Windletter #72 - Exploring the numbers of wind energy in Europe

Also: Nordex publishes results, the Chinese giant Zhenshi arrives in Spain, Mingyang manufactures the world's largest blade, and more..

Hello everyone and welcome to a new issue of Windletter. I'm Sergio Fernández Munguía (@Sergio_FerMun) and here we discuss the latest news in the wind power sector from a different perspective. If you enjoy the newsletter and are not subscribed, you can do so here.

Windletter is sponsored by:

🔹 Tetrace. Specialized services in operation and maintenance, engineering, supervision, inspection, technical assistance, and distribution of spare parts in the wind sector. More information here.

🔹 RenerCycle. Development and commercialization of solutions and specialized services in the circular economy for renewable energies, including comprehensive dismantling of wind farms and waste management, refurbishment and sale of components and wind turbines, management and recycling of blades and others. More information here.

Windletter está disponible en español aquí

The most read from the last issue has been: Juan Pinilla's post about the new versions of the Haliade X, the video of the installation of Modvion's wooden tower, the new regulation of Spanish offshore wind on the Ministry's website.

Let's move on to the news of the week.

Statistics of wind energy in Europe in 2023 and outlook to 2030

Annually, Wind Europe, the wind energy industry association in Europe, publishes a report that collects the data and statistics of the sector in 2023 and makes some future forecasts.

Personally, I enjoy these reports a lot, as they allow getting a global idea of how the sector is in terms of generation, installations, turbine sizes, auctions, repowering... and also to see the comparison between countries, both onshore and offshore. So, let's go through the main highlights and some conclusions that the report gathers.

▶ Europe installed a total of 18.3 GW of new wind power capacity in 2023, of which 79% (14.5 GW) was onshore and the remaining 21% (3.8 GW) offshore. If we only consider the EU-27, a new record of 16.1 GW was established, with 13.3 GW onshore and 2.8 GW offshore.

▶ The countries that installed the most wind power were:

Germany 3,567 MW Onshore / 329 MW Offshore

Netherlands 527 MW Onshore / 1,906 MW Offshore

Sweden 1,973 MW Onshore / 0 MW Offshore

France 1,385 MW Onshore / 360 MW Offshore

United Kingdom 553 MW Onshore / 833 MW Offshore

Finland 1,278 MW Onshore / 0 MW Offshore

Poland 1,157 MW Onshore / 0 MW Offshore

Spain 762 MW Onshore / 2 MW Offshore

Greece 543 MW Onshore / 0 MW Offshore

Italy 525 MW Onshore / 0 MW Offshore

▶ It is expected that the European Union will install 200 GW during the period 2024-2030, with an average of 29 GW annually. To meet the EU's objectives, 33 GW annually would be needed.

▶ The countries with the highest percentage of wind energy in their electricity generation mix were:

Denmark 56%

Ireland 36%

Germany 31%

United Kingdom 29%

Netherlands 27%

Spain 27%

Sweden 26%

Portugal 26%

Lithuania 21%

Greece 20%

▶ Other interesting data:

Wind energy generated 466 TWh of electricity in the EU in 2023, covering 19% of electricity demand.

The capacity factors for new onshore wind farms built in Europe in 2023 ranged between 30% and 45%. For offshore, they were around 50%.

The average power of new onshore wind turbines installed in 2023 was 4.5 MW, representing an increase from 4.1 MW in 2022. For offshore, the average power was 9.7 MW, compared to 8.0 MW in 2022.

Despite the war, Ukraine installed 146 MW of new wind power capacity. However, 71% of its 1.9 GW installed capacity is currently out of service.

Europe dismantled 736 MW of wind power capacity in 2023. At the same time, it commissioned 1.5 GW of repowered capacity.

Despite the ambitious target of 59 GW of installed wind power in Spain by 2030 set by the PNIEC, WindEurope estimates that only around 40 GW will be reached. According to calculations, this would entail approximately 16 GW of new installations and 6 GW of decommissionings.

Link to the full report on the Wind Europe website

_

Nordex releases results reducing losses and "stabilizing" the business

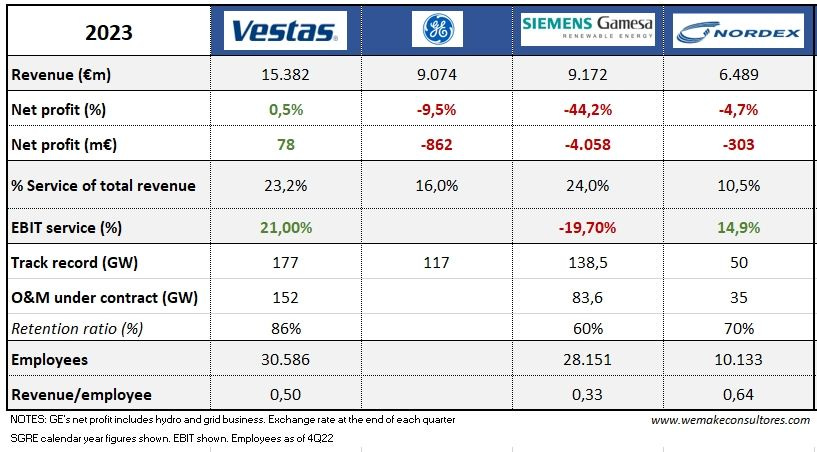

Finally, after messing up and apologizing, the forecasts were met, and Nordex closed the year with a -186.5 million euros EBIT, within the range of between -150 and -300 million euros that we discussed in Windletter #70 (an estimate given by one of you, by the way). Net profit, on the other hand, stood at -303 million. I leave you the link to Nordex's results report (pdf).

