one that comes to mind is the GE Vernova and Forestalia agreement for Spain, involving 693 MW and 110 GE Cypress 6.1-158 turbines for 16 wind farms.

RWE seems to be comfortable with these types of agreements, as they signed a similar one for 1,000 MW with Siemens Gamesa in May 2023. However, problems arose with the 4.X and 5.X models (which, according to Bloomberg, could return to the market soon), so it's likely that this contract between GE and Nordex will replace a portion of that agreement.

_

🏛️ Vestas' proposals to redesign offshore auctions

Despite not being directly affected but rather positioned in the second stage of the chain (meaning it affects their customers), wind turbine manufacturers have been very active lately in terms of lobbying.

After all, what happens in auctions and permitting, to name a couple of examples, affects their customers first, but the supply chain afterward.

So, Vestas has decided to publicly announce its own proposals for a potential redesign of auctions with a very clear message.

Basically, Vestas points out that despite the large volume of auctions expected for this year, many of those plans remain just that, plans that fail to materialize.

The Danish manufacturer also notes that many of the auctions are designed to raise money (see negative bidding) rather than to maximize wind turbine installation. And that this can lead to unviable business cases.

To address these issues, Vestas makes three proposals:

Revenue Sharing Mechanisms.

Harmonizing Prequalification Criteria.

Creating Value with Non-Economic Criteria.

For more information on each point, refer to the LinkedIn post.

🚆 Traveling from Utrecht to Bilbao by train to attend Wind Europe

Browsing through X (formerly Twitter), I stumbled upon this thread by Kees van der Leun, Managing Director of Common Futures.

Kees attended the Wind Europe event held in Bilbao and decided to make the journey from Utrecht (Netherlands) to Bilbao by train. He shared his adventure through a Twitter thread, detailing travel times, prices, and the overall tourist experience. The journey includes high-speed trains, local trains, transfers, and even Euskotren.

It's worth taking a look at the Twitter thread. And Keen, if you're reading this, thank you for your kind words about Bilbao and the Basque Country 🙂

_

💥 Strong winds topple a wind turbine in Tarifa (Spain)

Videos of wind turbine collapses are quite popular on the internet. It's the type of content that goes viral very well, very spectacular, and delights detractors.

I've always had doubts about sharing this type of content on social media, as I'm not sure if they do more harm than good in out-of-context settings. But the reality is that one way or another, the videos end up going viral, so upon reflection, it may make sense to share them with context.

The latest video of this kind circulating on social media is truly spectacular, if it can be defined as such. I hadn't seen anything like it before. It happened in Spain, in Cadiz, near Tahivilla (link to Google Maps of what I believe is the affected turbine). It occurred on March 22nd, when the strait was being battered by a strong storm.

In this case, the wind turbine is torn off halfway up the tower, even as the blades are still turning. I have no idea what could have happened, but it seems to be a failure in the tower's connection bolts. ¿Any idea?

You can drop by the comments section of this LinkedIn post to see people's reflections.

By the shape of the nacelle and what I've been able to search on the Internet, it seems to be a Made AE-59 wind turbine with a power of 800 kW.

Thank you very much for reading Windletter and many thanks to Tetrace and RenerCycle, our main sponsors, for making it possible. If you liked it:

Give it a ❤️

Share it on WhatsApp with this link

And if you feel like it, recommend Windletter to help me grow 🚀

See you next time!

Disclaimer: The opinions presented in Windletter are mine and do not necessarily reflect the views of my employer.