Windletter #108 - United States destroys legal certainty

Also: Enercon installs the prototype of its E-175 EP5 E2, floating wind project CAPEX comparison, first results of the Vestas and SGRE collaboration, and more.

Hello everyone and welcome to a new issue of Windletter. I'm Sergio Fernández Munguía (@Sergio_FerMun) and here we discuss the latest news in the wind power sector from a different perspective. If you're not subscribed to the newsletter, you can do so here.

Windletter is sponsored by:

🔹 Tetrace. Reference provider of O&M services, engineering, supervision, and spare parts in the renewable energy market. More information here.

🔹 RenerCycle. Development and commercialization of specialized circular economy solutions and services for renewable energies. More information here.

🔹 Nabrawind. Design, development, manufacturing, and commercialization of advanced wind technologies. More information here.

Windletter está disponible en español aquí

For those of you living in Spain or Portugal, how was the blackout? What a crazy situation we experienced last Monday. In Bilbao, it was resolved in just over an hour, although in many nearby towns it took several hours more. We were lucky — being close to France helped us, as the interconnections were used to restore supply.

Honestly, these events make you reflect. We enjoy electricity as if it were some sort of “natural right”, but in reality, there's a massive and highly complex system operating in a coordinated way across Europe. In fact, I’ve heard the European grid referred to as “the largest machine ever built”, a definition I really like.

I might publish something about the blackout in Windletter, but as you know, we’re not the fastest, we aim to analyze things calmly. For anyone looking for immediacy, memes, and hot takes, I recommend heading over to X/Twitter, which is pretty entertaining in these situations.

But as you’ve probably noticed, this week’s Windletter is about something else.

🇺🇸 United States destroys legal certainty by halting an offshore project under construction

On April 16, the Bureau of Ocean Energy Management (BOEM), following Trump administration directives, ordered the suspension of construction at the Empire Wind 1 offshore wind farm until the project undergoes a new review.

This was communicated through a letter sent by Secretary Doug Burgum to BOEM. In summary, the letter states:

Trump ordered a full review of federal permits for offshore wind projects in a memorandum published earlier this year (January).

During this review, serious issues were allegedly found in the approval of Empire Wind 1. The issues or supposed deficiencies have not been made public.

It is claimed that the project approval was rushed by the previous administration, without sufficient interagency analysis or consultation. Interestingly, BNEF points out that Empire Wind 1 took 46.4 months to receive federal approval—above the average of 42 months.

An immediate suspension is ordered for all construction activities on the Empire Wind Project.

The suspension will remain in place until a new review addresses the identified deficiencies.

Furthermore, Department of the Interior staff are instructed to continue reviewing all existing and pending offshore wind permitting procedures.

While the Trump administration had already taken steps to cancel permits and delay planned projects, this marks the first time action is taken against a project already under construction.

Equinor has stated that it is in contact with the relevant authorities to clarify the situation and is considering its legal options, including a possible appeal.

Meanwhile, New York Governor Kathy Hochul declared that she will fight the federal decision and will not allow "this abuse to stand."

The news has hit the sector like a bucket of cold water, as it completely undermines legal certainty in a country like the United States (supposedly one of the best in the world “to do business”) and reinforces fears and uncertainty triggered by Trump’s victory.

The suspension, if it becomes permanent, would have a massive impact on Equinor’s finances — but also on the entire offshore wind sector. It’s important to remember that this is a multi-billion dollar project already under construction (!)

Here are the figures for Empire Wind 1 to put into perspective what it means to halt such a project:

Location: Off the coast of New York

Installed capacity: 816 MW

Number of turbines: 54

Turbine model: Vestas V236-15.0 MW

Developer: Equinor

Commissioning: “First energy” by the end of 2026, fully operational in 2027

The project has a book value of $2.5 billion in Equinor’s financial accounts. For now, the Norwegian oil company is evaluating how this (currently temporary) suspension affects costs and planning.

According to a press release by Equinor, as of March 31, 2025, Empire Wind 1 had already drawn approximately $1.5 billion from its project finance loan. If the project were ultimately canceled, Equinor would have to repay the $1.5 billion loan and also pay penalties to its suppliers.

On the other hand, Sif, the monopile supplier, has stated that for now it is continuing production according to the contract. In fact, 6 out of the 54 monopiles have already left Rotterdam en route to New York.

As for Vestas, unless I'm mistaken, they haven’t made any statements, but the first wind turbines are scheduled to be delivered in 2026. If everything is resolved, these will be the first V236-15.0 MW units in the United States, and likely Vestas’ first offshore turbines in the country.

Another key point is the potential impact on the rest of the offshore projects in the United States. Besides Vineyard Wind and its own issues, Coastal Virginia Offshore Wind by Dominion (2,640 MW) and Revolution Wind by Ørsted (704 MW) are also currently under construction.