For 2024, Nordex expects sales between 7,000 and 7,700 million euros and an EBITDA between 2% and 4%.

Kiko Maza has also updated his famous comparative table of OEMs' financial results, and in his LinkedIn post, you can find some thoughts as well.

_

The Asian group Zhenshi acquires the Airbus plant in Puerto Real

This week, a piece of news caught my attention. According to several newspapers, the Chinese giant Zhenshi has purchased the Airbus plant in the Bay of Cádiz with the aim of manufacturing wind turbines.

However, delving beyond the headlines, it becomes apparent that they are not aiming to manufacture wind turbines but rather blades. Further investigation suggests that they are a supplier of raw materials for blade manufacturing, such as fiberglass or carbon fiber. In fact, their website lists the world's leading OEMs as clients, both Chinese and Western.

Nevertheless, one of the appealing aspects of the plant is the open space in warehouses 3 and 4, where parts of the Airbus A380 (the world's largest passenger aircraft) were manufactured until 2021. Given the dimensions, it seems like a suitable space for manufacturing large components.

So, I am uncertain about what to think, but contrary to mainstream media, I bet on the manufacturing and processing of raw materials.

If any of you have further information, I'm all ears.We will continue to closely monitor this issue, so if you don't want to miss out, subscribe.

_

Mingyang manufactures the world's largest wind turbine blade

Through a post by Markel Meseguer on LinkedIn, I learned that Mingyang has manufactured the world's largest wind turbine blade, measuring an impressive 143 meters in length.

This blade is for the MySE292 model, which has a power range of between 18 and 20 MW, and Mingyang has already manufactured the first nacelle for it as well.

In my Twitter account, I have shared some photos of the manufacturing process, which are actually very interesting and give us an idea of how artisanal this process still is.

_

Monna Lisa, Prysmian's vessel for laying submarine cable

Almost coinciding with its rebranding, the electrical cable manufacturer Prysmian has unveiled a new vessel for offshore cable laying, which it has named Monna Lisa.

According to Prysmian, the investment to build this vessel amounts to 240 million euros. Monna Lisa thus reinforces the company's Engineering, Procurement, Construction, and Installation (EPCI) capabilities and joins the other 5 vessels in its fleet.

Although Prysmian has always been known as a cable manufacturer, when it comes to such complex cables (high voltage and/or submarine), it is common for manufacturers to also offer installation services. This is a way to reduce risks and place the handling and installation of the cable under the manufacturer's umbrella, which requires a much greater understanding of the product and technology. This approach is not common with medium and low voltage cables (<33 kV).

The truth is that the video is amazing:

Interestingly, the Monna Lisa follows in the footsteps of its predecessor, the Leonardo da Vinci, which as you can see also has a very inspiring and appropriate name for the occasion.

_

Possible expansion of the Punta Lucero wind farm located in the Port of Bilbao

Until the arrival of the Esteyco's Elican and Saitec Offshore's DemoSATH, the Punta Lucero wind farm is the closest thing Spain has had to an offshore wind farm for many years.

Located on a breakwater in the Port of Bilbao, Punta Lucero consists of 5 Gamesa G80 wind turbines with a power of 2 MW each. Additionally, it has the dubious honor of being the last wind farm installed in the Basque Country, despite being constructed in 2006.

According to reports from Crónica Vasca, the Port of Bilbao is reportedly considering the possibility of expanding the installation with new wind turbines. This would be quite beneficial, considering that the Basque Country currently only has 143 MW installed capacity.

Before anyone mentions it: I haven't forgotten about the Gamesa Offshore prototype of 5 MW installed in the breakwater of the port of Arinaga, a similar installation to this one in the Port of Bilbao.

_

Two refurbished Bonus B450 wind turbines by WindTech

The curiosity of this edition comes from WindTech, a company dedicated to the repair and refurbishment of wind turbines and parts.

Through a LinkedIn post, WindTech has shared the recent acquisition of two Bonus B450 turbines from a decommissioned wind farm in Germany.

WindTech's objective is to recover and refurbish as many components as possible, so they can be reintroduced into the market for wind turbines that are still in operation. It's worth noting that the supply of many of these parts may not be easily available currently.

For those who are unfamiliar, Bonus was one of the pioneering manufacturers in the wind industry and was acquired by Siemens Power Generation in 2004 when it had installed 3,321 MW in 20 countries and a market share of around 9%.

Thank you very much for reading Windletter and many thanks to Tetrace and RenerCycle, our main sponsors, for making it possible. If you liked it:

Give it a ❤️

Share it on WhatsApp with this link

And if you feel like it, recommend Windletter to help me grow 🚀

See you next time!

Disclaimer: The opinions presented in Windletter are mine and do not necessarily reflect the views of my employer.