Windletter #113 - Lazard’s LCOE+ 2025: Is LCOE still a useful metric?

Also: TotalEnergies secures 1 GW of offshore wind, a full life-cycle analysis of the SG 5.0-145 (2.0), a demo of the C1 Wedge Connection™, and more.

Hello everyone and welcome to a new issue of Windletter. I'm Sergio Fernández Munguía (@Sergio_FerMun) and here we discuss the latest news in the wind power sector from a different perspective. If you're not subscribed to the newsletter, you can do so here.

Windletter is sponsored by:

🔹 Tetrace. Reference provider of O&M services, engineering, supervision, and spare parts in the renewable energy market. More information here.

🔹 RenerCycle. Development and commercialization of specialized circular economy solutions and services for renewable energies. More information here.

🔹 Nabrawind. Design, development, manufacturing, and commercialization of advanced wind technologies. More information here.

Windletter está disponible en español aquí

The most read in the latest edition: the video showcasing the modularity of Vestas’ EnVentus platform, the table of pre-commercial floating wind projects worldwide, and the first SG5.X units installed in Spain.

📢 Last call! The deadline has been extended to vote for the “Best Energy Communicator” award organized by El Periódico de la Energía. I’d really appreciate your support. To vote, just enter your email address in the form available at this link.

Now, let’s get into this week’s news.

📊 Lazard's Levelized Cost of Energy+ (LCOE+)

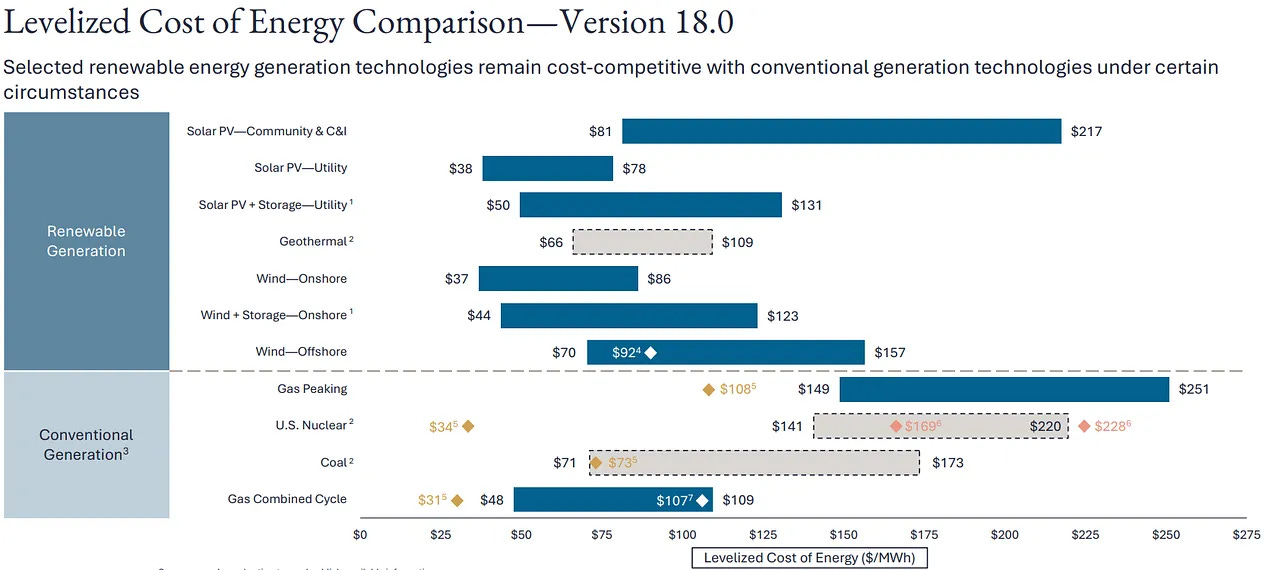

The Levelized Cost of Energy+ (LCOE+) report by Lazard is one of the most widely cited analyses in the energy sector. Published annually for the past 18 years, it compares the generation cost of different technologies (renewables, thermal, and storage) and evaluates their competitiveness. It’s important to note that the report focuses on the U.S. market.

The latest edition of the report confirms what has become a recurring reality in recent years: renewables remain the most competitive option for new-build generation, even without subsidies. In a context of high electricity demand and macroeconomic volatility, solar and wind stand out as the cheapest and fastest-to-deploy technologies.

