Windletter #109 - Ørsted cancels the 2.4 GW Hornsea 4 offshore project in the United Kingdom. What is happening?

Also: 132 kV for offshore wind turbines, BW Ideol's 20 MW+ floating platform, the challenge of blade repair, and more.

Hello everyone and welcome to a new issue of Windletter. I'm Sergio Fernández Munguía (@Sergio_FerMun) and here we discuss the latest news in the wind power sector from a different perspective. If you're not subscribed to the newsletter, you can do so here.

Windletter is sponsored by:

🔹 Tetrace. Reference provider of O&M services, engineering, supervision, and spare parts in the renewable energy market. More information here.

🔹 RenerCycle. Development and commercialization of specialized circular economy solutions and services for renewable energies. More information here.

🔹 Nabrawind. Design, development, manufacturing, and commercialization of advanced wind technologies. More information here.

Windletter está disponible en español aquí

🔌 What intense days we’re living in the energy sector with this blackout in Spain. It’s the trending topic 24/7 on TV, in the press, and on social media. And every interest group is pushing its own agenda. Honestly, I’m getting a bit tired of it, especially when it turns into a political or ideological debate (which is 95% of the time) instead of a technical one.

For those looking for a technical analysis, the best I’ve found online is this one by Luis Badesa on LinkedIn. A bit of light (pun not intended) amid all the noise.

That said, the most-read pieces from the latest edition have been: the report by Energy Cluster Denmark on the SGRE and Vestas collaboration project in seafastening, Aegir Insights’ post on floating wind CAPEX, and the information about Enercon’s new 7.X MW prototype.

Let’s get into this week’s news.

🛑 Ørsted halts development of the Hornsea 4 offshore wind project due to economic unviability

Offshore wind keeps running into trouble. If last week we were talking about the United States and the suspension of the Empire Wind 1 project by the Trump administration, this week’s news isn’t much better.

Ørsted has announced to the market its decision to halt the development of the Hornsea 4 offshore wind project (2.4 GW) in the United Kingdom. The project had been awarded a Contract for Difference (CfD) in the 2024 AR6 round.

Among the reasons cited by the Danish company in its statement are:

Continued increase in supply chain costs.

Rising interest rates.

Increased risk of building and operating a project of this scale within the expected timeframe.

As a result, Ørsted has decided to stop further spending on the project and terminate contracts with the supply chain, thus relinquishing the CfD awarded in the AR6 auction. As a consequence of the decision, Ørsted expects to incur costs of between EUR 470 and 605 million in 2025.

Personally, this move has really surprised me, given that the 15-year CfD had been awarded in 2024 with a guaranteed electricity selling price of approximately £83/MWh, equivalent to €96/MWh at 2025 prices. That’s not exactly a low price.

So, obviously, this leads one to think that, for the project to be viable under current conditions, Ørsted needs either a higher tariff or longer-term revenue visibility (i.e., reduced uncertainty after the CfD ends).

And that got me thinking. On one hand, what has changed since 2024 that makes the project financially unviable in 2025? I honestly don’t see many possibilities here.

Market conditions can’t have changed much compared to last year. So my bet is that what has changed is Ørsted’s risk profile when it comes to undertaking investments. That is, Ørsted is now more conservative. This hypothesis makes some sense considering the company changed its CEO on February 1st, so the partial abandonment of the project could be a decision from the new management team. Raya Peterson’s post from Ramboll is worth a read.

On the other hand, what’s different from the Hornsea 1, 2, and 3 projects that makes this one unviable? Of course, there could be many factors requiring detailed analysis, but just to mention a few:

Greater seabed depth, implying higher foundation costs. According to the project description submitted to the authorities, the depth ranges between 30 and 60 meters.

Worse geotechnical conditions. This would require detailed data, but it could have an impact.

More expensive grid connection infrastructure. This requires detailed evaluation, though looking at the map (page 8), the project is actually closer to shore, although it’s true the onshore section of the export cable looks more complex.

Lower wind resource. Even though it’s the same area, could Hornsea 4 be affected by the wake effects from Hornsea 1, 2, and 3? It’s a hot topic, and based on the wind rose of Hornsea 1, it might make sense.

