Windletter #115 - GE Vernova obtains a permit to install an 18 MW prototype

Also: curiosities from the dismantling of the Muel wind farm, SGRE receives the first order for the 4.X platform, offshore wind farms in Denmark extend their license, and more.

Hello everyone and welcome to a new issue of Windletter. I'm Sergio Fernández Munguía (@Sergio_FerMun) and here we discuss the latest news in the wind power sector from a different perspective. If you're not subscribed to the newsletter, you can do so here.

Windletter is sponsored by:

🔹 Tetrace. Reference provider of O&M services, engineering, supervision, and spare parts in the renewable energy market. More information here.

🔹 RenerCycle. Development and commercialization of specialized circular economy solutions and services for renewable energies. More information here.

🔹 Nabrawind. Design, development, manufacturing, and commercialization of advanced wind technologies. More information here.

Windletter está disponible en español aquí

The most read from the last edition was: innovation vs standardisation by RWE’s Offshore CEO, Nabrabase foundation solutions, Klaus Rockenbauer’s Instagram.

Now, let’s get to this week’s news.

🌊 GE Vernova obtains a permit to install an 18 MW prototype

The Norwegian energy regulator (NVE) has granted permission to install an offshore turbine of up to 18 MW, 275 m in height and 250 m in rotor diameter in the industrial area of Sløvåg (municipality of Gulen).

The developer that has received the permit is Georgine Wind, a 100% subsidiary of GE Renewable Norway, which is part of GE Vernova. The project, named Gulavind, has been processed as a technology test site for offshore wind development. A five-year testing phase is planned, followed by 25 years of operation.

With this permit on the table… is GE Vernova truly resuming its offshore strategy? Or is it just a manoeuvre to keep an option open?

Public information is somewhat contradictory:

If we go back to July last year, it was published at the time that the project had received 29 million euros in funding from Enova (a public company under the Norwegian Ministry of Climate and Environment).

At the same time, months earlier, it had also been published that GE had halted the development of its 18 MW turbine to focus on a 15.5 MW version. This was something GE even officially communicated to the American stock exchange.

In recent times, GE Vernova has publicly stated that it is pausing offshore turbine sales while waiting for better market conditions.

However, it seems that the American giant has decided to move forward with the permits for this prototype. In fact, the approval has been published on the website of the Norwegian energy regulator itself and has also been reported by Recharge and EnergyWatch.

So, what is GE Vernova going to do? Good question.

But to speculate a bit, the truth is that, if it really has secured the 29 million euros in funding, that could practically cover the development of the prototype.

That prototype, more than a revolution, could be an upgrade of the current Haliade X, which could be industrialised without major investments in the current factories, and ending up somewhere between 15 and 18 MW, probably at the mentioned 15.5 MW. All this in preparation for a possible return to the market.

Have market conditions changed? Well, judging by recent publications, offshore turbine prices have increased significantly, as noted by Ørsted in its white paper. The question is whether that price increase can be transformed into profit with contained risk.

Let’s remember that, although it hasn’t received new orders for quite some time, GE is currently completing the supply, assembly and commissioning of the projects it had committed to (Vineyard Wind, Dogger Bank).

We will be watching developments closely.

♻️ Curiosities from the dismantling of the Muel wind farm

Our sponsor RenerCycle is making progress on the dismantling of the Muel wind farm, in Spain, owned by RWE. According to RenerCycle’s LinkedIn account, the 27 NordTank 600/43 turbines have already been dismantled and stored at RenerCycle’s facility in Falces, ready for recovery or recycling.

We will talk more about the recovery process later, but today we focus on something we love at Windletter: the technical details and curiosities of this kind of work.

One of the first surprises appears when looking at the nacelles: all of them are labelled “TAIM NordTank”. TAIM stands for “Talleres Auxiliares de la Industria Minera,” a company from Zaragoza that, in the 1990s, partnered with NordTank to manufacture under licence the NTK 600/43 model. A collaboration that continued after NordTank was acquired by NEG Micon.