Key takeaways from the report:

The cost gap between new renewables and the marginal cost of gas-fired combined cycles has narrowed, mainly due to low gas prices and a slight increase in renewable LCOE. Still, renewables continue to lead in economic viability.

Good news for storage: battery costs (both at utility-scale and commercial & industrial levels) have dropped significantly. This is largely due to reduced EV-related demand and technological improvements in battery cells (greater capacity and energy density).

The report also sends a critical message: the energy transition requires diversified generation fleets and system-wide planning to ensure firmness, reliability, and flexibility. The cost of firming increases as renewable penetration rises, likely due to reduced usage of so-called flexible plants. It's more expensive per MWh to operate a gas plant for 1,000 hours/year than for 4,000.

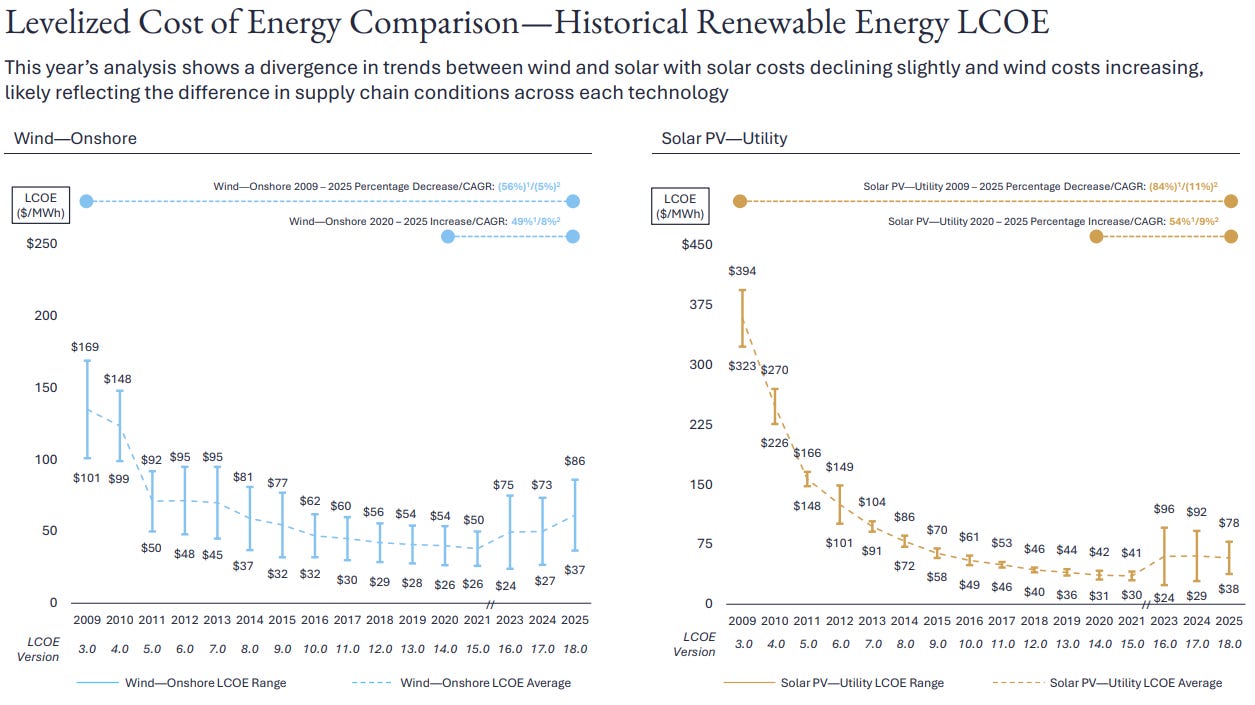

One particularly striking chart shows the evolution of wind and solar LCOE since 2009. As expected, costs have dropped significantly, especially for solar.

However, the graph reveals a concerning trend: the average cost of onshore wind has increased for the third year in a row. The LCOE downward trend we saw from 2009 to 2021 has reversed in recent years.

Is LCOE still a useful metric?

That’s a question that’s increasingly up for debate. Critics of renewables often claim that LCOE is "misleading" and argue that energy costs should be assessed at the system level.

