Windletter #87 - A look at emerging offshore wind markets

Also: reducing noise in monopile installation, ZF delivers the first drivetrains for the V236, reinforcing a foundation for repowering, and more.

Hello everyone and welcome to a new issue of Windletter. I'm Sergio Fernández Munguía (@Sergio_FerMun) and here we discuss the latest news in the wind power sector from a different perspective. If you are not subscribed to the newsletter, you can do so here.

Windletter is sponsored by:

🔹 Tetrace. Specialized services in operation and maintenance, engineering, supervision, inspection, technical assistance, and distribution of spare parts in the wind sector. More information here.

🔹 RenerCycle. Development and commercialization of solutions and specialized services in the circular economy for renewable energies, including comprehensive dismantling of wind farms and waste management, refurbishment and sale of components and wind turbines, management and recycling of blades and others. More information here.

Windletter está disponible en español aquí

Windletter is back! After a well-deserved (or so I believe) break, we're back to bring you the best news and analysis from the ever-exciting wind sector.

In the past few weeks, there have been so many updates that it’s literally impossible to cover them all in a single edition, but I’ll try to highlight the most relevant topics in the upcoming issues, even if they aren't always the most current.

The new season looks promising, although first we need to get back into the rhythm, which I assure you is not easy. But we’re on it.

That said, even though a lot has happened, I didn’t want to miss sharing the most-read items from the last edition: the video on the offshore tower and foundation connection system C1 Wedge Connection™, Kiko Maza’s article on the capacity factor of renewable energies, and the video about the day LM transported wind turbine blades on an Antonov 225.

Now, let's dive into the news. A new season of Windletter begins!

🚤 A look at emerging offshore wind markets

Since the first offshore wind farm in history was installed in Denmark in 1991, and excluding China, offshore wind has historically been concentrated in Europe, specifically in certain markets in Northern Europe.

When we think of offshore wind in Europe, the UK, Germany, the Netherlands, Denmark, Belgium, and, slightly behind, France likely come to mind. In a second wave, with many installations planned for the coming years, we have Sweden, Norway, Finland, Ireland, and Poland.

Southern Europe, on the other hand, lags further behind, partly due to weaker economies and a greater reliance on floating wind—a more immature and less economically competitive technology.

Beyond Europe, things are starting to pick up in several countries: Brazil, India, Japan, South Korea, Australia… and, of course, the United States, which, despite some turbulence, has a significant project pipeline.

So, which are the emerging offshore markets to watch in the coming years? Taking advantage of the release of the Global Offshore Wind Report by GWEC and the insightful posts by Rafael Menendez from AFRY on LinkedIn (whom I recommend following), let’s do a brief analysis by country.

_

🇵🇹 Portugal

Portugal has coastal conditions similar to those of Spain but is a step ahead in floating wind. In fact, it hosts the pre-commercial WindFloat Atlantic wind farm, which consists of three Vestas V164-8.4 MW turbines located in the Portuguese municipality of Viana do Castelo, very close to Galicia.

Moreover, according to reports in the Portuguese press and highlighted by Rui Silvano on LinkedIn, Portugal may be planning to hold an auction this very year. The auctioned capacity could reach up to 2 GW, divided into 500 MW lots.

_

🇪🇸 Spain

As for Spain, the reality is that there have been no significant updates in recent months. Last February, a royal decree was published to regulate offshore wind auctions. But since then, there have been no further developments.

Looking into the crystal ball, everything suggests that the first auction will take place in the Canary Islands, and my guess is that it will award between 200 and 300 MW.

For those interested in more details, I’ve provided links to editions #70 and #71.

_

🇮🇹 Italy

In recent weeks, there have been significant movements in offshore wind in Italy. Just recently, the European Union approved an aid package from Italy for various renewable energies, including offshore wind.

The key details, summarized by Rafael Menendez, are as follows:

A total of 3,800 MW of offshore wind will be supported.

At least 3 auctions will be held between 2024 and 2028.

Remuneration through a two-way contract for difference (2-way CfD), potentially indexed to inflation.

Reference price of €185/MWh in 2024.

There have also been some news about a possible Mingyang factory in Italy, which we will discuss in future editions.

_

🇬🇷 Greece

Greece published the law regulating offshore wind in 2022, and a year later identified 25 areas (19 floating and 6 fixed-bottom):

2 priority areas for fixed-bottom pilot projects, already awarded to local developers.

10 areas for the medium term (before 2032).

13 areas for the long term (after 2032).

In total, these areas have a potential of more than 12 GW.