In any case, we’ll see how all this ends, but for now, the reputational damage is already done, and the legal certainty of the country has been seriously undermined. And while this gets sorted out, which will likely take time, Equinor has a major problem on its hands.

🏗️ Enercon installs the prototype of its 7.X MW E-175 EP5 E2

Enercon has installed the prototype of its new E-175 EP5 E2 turbine rated at 7.X MW in Wachendorf (Germany). This turbine, which we have previously covered in Windletter, stands out for its most notable feature: its Direct Drive generator is divided into two pieces.

According to Enercon’s official website, this new generator with an external rotor (a change from the internal rotor used in the previous generation) allows for the following:

Improved air gap, which is essential for increasing power.

A reduction of over 40% in the use of permanent magnets.

This segmented design meets logistical limitations in Germany (4.99 m), since the total dimensions of the full generator are 9.9 meters. The total weight of the generator is 124 tons, so each segment weighs 62 tons.

For some reason, I had imagined both parts of the generator being joined on the platform and then lifted together into the nacelle. However, the following photo shows that both segments are joined at the top of the tower.

Technical data:

Rated power: 7.0 MW (compared to 6.0 MW in the previous version).

Rotor diameter: 175 meters.

Hub height: 162 meters (hybrid tower).

Interestingly, it seems that Enercon has partially returned to its E-40 design, in what appears to be a kind of tribute.

🔧 Dajin Heavy Industries hires BlueFloat’s top management to expand floating wind business in Europe

An interesting move in the offshore wind foundation supply sector. Chinese company Dajin Heavy Industries has announced the hiring of four former BlueFloat Energy executives to form a floating wind team in Madrid. The team will be led by Carlos Martin, former CEO of BlueFloat.

For those unfamiliar, Dajin is based in Beijing, has supplied monopiles to Ocean Winds for the Yeu-Noirmoutier project (France), and is currently supplying RWE for the German Nordseecluster A project.

With this move, Dajin positions itself as a global supplier of floating offshore wind foundations, incorporating a team with extensive experience in the sector and deep knowledge of the challenges and issues faced by developers.

Interestingly, BlueFloat and Dajin had recently signed a Memorandum of Understanding (MoU) in Madrid.

It’s worth noting that floating wind is in full expansion, with nearly 2 GW of projects at an advanced stage in France (750 MW), the United Kingdom (400 MW), and South Korea (750 MW), as we mentioned in Windletter #99

Additionally, auctions are expected between 2025 and 2026 in the United Kingdom, France, South Korea, Italy, Norway, Portugal, and Spain.

Dajin's objective is to offer a comprehensive solution for floating foundations, covering manufacturing, transportation, assembly, and final delivery.