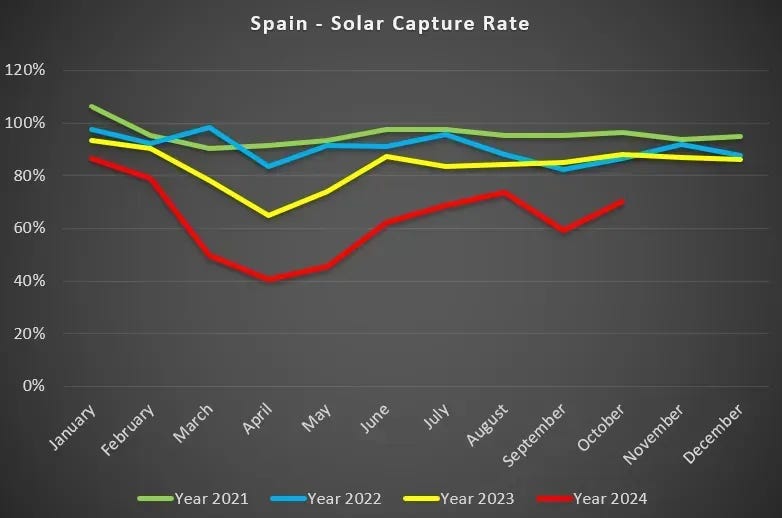

To be fair, in high-renewable penetration power systems, LCOE is becoming less relevant, especially in solar-heavy grids, where when electricity is generated, and what market price it captures, matters more and more.

This is the VOE (Value of Energy) vs. LCOE discussion we’ve touched on before.

To oversimplify: in today’s Spanish electricity market, generating power at 10 p.m. is far more valuable than at 1 p.m., due to solar cannibalization. But LCOE doesn't reflect that difference.

Of course, this wasn’t an issue in the days of feed-in tariffs or fixed energy prices, where LCOE was a perfectly valid metric.

And just to be clear: this also happens in wind-heavy systems, though to a lesser extent.

That said, I still think that for macro-level comparisons, LCOE remains the best tool we have, unless someone can point me to a better one.

What do you think?

CITE25 Congress – The energy transition takes the stage in Navarra

Pamplona will host the 4th International Congress of the Industry for the Energy Transition (CITE25) on October 23, organized by Enercluster.

The event brings together key players from the wind, solar, energy storage, and green hydrogen industries, with both national and international speakers and attendees.

You can check out the list of speakers here, and the full agenda for the day here (we’ll share more details soon). All the latest updates are being posted on the official CITE Congress LinkedIn page.

🎟️ Tickets are now available. Click the banner below to get yours and take advantage of discounted prices until August 1.

⚡TotalEnergies secures 1 GW of offshore wind in latest German auction

Germany has published the results of its offshore wind auction for site N-9.4, a 146 km² area in the North Sea that will host an offshore wind farm with a capacity of up to 1.2 GW, but with a grid connection limited to 1 GW (meaning the project will be overplanted). The concession is granted for 25 years, extendable to 35.

The site was not pre-developed, and the auction was price-only, including negative bidding. The winner was TotalEnergies, which will pay €180 million for the development rights.

That amounts to €180,000 per MW, which may sound high, but is well below the levels seen in the 2023 auctions, where developers paid between €1.1 and €1.3 million per MW. Those record-breaking figures were what triggered the broader debate around negative bidding in the first place.

Germany’s auction model has once again drawn criticism from WindEurope. Its CEO, Giles Dickson, summed it up as follows: “Negative bidding imposes additional costs that will ultimately fall on consumers and the supply chain.”

According to published information, only two bidders took part in the auction. Many analysts agree that low participation was driven by the high level of risk developers had to assume in this particular case, as explained by Kiko Maza:

No preliminary studies: no resource measurements or site assessments, meaning developers faced significant uncertainties.

Mandatory overbuilding: developers were required to install more turbine capacity than the grid connection allows. While this may optimize grid usage in theory, it increases CAPEX by 10–20%, and overbuilding is not always the most efficient business case. Allowing it is one thing, but making it mandatory is another.

2032 commissioning target: if the timeline is met, the project will come online in seven years, a long horizon with many variables.

No revenue visibility: no Contracts for Difference (CfDs), no clear PPA framework, only market exposure.

