Windletter #104 - Electrify everything you can

Also: Blade rettiping, BlueFloat Energy's CEO resigns, Australia's oldest wind farm will not be repowered, and more.

Hello everyone and welcome to a new issue of Windletter. I'm Sergio Fernández Munguía (@Sergio_FerMun) and here we discuss the latest news in the wind power sector from a different perspective. If you're not subscribed to the newsletter, you can do so here.

Windletter is sponsored by:

🔹 Tetrace. Specialized services in operation and maintenance, engineering, supervision, inspection, technical assistance, and distribution of spare parts in the wind sector. More information here.

🔹 RenerCycle. Development and commercialization of solutions and specialized services in the circular economy for renewable energies, including comprehensive dismantling of wind farms and waste management, refurbishment and sale of components and wind turbines, management and recycling of blades and others. More information here.

Windletter está disponible en español aquí

The most-read from the last edition are: the video on the mass production of BW Ideol's floating structures, the Nordex N175/6.X prototype with its 179-meter tower, and the innovative C1 Wedge Connection™ solution for the tower-to-transition piece connection.

Additionally, last week we asked you the following question regarding the progress of SGRE's 21.5 MW prototype.

62% of you believe that Vestas can wait. Is SGRE moving too fast? Will it still take a long time before we see the SG21.5-276 DD on the market?

Now, let’s dive into this week’s news.