The NTK 600/43 model is a gem in wind energy history. Launched in the mid-90s by the Danish manufacturer, it marked a technological and industrial milestone. Famous for its reliability, it presents several features that make it a historic reference:

Steel nacelle with “shell-type” opening using a hydraulic system.

Passive regulation by aerodynamic stall, predecessor of today’s Pitch control. One day we will talk about this in Windletter, as it’s a very interesting topic.

Blade tip air brake, capable of rotating to stop the rotor (a blade with the brake activated can be seen in the image).

Tapered steel tower in segments, a pioneering solution at the time.

Semi-integrated drivetrain, with gearbox, main shaft and brake forming a compact unit.

Many auxiliary components, such as pumps or solenoid valves, are compatible with later models like the NEG Micon NM600 or NM750. This allows for recovering those elements as spare parts, extending the service life of other operating wind farms.

Dismantling an installation of this age involves multiple technical challenges. Geotechnical studies have been required to ensure the load-bearing capacity of the ground, and dismantling and transport tools had to be designed from scratch, as the original ones no longer exist. For this, reverse engineering techniques were used.

Transporting, storing, dismantling and recycling more than 95% of the total weight of turbines that were not designed with circularity in mind is no simple task. But it is precisely this kind of challenge that drives the circular economy in wind power.

💨 Siemens Gamesa receives the first order for the 4.X platform after its return to the market

Siemens Gamesa has announced its first public sale of the 4.X platform since sales were halted in 2023 and resumed in September last year.

And it will be with a project that also marks another milestone: the first wind farm to be built in the Basque Country in two decades. This is something special for Windletter, since, for those who don’t know, these words are being written right now from the Basque Country.

The project will be located in Labraza (Álava) and will consist of 8 SG 5.0-145 (2.0) turbines of 5 MW, the updated model of the 4.X range. It totals 40 MW and is being developed by Aixeindar, a public-private partnership between Iberdrola and the Basque Energy Agency (EVE).

With a capacity of 40 MW, the wind farm will feature 8 Siemens Gamesa wind turbines of the SG 5.0-145 (2.0) model, part of the 4.X platform. According to Siemens Gamesa, the reactivation of the 5.X is expected before the end of the fiscal year this coming September. Good news for the return to normal operations of Siemens Gamesa onshore.

With only 153 MW of installed wind power, the Basque Country is one of the most lagging regions in terms of wind development in Spain. The last wind farm built was Punta Lucero, installed in 2006 on a breakwater of the Port of Bilbao, with 5 G87 turbines of 2 MW.

Will it be time for a visit when the turbines arrive? 😁

🌎 Wind power will break global installation records in 2025… but not offshore

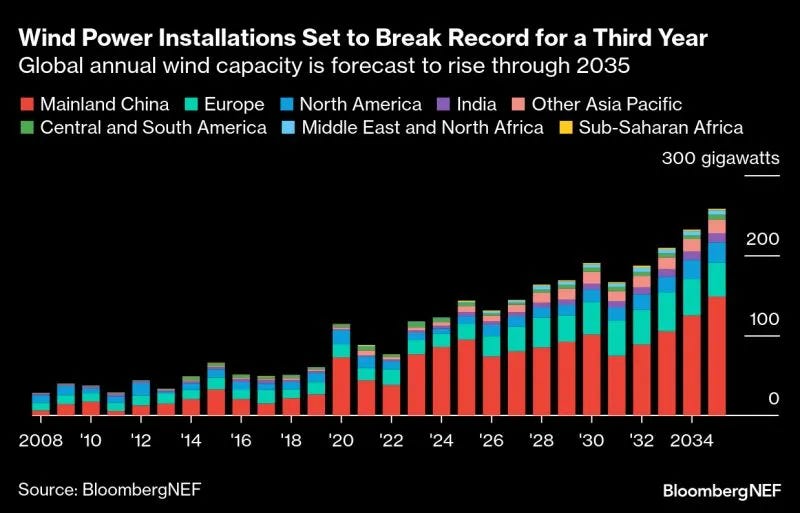

Wind energy will set a new global installation record in 2025, with 143 GW of new capacity, a 17% increase compared to the previous year, according to the latest report by BloombergNEF and shared by Cristian Bogdan Dinca on LinkedIn.