Maintenance costs. Here I actually think the opposite. Considering Hornsea 4 is right next to 1, 2, and 3, there should be significant O&M savings. In addition, Ørsted is a self-performer, meaning they bypass the OEM after the initial maintenance period, which should lower costs.

Higher supply chain costs. This is one of the main reasons cited by Ørsted. Are turbine, monopile, and other supply costs higher than in previous years?

The truth is Ørsted has been publicly discussing rising costs for some time, and it’s clearly mentioned in their newly published white paper Offshore wind at a crossroads. I quote:

…between 2019 and 2024, offshore wind CAPEX/MW has been estimated to increase by an average of 18% in the UK, Germany, the Netherlands, and Denmark.

Regarding the increase in interest rates for project financing, they also mention the following:

The weighted average cost of capital (WACC) for offshore wind projects in Europe has risen by approximately 3 to 4 percentage points between 2020 and 2024.

…this 3–4 percentage point increase in WACC is consistent with a levelized cost of energy (LCoE) increase of around 30%.

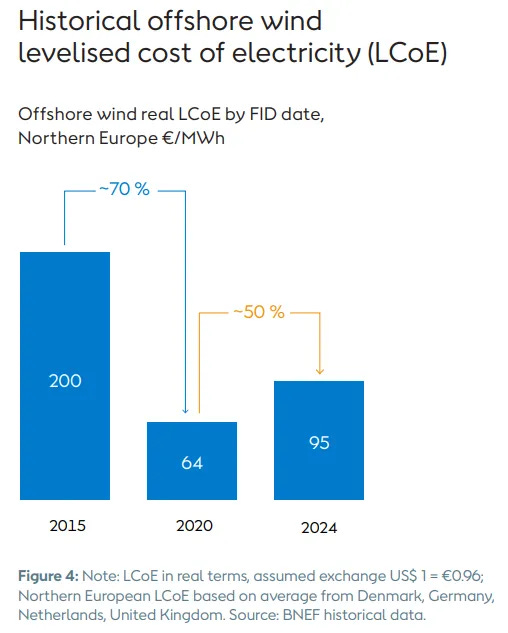

The result is a reported LCoE increase of 50% (according to BNEF data) published in the aforementioned Ørsted white paper.

Are these costs sustainable in the medium to long term, and are they aligned with European offshore wind ambitions and targets?

Be that as it may, the Danish company is leaving the door open to reassessing other options for Hornsea 4 in the future, as it retains the development permits, seabed rights, and the grid connection agreement.

On this topic, it’s worth reading the critical perspective of , which also provides valuable context and details on how project financing works.

A very relevant point raised by Jérôme is that the “penalty” or “liabilities” for withdrawing from the CfD are quite low and amount simply to a 13-month ban from submitting bids in upcoming auctions.

Trying to see the positive side as well, this cancellation could also be interpreted as another step toward market consolidation, with the main players being more selective with their investments and a supply chain that will likely be under less pressure.

And you, what’s your take on it?

⚡ Does 132 kV make sense for offshore wind turbines?

We recently discussed here the Siemens Energy Clean Air GIS rated at 72.5 kV (66 kV nominal), the evolution of wind turbine output voltages, and how the next generation of offshore turbines might feature a transformer output voltage of 132 kV.

Closely related to this, I came across a LinkedIn post by Albert Winnemuller, Head of Global Offshore Product Market Strategy at Vestas, where he questions the need to jump from 66 kV to 132 kV.

The reasons Albert cites are:

Wind turbine sizes are stabilizing around 15 MW, meaning 66 kV remains sufficient.

The CAPEX levels of 132 kV solutions do not offer a real competitive advantage.

However, Albert also mentions that the German, French, and Dutch governments are planning 132 kV connections for 2033, 2032, and 2034 respectively, and calls for a reassessment of the situation.

Some might ask: why is it the governments that determine the voltage level? In the case of these three countries, it’s because they are the ones building and operating the grid connection infrastructure.