⚡ Electrify everything you can

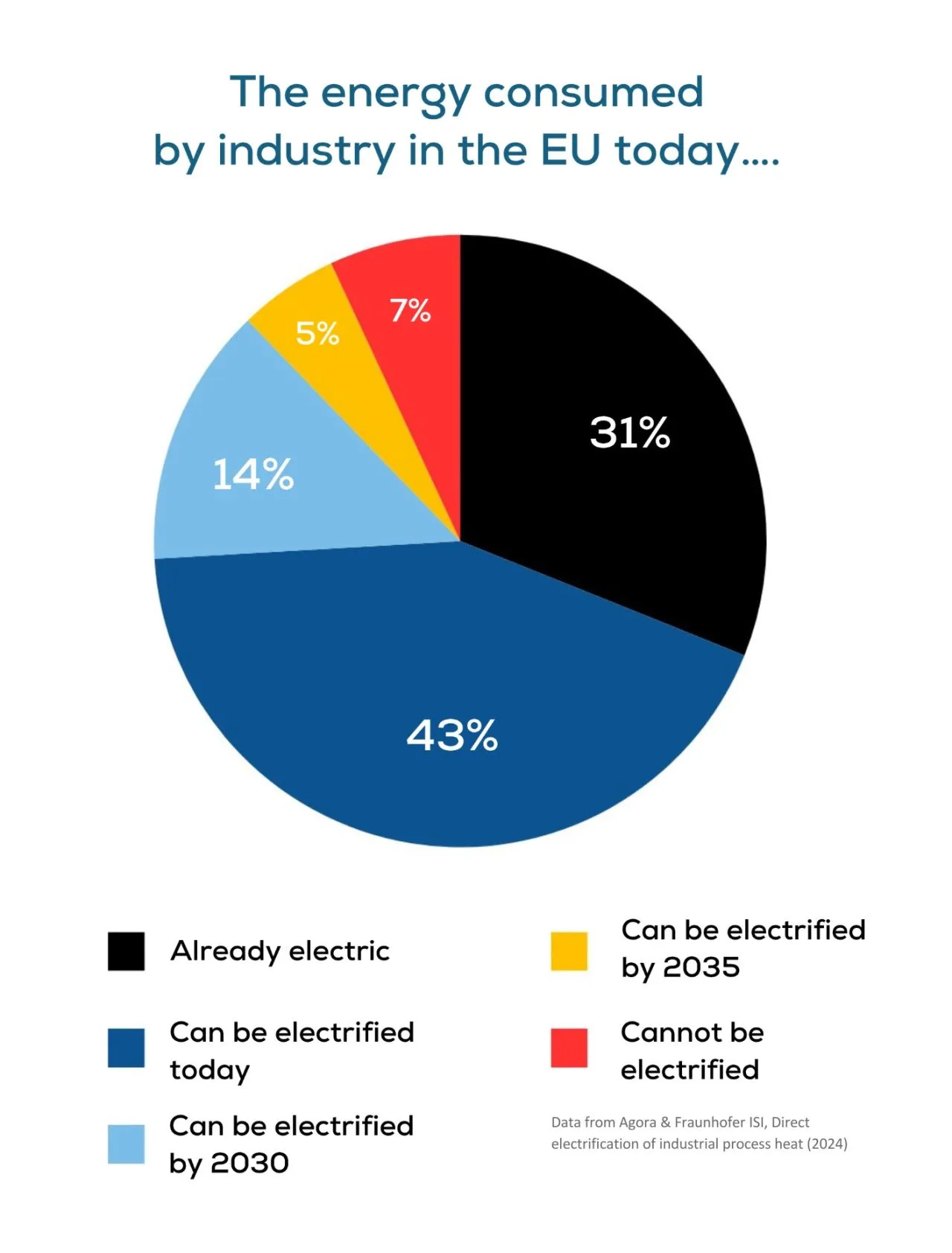

Today's main topic stems from a post by Giles Dickson, CEO of WindEurope. In it, Dickson calls for the electrification of industrial consumption, citing current data from the European Union based on a report by Agora Industry.

The graph above shows that currently, only 31% of all industrial consumption in Europe is electric, but there is potential to electrify an additional 43% now, and aditional 14% by 2030, and a further 5% by 2035.

Essentially, electrification means converting industrial heat processes that currently rely on fossil fuels to ones that can use electricity directly. Since a growing share of that electricity comes from renewable sources, emissions are reduced in the process.

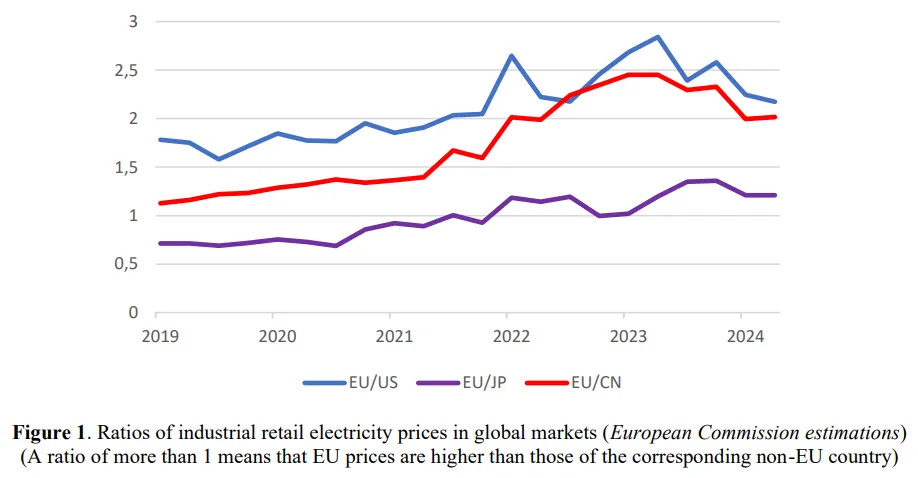

However, this is just one part of a much larger debate. The reality is that electricity demand is declining in Europe, largely due to the collapse of industrial consumption in energy-intensive activities that cannot remain competitive against energy prices in other regions.

Additionally, pro-electrification campaigns or movements are weak, likely because there is no single industry or sector behind them. It's easy to rally and lobby around solar energy, wind power, batteries, or self-consumption. But when it comes to electrification, there are many sectors and different interests involved, making it hard to unite under a single cause. There are many ways to electrify:

🚗 Transport: Electric vehicles, which are still not growing at the expected pace. Electrified public transport. Increased use of trains for freight transport. High-speed rail replacing air travel for medium distances.

🔥 Heating: Heat pumps are positioning themselves as a strong alternative to traditional oil and gas boilers, but they still face challenges in terms of investment and integration into older apartment buildings. Electric water heaters, though they may sound outdated, are starting to regain popularity.

🧪 Fertilizers: Ammonia production using green hydrogen, a process already being implemented in some locations.

🏭 Industrial processes: Electrifying fossil fuel-based processes, as mentioned earlier.

…

All of this sounds great, but I humbly believe that the best way to stimulate electrification is to make electricity cheaper. With lower electricity costs and the right policies, electrification will naturally happen.