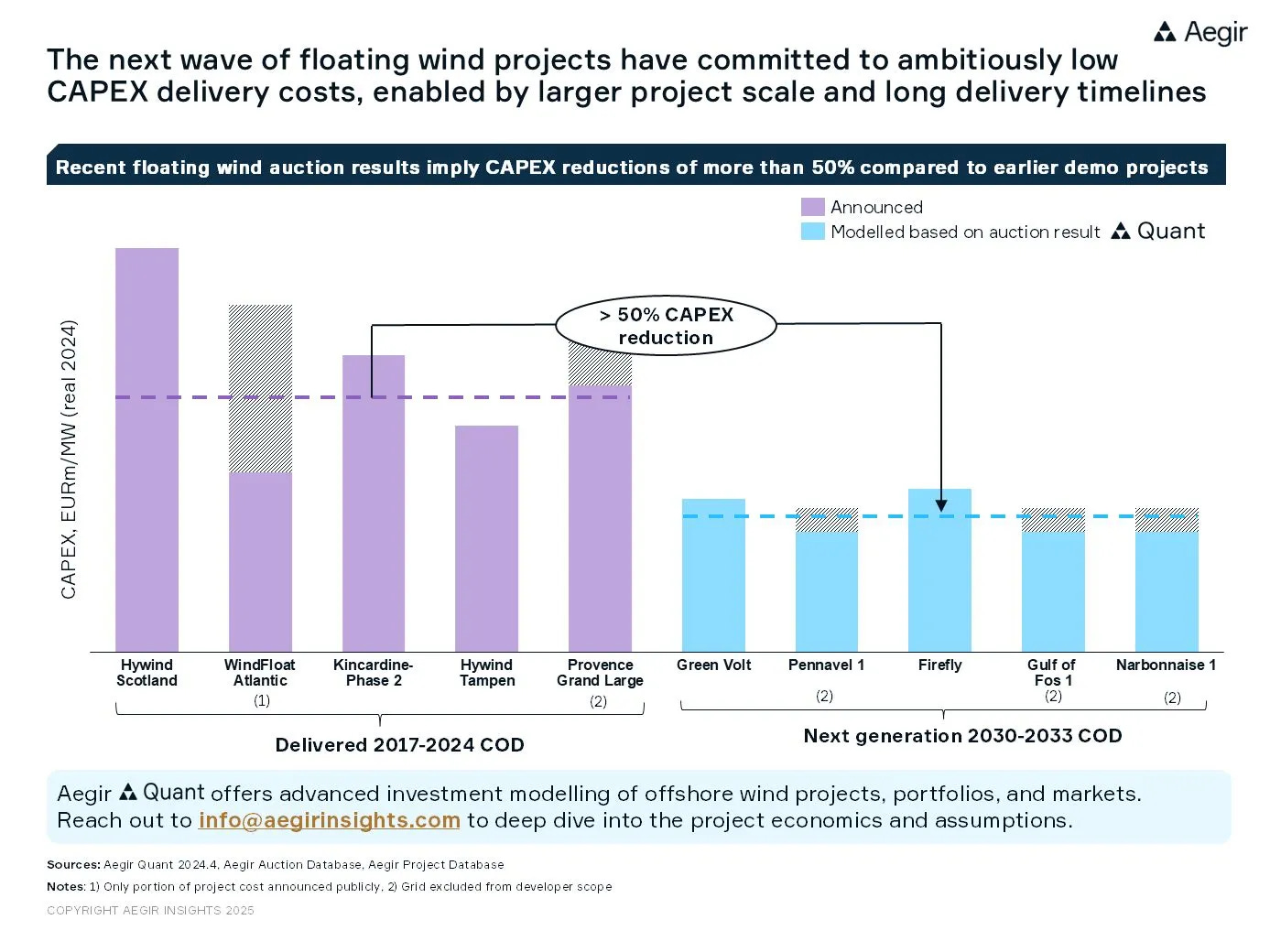

💰 Capex comparison of floating wind projects

The era of large-scale floating wind farms is already here, and the team at Aegir Insights has shared truly interesting content on project CAPEX.

The chart below compares the CAPEX of existing pre-commercial projects around the world with the CAPEX of the first commercial-scale projects (in this case, modeled by the Danish startup).

As can be seen, the main conclusion is that a CAPEX reduction of around 50% is expected, as a result of learnings and economies of scale.

Although Aegir Insights does not show the specific data (something reserved for clients), as we saw in the analysis we carried out in Windletter on the French floating wind auction, the announced investment cost of the projects ranges between 3.2 and 4.2 billion euros per installed MW.

However, caution is advised when interpreting this figure, as Aegir Insights rightly points out that it does not include the grid connection cost, which in France is covered by RTE (the French TSO).

🌊 First results of the collaboration between Vestas and SGRE for offshore transport tools

Collaboration between different wind turbine manufacturers has always been identified as one of the main ways to drive technological evolution and cost reduction in the wind industry.

It is evident that manufacturers are not going to share with each other their most advanced control strategies or the new materials used to develop lighter and more resistant blades. Innovation represents a key competitive advantage. However, there are other areas where advancing independently does not seem to make much sense.

One of the first areas where a real opportunity for collaboration has been identified is the development of transport tools for offshore wind turbines, known as seafastening. In this field, Siemens Gamesa and Vestas have decided to take a joint step and work on a common solution.

These tools involve the use of tons of steel and require intensive work at the dock. Once the installation offshore is completed, they must be dismantled and removed from the vessel, which involves significant cost in both time and resources. In addition, these processes require keeping the vessels idle for several days, reducing their operational availability.

Therefore, the Denmark Energy Cluster promoted a collaborative project between Siemens Gamesa and Vestas to standardize and reduce the costs of these tools.

The first results of this project have already arrived in the form of a report (44 pages): Seafastening Design Guideline SG 14-222 DD & SG 14-236 DD and Vestas V236.

The report provides a wealth of details and gives an idea of the complexity of seafastening.

🏭 GRI Renewable Industries acquires 45% of Windtechnic Engineering

The company GRI Renewable Industries, specialized in the manufacturing of steel wind turbine towers and flanges, has acquired 45% of Windtechnic Engineering, a company specialized in the engineering, manufacturing, assembly and technical support of hybrid and concrete towers for wind turbines.

This is a strategic move for GRI, allowing the company to expand its product portfolio and enter a market segment that represents around 15% of the global market.

It is worth remembering that in large onshore wind turbines, once certain hub heights are exceeded (approximately 140 meters, although it depends on many factors), conventional steel towers lose competitiveness and hybrid or 100% concrete towers gain prominence.

Trends suggest that in the next generations of onshore wind turbines, hybrid and concrete towers will become more common, likely one of the key reasons behind GRI's decision to take this step.

These types of products are very common in markets with high hub heights, especially in Northern Europe, where they are widely used.

Thank you very much for reading Windletter and many thanks to Tetrace, RenerCycle and Nabrawind our main sponsors, for making it possible. If you liked it:

Give it a ❤️

Share it on WhatsApp with this link

And if you feel like it, recommend Windletter to help me grow 🚀

See you next time!

Disclaimer: The opinions presented in Windletter are mine and do not necessarily reflect the views of my employer.