The comment section is also very insightful, with people both supporting and opposing the change. A particularly relevant point about the move to 132 kV is that, for projects with moderate capacity, it might make it feasible to eliminate the offshore substation.

Let’s not forget that, according to the information we published about Siemens Gamesa’s SG21-276 DD (not yet commercially available), its design is expected to support a 132 kV voltage level.

🏗️ This is how BW Ideol’s floating platform scales

I really liked the following infographic shared by BW Ideol, showing the size of one of its floating platforms designed to host 20MW+ turbines.

If we think about scaling a platform from 15MW+ to 20MW+, our minds often trick us into intuitively imagining a much larger platform (at least mine does 😅).

However, thankfully, engineering doesn’t scale that way. Obviously, a 20MW turbine doesn’t require a platform twice the size of one for 10MW.

But BW Ideol didn’t publish this infographic by chance. The recent French AO5 and AO6 auctions, which awarded three 250 MW blocks each, foresee the use of turbines rated above 20 MW.

And they go as far as stating the following:

The engineering challenges of adapting 20MW+ offshore wind turbines for floating applications are limited and entirely manageable, making it highly feasible to have 20MW+ turbines ready by 2030.

A claim that I’m not sure many OEMs would feel comfortable with.

We saw a similar comparison with Saitec Offshore Technologies and their SATH 15+ floating platform, although in that case it was through 3D models.

🇳🇴 State aid for floating wind approved in Norway

The EFTA Surveillance Authority (ESA), which oversees compliance with the rules of the European Economic Area in Iceland, Liechtenstein, and Norway, has approved a state aid package for floating offshore wind in Norway.

Specifically, the aid package is intended for the development of a floating offshore wind farm in Utsira Nord, an area located in the North Sea, off the coast of Rogaland County in Norway.

The aid will be managed by Norway’s Ministry of Energy and will have a total budget of 35 billion Norwegian kroner (around €2.95 billion). It will be granted as a direct subsidy, aimed at making the high upfront costs of floating offshore technologies viable.

The auction process will be carried out in two stages. First, a prequalification round based on qualitative criteria will be held. In a second phase, scheduled for 2028–2029, a competitive auction will take place in which funding will be awarded to the developer requesting the lowest amount of state aid per installed megawatt. In other words, a direct CAPEX subsidy.

It is estimated that the Utsira Nord area could reach a capacity factor of 47%.