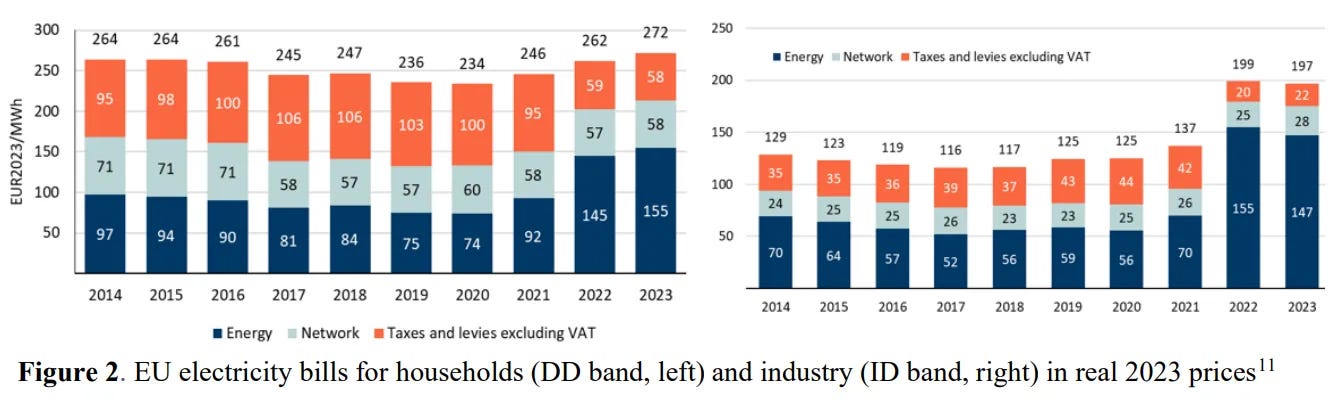

However, the reality is that European electricity pricing schemes (with country-specific differences) are generally burdened with excessive regulated costs and taxes.

Want to electrify? Make electricity more attractive than its alternatives…

And let’s not forget, electrification is not only crucial for reducing emissions, but it is also key to maintaining the "health" of the renewable energy sector. In electricity systems with declining demand but increasing renewable penetration, renewables risk losing market value.

Interestingly, the European Union has just published the Action Plan for Affordable Energy. I’ll leave the analysis to you, but let’s hope it doesn’t remain just a plan 🙂.

And we still need to talk about data centers, which seem to be arriving with a huge thirst for electricity to drive demand growth—but that’s a topic for another edition…

🌀 Increasing rotor size on operational wind turbines by replacing blade tips

There are different retrofit methods available in the market that allow increasing the energy production of operational wind turbines by modifying the blades.

Depending on the extent of the modification, this process is known as rettiping (changing the blade tip) or reblading (replacing the entire blade). A complete rotor replacement is sometimes also referred to as partial repowering. In any case, terminology in this area is not fully standardized 😅.

Through a LinkedIn post by Gang Wang, I came across an interesting video showing rettiping work in China. The process consists of literally cutting off the existing blade tip and replacing it with a longer one. These labor-intensive operations are performed while suspended in mid-air.

According to Gang Wang, this technology has become widespread in China. The results show an increase in AEP (Annual Energy Production) of approximately 5-6%, but at the cost of higher turbine loads, which could reduce the lifespan of certain components.

I find this topic very interesting, although I’m not sure how it affects permitting (since it increases rotor size and blade tip height) or turbine certification, as this represents a substantial modification.

That said, in Windletter #30, we discussed a case in France where Nordex performed a full blade replacement, increasing the rotor diameter from N100 to N117. In that case, the results showed an AEP increase of up to 20%, a noise reduction of -4 dBA, and an extended lifespan from 20 to 25 years.

👤 Carlos Martin Rivals resigns as CEO of BlueFloat Energy

Through a LinkedIn post, Carlos Martin Rivals announced his decision to step down as CEO of BlueFloat Energy, a position he had held since the company's founding in 2020 by 547 Energy and Quantum Capital Group.

For those unfamiliar, BlueFloat Energy, headquartered in Madrid, is one of the world's leading offshore wind developers, with a special focus on floating wind, as its name suggests. Its portfolio is primarily in Europe, but also includes projects in Australia and Taiwan.

According to Carlos, after deep reflection, he believes it is the right time to explore new professional opportunities.