_

🇮🇳 India

India recently surpassed China as the most populous country in the world. In onshore, it is also one of the leading global powers, following China, the United States, and Germany.

Regarding offshore wind, the country currently has no offshore wind farms, but 500 MW are expected to be auctioned this year, with at least another 500 MW planned for 2025.

And much more is to come. You can find more details in this post by Rafael Menendez.

_

🇧🇷 Brazil

Brazil is also a major player in onshore wind, ranking as the 6th largest in the world. But in offshore, they still don’t have any wind farms despite having an estimated potential of 1,200 GW, according to a DNV study for the World Bank.

The same report presents three future scenarios:

Base Case: 16 GW by 2050, which would represent 3% of the generation mix.

Intermediate: 32 GW by 2050, equivalent to 6% of the generation mix.

Ambitious: 96 GW by 2050, covering almost 20% of the generation mix.

Moreover, Brazil recently announced a collaboration between the National Industrial Training Service, Dois A, Esteyco, and Goldwind to build an offshore testing center on the northern coast of Rio Grande.

This “test center” will consist of two wind turbines, one with a capacity of 16 MW and the other with 8.5 MW, which will be installed at locations with water depths of 6 to 8 meters.

_

🇦🇺 Australia

Recently, the Australian government granted feasibility licenses for 12 projects with a total capacity of up to 25 GW in the Gippsland area. Additionally, feasibility licenses were granted for another 2 GW, this time in the Newcastle area.

These are still preliminary licenses with a 7-year period for conducting initial studies and applying for a commercial license. As can be seen, there are still years ahead, but this demonstrates that Australia is an attractive market. In fact, nearly all the major global players are there: CIP, Corio, Iberdrola, Ocean Winds, RWE, BlueFloat Energy, Ørsted…

There are still many countries to cover (Poland, Japan, South Korea, Norway, Finland, Vietnam…), but the text is getting too lengthy… so we will discuss them in future editions. So if you don't want to miss out, subscribe for free.

_

Sustainable mobility and cities have an appointment in Málaga… and we have an invitation for you

On September 24th and 25th, the Greencities & S-Moving event will be held in Málaga. With over 15 years of history, this event will allow you to discover how cities are becoming smarter and more sustainable, as well as the future of urban mobility.

The participation of experts such as Mario Picazo, meteorologist and presenter, and Javier Goyeneche, founder of Ecoalf, has recently been confirmed. Their presentations will headline the event's agenda, where more than 140 speakers will gather to discuss urban planning, mobility, and sustainability.

All Windletter subscribers can register for the event for free through this link.

_

🌊 Methods for noise reduction during monopile installation in offshore wind farms

Ørsted has developed a new monopile installation method that significantly reduces noise, potentially marking a turning point in the industry.

This technology has already been successfully tested in Germany and now complements the other measures Ørsted uses to limit environmental impact during wind farm construction. The chosen site for the tests was Gode Wind 3, where it was used on three monopiles.

The use of this technology has allowed for a noise reduction of 34 decibels compared to the most commonly used installation method in the market. Noise during offshore wind farm installation has always been highlighted as one of the major impacts on marine life.

In fact, it seems to be a hot topic in the industry, as just a week later, EnBW also tested another technology (you can find a video in the link) to reduce noise during monopile installation.

_

⚙️ ZF delivers the first series powertrains for the Vestas V236-15.0MW

The giant ZF has announced the delivery of the first series powertrains for the V236-15.0MW.

The powertrains include the generator and gearbox within a single chassis and come fully assembled from the Lommel factory in Belgium. If I'm not mistaken, ZF receives the generator at the factory and is responsible for integrating it into the chassis along with the gearbox, which is indeed their own manufactured product.

ZF has a production line specifically dedicated to offshore products, but it also has another for onshore, where it is also a supplier for Vestas, at least for the EnVentus platform.

I’m not sure if Vestas and ZF are currently experiencing or have experienced any issues with production, but after checking the Windletter archive, I noticed that series production was supposed to start in the first quarter of this year. It’s not a significant delay, though.

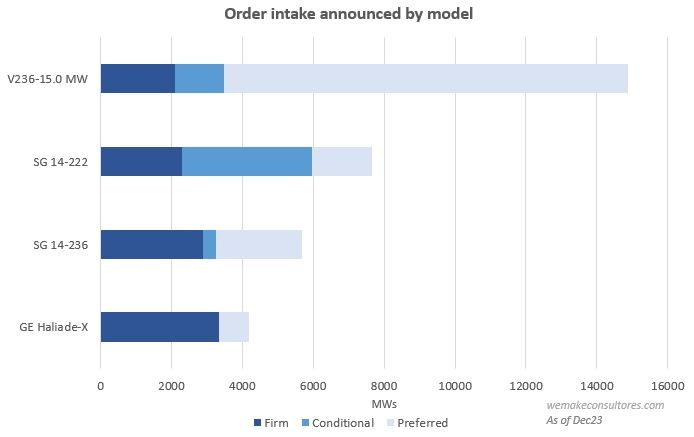

Let’s remember that Vestas has orders for over 14 GW, including signed, conditional, and preferred supplier agreements.