In contrast, most other European countries have opted for bilateral CfDs, which lower financing costs, stabilize revenues, and encourage broader competition.

Germany’s second offshore auction round for 2025 will take place in August, with 2.5 GW up for bidding across two pre-developed sites, using a mix of economic and non-economic criteria. We’ll be watching those results closely.

🌬️ Goldwind connects experimental wind farm featuring GWH266-16.2MW and GWH191-7.15MW turbines

Goldwind’s new experimental wind farm in Yancheng-Dafeng (Jiangsu, China) is now online. The site will serve as a testing ground for some of the Chinese manufacturer’s most advanced turbines, including the GWH266 (16.2 MW) and the GWH191 (7.15 MW).

Interestingly, Gang Wang recently shared a video on LinkedIn showing the installation of the GWH266-16.2 MW, likely at this very site.

One particularly intriguing aspect is that the wind farm will also be used to test high-power AC transmission technology at 17 Hz. I found this quite fascinating—and I hope the translation from Chinese didn’t fail me here.

According to the article, the lower frequency reduces line reactance by 60%, allowing for longer transmission distances with lower losses. This could be a key solution for offshore wind projects located far from shore.

For those with some background in electrical engineering, the logic does make sense. To simplify a bit, 17 Hz behaves more like DC than 50 Hz, in terms of how it interacts with inductive components like cables.

Of course, using 17 Hz AC would require frequency converters at both ends of the line, which adds cost and complexity. And at that point, one might wonder: why not just go with HVDC?

🌱 Life Cycle Analysis of the SG 5.0-145 (2.0)

Siemens Gamesa has published the Life Cycle Analysis (LCA) of its SG 5.0-145 (2.0) wind turbine. This is a topic we previously discussed in Windletter #80, following the release of the detailed Environmental Product Declaration (EPD) for the Vestas V236-15 MW.

According to the report, each kilowatt-hour produced by an average onshore wind farm equipped with the SG 5.0-145 (2.0) results in only ~7g of CO₂eq, compared to the current global electricity mix average of 475g CO₂eq/kWh.

The wind farm recovers the energy used in its construction, transport, assembly, and manufacturing in less than 7 months, and generates 38 times more energy than it consumes over its 25-year lifetime.

You can access the full report here. For those curious to dive deeper, below are links to LCAs from other manufacturers and turbine models (though they’re not always easy to find):

🌊 Ocean Winds celebrates 5 years of WindFloat Atlantic and begins installation of EFGL

Ocean Winds is celebrating a double milestone: five years of operation for the pioneering WindFloat Atlantic in Portugal, and the start of turbine installation at EFGL (Les Éoliennes Flottantes du Golfe du Lion), the first floating wind farm in the French Mediterranean.

In Port-La-Nouvelle, the first 10 MW floating turbine has been successfully assembled on the WindFloat semi-submersible platform. This achievement is the result of collaboration between Ocean Winds and Banque des Territoires (developers), Vestas (turbine supplier), Principle Power (platform designer), Euroports (port operator), RTE (French TSO), and Eiffage Métal (platform manufacturer).

This pilot project, featuring three turbines, combined with five years of operational experience at WindFloat Atlantic, paves the way for the 250 MW commercial floating wind farm awarded to Ocean Winds and Banque des Territoires in a recent French auction.

Meanwhile, in Viana do Castelo, Portugal, Ocean Winds celebrated the 5th anniversary of WindFloat Atlantic, the world’s first semi-submersible floating wind farm. With a cumulative production of 345 GWh since commissioning in 2019, the project reached a record output of 86 GWh in 2024.

This operational experience will no doubt be crucial as Ocean Winds strengthens its position as a key player in the future of commercial-scale floating wind.