Under his leadership, the company has developed a project portfolio of over 13 GW in markets such as the United Kingdom, Australia, Italy, and Spain. It has also secured exclusive concessions for 11 GW, with investment decisions expected between 2028 and 2032.

Interestingly, Quantum Capital Group recently explored selling BlueFloat Energy for €500 million, but ultimately canceled the sale, prioritizing the company’s growth while waiting for more favorable market conditions.

Offshore wind is a sector that requires patience—and even more so for floating wind. The offshore industry is currently facing challenges, with projects being canceled or delayed, and costs failing to return to previous levels. These factors have likely affected expected returns and asset values.

When it comes to floating wind, these challenges are even greater, with higher costs and greater technological uncertainty, increasing investment risk.

Fortunately, as we mentioned in Windletter #99, the first floating wind projects are advancing in countries such as France, the UK, and South Korea.

🔩 The impressive mold for Goldwind's 123-meter blades

Last week, we discussed the 147m blade for the Goldwind GW300-20-25MW—one of the largest rotors in the industry for the most international of China's wind manufacturers. Designed by Goldwind and manufactured by Sinoma Blades, it already has a prototype.

Today, we focus on another Goldwind rotor, slightly smaller but still impressive and closer to commercial operation. This is a 123-meter blade, weighing 50 tons, over 5 meters in diameter, with a swept area of more than 1,000 square meters. It is designed for 16 MW offshore wind turbines.

This blade is manufactured by LZ Blades at their Jiangsu Lianyungang factory. A fascinating video showcases the impressive mold and the manufacturing process.

🏗 Europe’s wind supply chain continues to grow

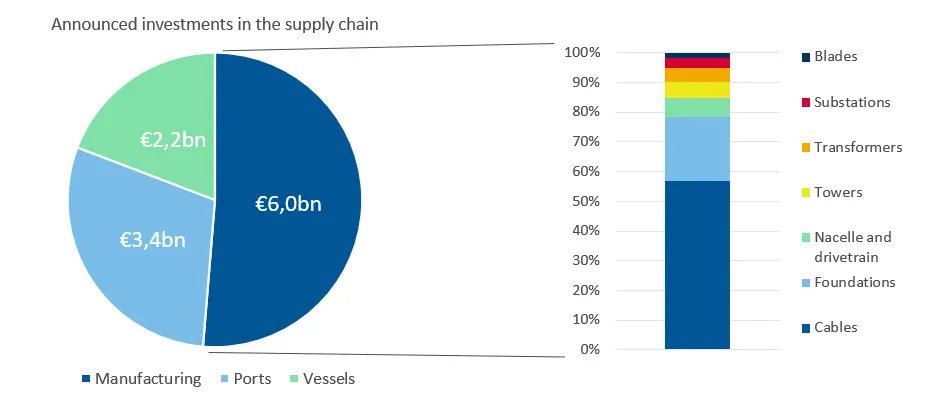

There have been two major announcements regarding investments in Europe’s wind supply chain.

Siemens Gamesa has announced a €200 million investment to expand its Le Havre factory (France) to produce blades for its SG14.0-236 DD model. This investment will create 200 new jobs, and production is expected to begin in early 2026.

Sif expects to commission new production lines by mid-2024 at its monopile and transition piece factory in the Port of Rotterdam. According to WindEurope, this expansion will increase annual production capacity to the equivalent of 200 XXL foundations. Interestingly, this factory is located next to the first prototype of GE's Haliade X.