_

💼 The impact of lack of experience on the bankability and insurance of floating wind

We return to quoting Bruno G. Geschier in Windletter, this time with an article that reviews the challenges faced by floating wind when it comes to bankability and “insurability”.

Bruno also suggests ways to mitigate these challenges, including investing in pilot projects, improving modeling and simulation, public-private risk reduction mechanisms, developing certifications and standards…

The article is definitely worth reading.

_

🛠️ Reinforcing a foundation for partial repowering

When we talk about repowering in Europe, we typically think of completely dismantling the existing wind farm and constructing a new one in the same location.

However, in the United States, there exists another concept of repowering, which could be termed as partial repowering. This concept involves replacing only certain elements of the wind turbine, with various options available:

Rotor

Rotor + nacelle (or certain components of the drive train)

Rotor + nacelle + top tower section

The remaining components are retained, resulting in an upgrade of the wind turbine, typically leading to increased energy generation and extended lifespan. Sometimes, reinforcing certain components is necessary.

This was the case with RWE and the partial repowering of its Champion Wind farm in Texas. Due to the larger rotor size of the existing Siemens 2.3 MW turbines (likely increasing from 93 m to 108 m, although specific data wasn't found), reinforcing the foundation became necessary.

To achieve this, a reinforced concrete ring is being installed around the existing pedestal, which is an uncommon practice in the industry.

In edition #30, we discussed a case of partial repowering carried out by Nordex in France, where they upgraded the rotor from an N100 to an N117 model.

_

🎉 The story of Claus Engholm Nielsen: 40 years working at Vestas

An inspiring story about Claus Engholm Nielsen, a Dane who recently marked 40 years working at Vestas.

To celebrate the anniversary, and as Claus is soon to retire, Vestas published his story on their website as a tribute.

Claus was involved in the production of the first molds developed by Vestas when the company decided to internalize their manufacturing to control quality (previously, they were purchased from a third party). These were 8-meter blades for the Vestas V16 model.

I’m struck by a quote from Claus that I believe perfectly sums up 40 years of development in the wind industry:

“I’m very proud to be part of this journey. Going from developing 8-meter-long blades to manufacturing 115-meter blades is amazing”.

_

🌍 Name changes in the renewable sector. SolarPack is now Zelestra, and Nervión Naval Offshore is now WindWaves

The renewable sector is in a phase of consolidation, which involves mergers, investments, name changes, and more.

Recently, there have been two significant name changes that I wanted to share here, as branding it’s a topic that has always caught my attention.

The IPP Solarpack, based in Getxo (Bizkaia), has now changed its name to Zelestra, coinciding with the announcement of a €5 billion investment in the coming years. Additionally, as part of its new strategy, Zelestra will become a multi-technology company, expanding beyond solar to include wind, batteries, and green hydrogen.

Nervión Naval Offshore, a company within the Amper Group specializing in the manufacturing of offshore wind structures and shipbuilding, and based in Narón (A Coruña), has also rebranded and will now be known as WindWaves. The company has a significant order book for jackets and floating platforms.

_

🎥 Video of the construction and assembly of a Vestas V126

The video I’m sharing today may not be the most “novel,” but the truth is, there aren’t many videos of wind turbine construction and assembly that are as well-recorded and high-quality as this one.

In the video, you can see the entire civil and mechanical process. From the assembly of the bolt cage and concreting to the complete assembly of towers, nacelle, hub, and blades. It also includes excellent shots that showcase a high level of detail.

It’s definitely worth watching, especially if you spend a lot of time in the office and not much in the field (like me 😅).

The wind turbine is a Vestas V126 with a hub height that I don't know but seems to be above 120 meters.

Thank you very much for reading Windletter and many thanks to Tetrace and RenerCycle, our main sponsors, for making it possible. If you liked it:

Give it a ❤️

Share it on WhatsApp with this link

And if you feel like it, recommend Windletter to help me grow 🚀

See you next time!

Disclaimer: The opinions presented in Windletter are mine and do not necessarily reflect the views of my employer.