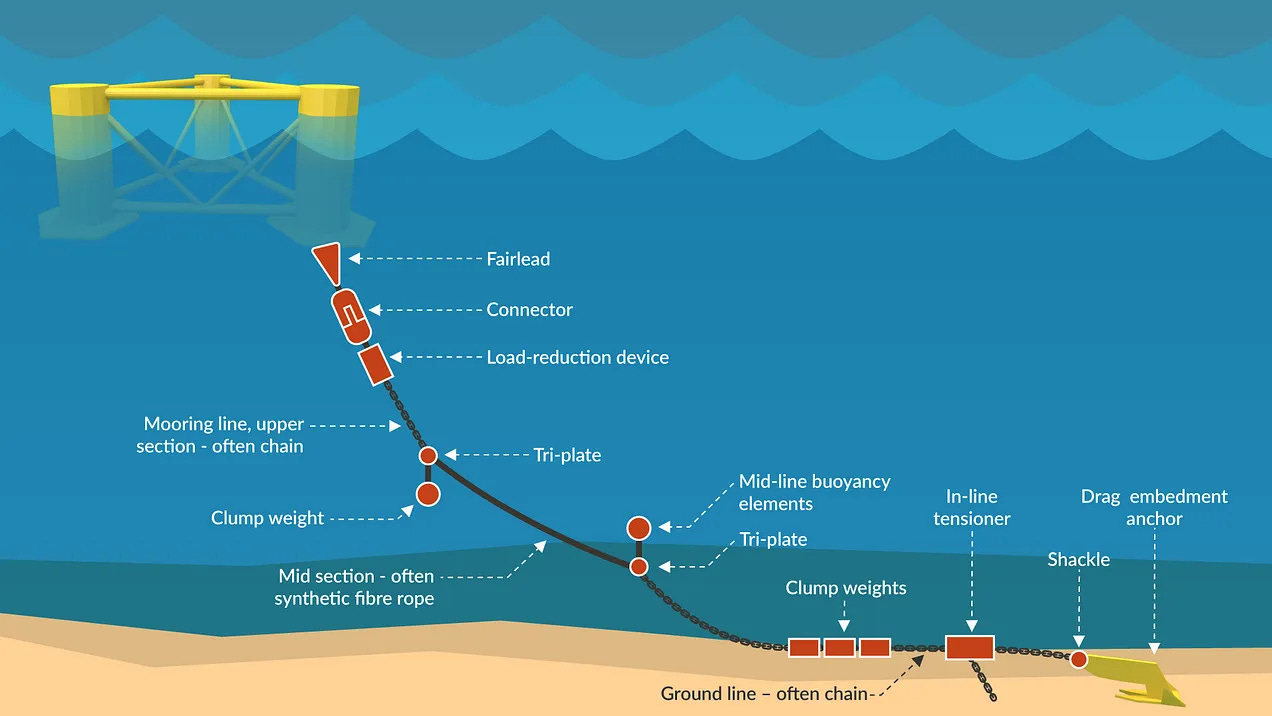

⚓ These are the anchors that hold floating wind turbines in place

While browsing LinkedIn, I came across a photo posted by Mooreast that really caught my attention.

The large metal components shown in the image are anchors (sometimes referred to as mooring foundations) used to secure floating wind turbines to the seabed.

As you may know, floating platforms are held in place by chains or synthetic ropes, which are in turn anchored to the seabed using these systems, in this case, what’s known as drag embedment anchors.

This video by Mooreast is a great way to understand the kind of work involved in installing these critical components.

🛠️ C1 Wedge Connection™ showcases its innovative tower-to-foundation connection system

As wind turbines grow larger and heavier, some of the traditional technologies used in their construction are becoming less optimal.

One such case is the connection between the foundation and the transition piece, which typically relies on dozens of bolts inserted into the tower flange and secured with nuts. This challenge led to the creation of the C1 Wedge Connection™ project, aimed at developing and commercializing a new solution for this critical interface.

Last week, the project team hosted an official launch event attended by over 200 participants, featuring a full-scale live demonstration of the system.

According to some attendees, the connection process was completed in just 52 minutes, which is reportedly a strong success (though I don’t know how long this usually takes with conventional systems). Judging by LinkedIn posts, the test was widely seen as a major achievement.

For those who want to dive deeper, here's a link to a technical paper with more details. We’ll have to wait and see when this solution is deployed for the first time in a commercial wind farm.

You can also watch a video of the event here.

Thank you very much for reading Windletter and many thanks to Tetrace, RenerCycle and Nabrawind our main sponsors, for making it possible. If you liked it:

Give it a ❤️

Share it on WhatsApp with this link

And if you feel like it, recommend Windletter to help me grow 🚀

See you next time!

Disclaimer: The opinions presented in Windletter are mine and do not necessarily reflect the views of my employer.