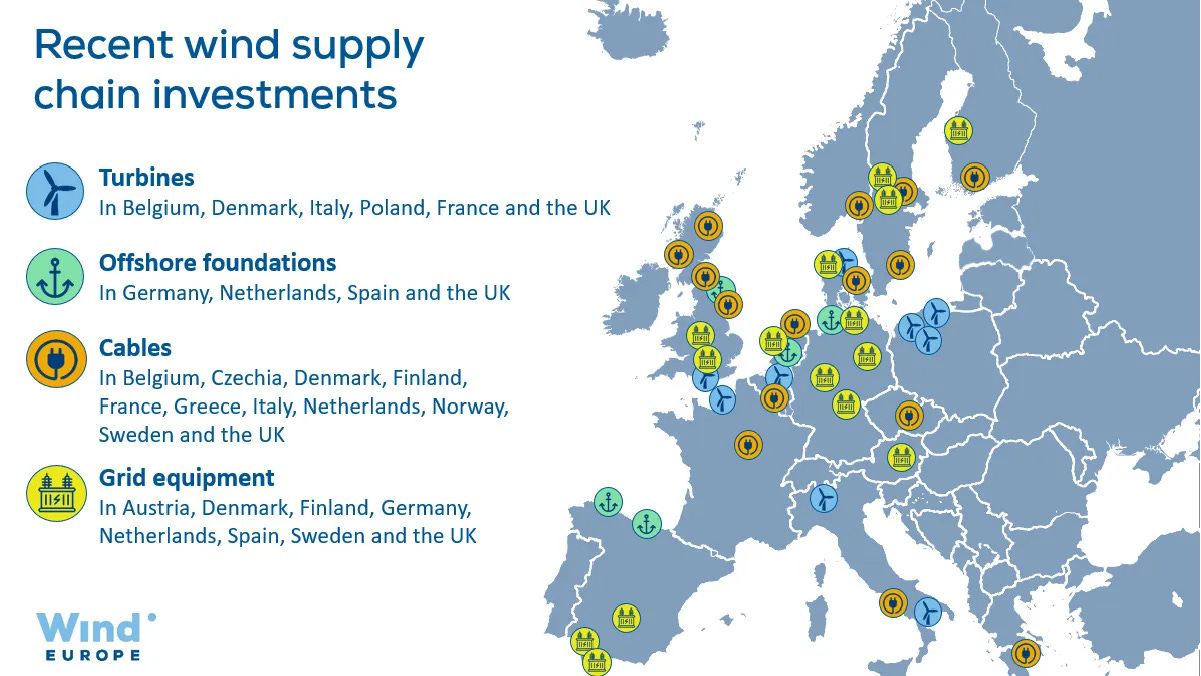

WindEurope has also updated the European Wind Supply Chain map, providing a clear overview of recent investments in wind energy and its associated industries.

One of the most interesting charts I came across shows investment by sector (manufacturing, ports, and vessels). Notably, cable factories account for over 50% of total investment in new manufacturing facilities.

🇦🇺 Australia’s oldest wind farm will not be repowered

Developer Pacific Blue will not repower the Codrington Wind Farm, located in southwest Victoria and considered Australia's oldest wind farm.

The project consists of 14 iconic AN Bonus 1.3 turbines, each with a nominal power of 1.3 MW, totaling 18.2 MW of installed capacity. The turbines have a hub height of 50 meters and a total blade tip height of 81 meters.

Despite its excellent coastal location and strong wind resources, Pacific Blue has deemed repowering financially unfeasible due to two key reasons:

Upgrading the grid connection infrastructure would require a major investment.

Environmental and permitting restrictions do not allow for modern, larger turbines. Some wondered on LinkedIn whether second-hand Vestas V90 turbines or Enercon E-70s could be installed (which Enercon might still sell new, even if they are not listed on their website).

Codrington, which began commercial operation in 2001, will be dismantled in 2027. Pacific Blue has already initiated discussions with local authorities and landowners regarding decommissioning.

This news reminded me of an article I’ve had in my drafts for a long time: Will there be a future market for "small" wind turbines? Will we see the return of 1.5-2.5 MW turbines being mass-produced? Will the second-hand turbine market grow for such locations?

We’ll discuss this someday, so if you don’t want to miss it, subscribe now!

🚛 How NOT to transport blades with a blade lifter

Some of the craziest wind energy videos often come from China, where unorthodox solutions and questionable safety standards are sometimes seen.

The latest such video, shared by china.dre on Instagram, shows a blade being transported using a blade lifter truck. So far, everything seems normal.

But to prevent the blade tip from rising—likely to avoid an aerial obstacle—workers decided to place small wheels on the tip and have a person sit there as it rolls along the road.

Not sure if my description is clear—it's best to watch the video.

According to the Instagram post, the blade is 93.8 meters long and weighs 28 tons, though I couldn’t confirm it.

Anyway, it's best to take it with humor and keep our fingers crossed that no one was injured during the transport 😅.

Thank you very much for reading Windletter and many thanks to Tetrace and RenerCycle, our main sponsors, for making it possible. If you liked it:

Give it a ❤️

Share it on WhatsApp with this link

And if you feel like it, recommend Windletter to help me grow 🚀

See you next time!

Disclaimer: The opinions presented in Windletter are mine and do not necessarily reflect the views of my employer.