This would mark the third consecutive year of record highs, driven mainly by the momentum from China.

Mainland China will account for two-thirds of global growth, pushing the Asia-Pacific region to exceed 100 GW of new annual installations for the first time. For context, in 2024 the world installed 117 GW of wind power, of which China installed nearly 80 GW.

Europe will add 20 GW in 2025, which is a decrease from the previous year. However, onshore wind is expected to reach a historic high of 18 GW, and between 2026 and 2030 the average annual installation rate is expected to rise to 25 GW.

The rest of the conclusions can be found in Cristian’s post.

⚓ Three offshore wind farms in Denmark extend their operating license

Three of Denmark’s oldest offshore wind farms (Middelgrunden, Nysted and Samsø) have recently been authorised to extend their operational life, as shared by Giuseppe Costanzo on his LinkedIn account.

Middelgrunden, operational since 2001 and located off the coast of Copenhagen, has been approved to operate for 25 more years after passing a technical assessment that analysed the structural integrity of towers and foundations. The 40 MW wind farm is made up of 20 Bonus B76/2000 turbines of 2 MW.

Nysted (Rødsand I), with 161 MW and in operation since 2003, has been authorised to operate for 10 more years. Equipped with 70 Siemens SWT-2.3-82 turbines, it is worth recalling that in 2022 one of the turbines collapsed due to a foundation failure.

Then there’s Samsø, with 23 MW, operational since 2002 and composed of 9 Bonus B82/2300 turbines, which received approval last month to operate for an additional 10 years.

Applications have also been submitted to extend the life of:

Horns Rev 1: 160 MW, operational since 2002 with 80 Vestas V80/2000 turbines.

Rønland: 8 MW, operational since 2003 with 4 Vestas V80/2000 turbines.

That said, the extension comes with certain obligations:

First, the Danish Energy Agency (DEA) requires all operators to submit independent lifetime assessments as a basis for granting these extensions.

Second, operators must carry out thorough annual technical inspections.

Does this mean Middelgrunden will be able to operate for 50 years? Probably not. In fact, no modern wind farm has ever reached that age. What we do know is that the owner has permission to do so—and if the turbines endure, which remains to be seen, they could.

⚡ Sungrow sells 44 GW of wind converters in 2024 with a 39% market share

Sungrow is one of the world’s leading suppliers of solar inverters. Its global presence in this segment, along with its growing role in the BESS storage systems market, has consolidated this Chinese manufacturer as a key supplier worldwide.

However, where it might not be as well known is in the wind sector, specifically as a supplier of converters for wind turbines. A position that, in light of the latest data, deserves much more recognition.

Through a LinkedIn post, Sungrow Wind states that it has reached 44 GW of delivered capacity in wind converters during 2024, which would give it a global market share of 39%.

Most of Sungrow’s recent growth in wind has been driven by the dynamism of the APAC market, with India as the main hub, where it has deployed a complete network of manufacturing, service, and technical support.

In fact, Sungrow is building strong relationships with manufacturers in the Indian market. According to Sungrow itself:

Adani: Converters of 3.3 MW supplied to Adani.

Suzlon: A constructive relationship is being maintained.

SANY: Converter shipments of 260 MW to SANY in India.

Envision: Converter shipments of 633 MW to Envision in India.

The truth is, I didn’t know Sungrow played such a relevant role in the supply of wind converters. That said, as far as I know, none of the Western OEMs use their products.

Thank you very much for reading Windletter and many thanks to Tetrace, RenerCycle and Nabrawind our main sponsors, for making it possible. If you liked it:

Give it a ❤️

Share it on WhatsApp with this link

And if you feel like it, recommend Windletter to help me grow 🚀

See you next time!

Disclaimer: The opinions presented in Windletter are mine and do not necessarily reflect the views of my employer.