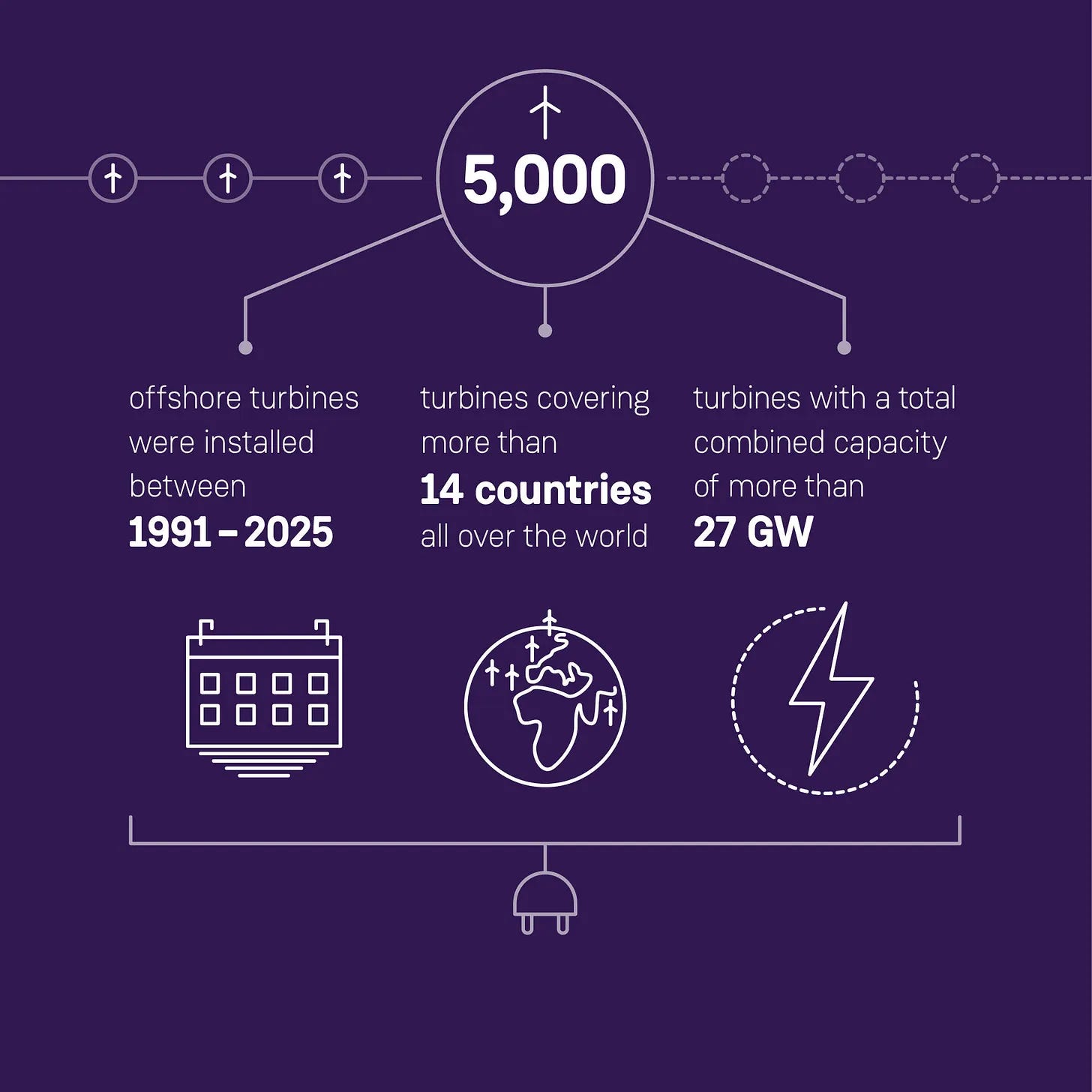

🌊 Siemens Gamesa installs its 5,000th offshore wind turbine

Since Bonus installed the world’s first offshore wind farm in Denmark (11 x 450 kW) back in 1991, Siemens Gamesa has gone on to install an impressive 5,000 offshore wind turbines.

Specifically, turbine number 5,000 was an SG 14-222 DD installed at the Sofia wind farm, in British waters and owned by RWE.

A curious fact is that 2,500 of these turbines are based on Direct Drive technology, which, according to SGRE, has significantly reduced maintenance and improved efficiency.

Siemens Gamesa’s offshore activity is truly remarkable at the moment, as highlighted by Markus Wiemann, Global Head of Offshore Construction, on LinkedIn:

The 5,000th offshore wind turbine has been installed.

The first turbine at Greater Changhua 2/4 in Taiwan has been installed — the first of the new SG 14-236 DD model.

Installation has started on the Hai Long project in Taiwan (SG 14-222).

The first turbine has been installed at the Sofia project in the UK (SG 14-222 DD).

All turbines at the Jeonam project in South Korea (SG 10.0-193 DD) have been installed, commissioned, and delivered.

All turbines at Neart na Gaoithe in the UK (SG 8.0-167 DD) have been installed and commissioned.

All turbines have been delivered and the Yunlin project in Taiwan (SG 8.0-167 DD) has been inaugurated.

An industry standard for sea fastening has been jointly developed and published.

A new GWO High Voltage training standard has been launched.

A new wind turbine prototype (SG21-276 DD) has been installed.

All turbines for the Moray West project, the first with 14 MW turbines (SG 14.7-222 DD), have been delivered.

🛠️ The challenge of wind turbine blade repair

Blade repair is arguably one of the most specialized, complex, and “hands-on” maintenance tasks in the entire wind sector—and also one of the main O&M cost drivers. According to a 2019 report by Wood Mackenzie, blade maintenance costs accounted for 25% of the cost of major corrective actions in wind turbines.

Blade issues can stem from various causes:

Manufacturing defects

Damage during transport and installation

Damage during operation (delaminations, erosion, impacts, lightning strikes)

Constant exposure to harsh weather conditions and airborne particles causes wear, especially on the leading edge. This deterioration can significantly reduce the annual energy production (AEP), depending on the level of erosion. Furthermore, damage such as delaminations or impacts can compromise the structural integrity of the blade, increasing the risk of catastrophic failure.

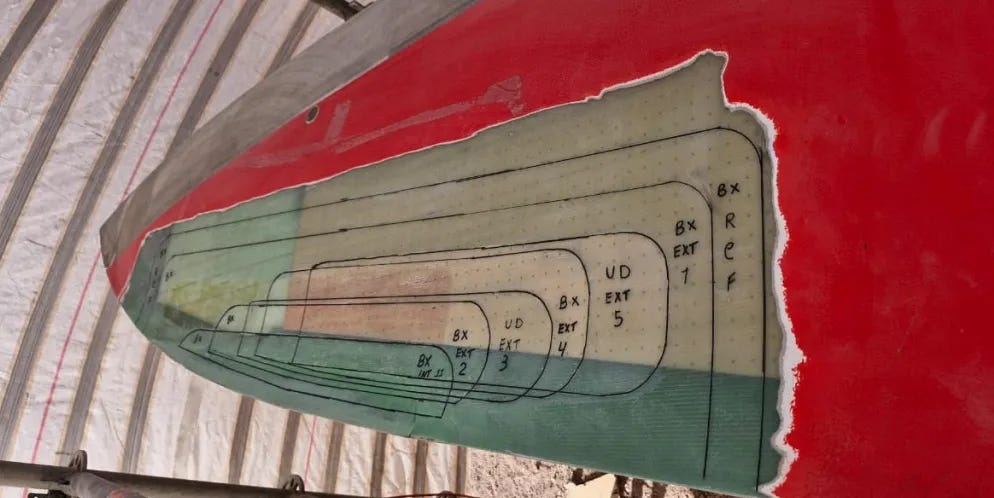

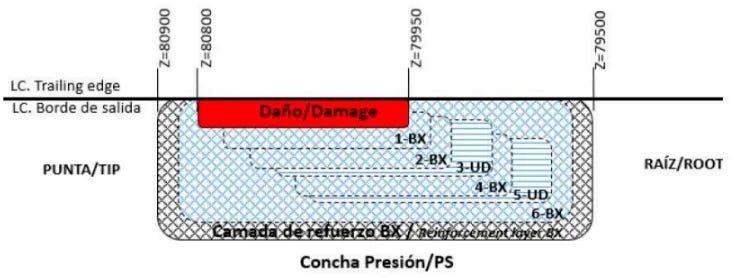

Our sponsor Tetrace, specialists in blade repair, has shared on LinkedIn some details about the process of repairing a delamination. Thanks to this, we can take a first-hand look at each step of the work and better understand how the structural integrity of the blade is restored. In this case, the repair was carried out with the blade on the ground.

One of the biggest challenges in blade repair is that each case is different, meaning the procedures must be tailored individually.

In this case, the blade is repaired by removing the layers adjacent to the damaged area and replacing them with new material and fiber. As can be seen, the extension of each layer gradually decreases toward the center of the damage, forming a kind of "staircase."

Tetrace offers blade repair services in 17 markets, with a current focus on growth in the United States, Canada, Australia, and Brazil.

Thank you very much for reading Windletter and many thanks to Tetrace, RenerCycle and Nabrawind our main sponsors, for making it possible. If you liked it, give it a ❤️, subscribe, share it on WhatsApp with this link, follow Windletter's profiles on Twitter and LinkedIn and follow me on Twitter and LinkedIn.

And if you feel like it, recommend Windletter to help me grow 🚀

See you next time!

Disclaimer: The opinions presented in Windletter are mine and do not necessarily reflect the views of my employer.

Hi Sergio - thanks for linking to my post. Just a small clarification (which was kindly provided by a commenter on my post) - the rule was changed to forbid a participant for bidding in the next two CFD rounds if they give up the contract