Windletter #107 - More signs of a trend shift in investments

Also: spacing between floating wind turbines, SGRE sells its business in India, the paperwork for the permits of a wind farm, and more.

Hello everyone and welcome to a new issue of Windletter. I'm Sergio Fernández Munguía (@Sergio_FerMun) and here we discuss the latest news in the wind power sector from a different perspective. If you're not subscribed to the newsletter, you can do so here.

Windletter is sponsored by:

🔹 Tetrace. Reference provider of O&M services, engineering, supervision, and spare parts in the renewable energy market. More information here.

🔹 RenerCycle. Development and commercialization of specialized circular economy solutions and services for renewable energies. More information here.

🔹 Nabrawind. Design, development, manufacturing, and commercialization of advanced wind technologies. More information here.

Windletter está disponible en español aquí

The most read content in the latest edition was: the BNEF ranking of the top 10 wind turbine manufacturers, the DNV webinar on wake effects in wind farms, and the 500 MW signed by Siemens Gamesa in Egypt.

Additionally, last week we published an analysis of Chinese OEM sales outside their local market.

By the way, while you are reading this, and if everything goes well, I will be on the other side of the pond enjoying my honeymoon 🌴.

But don’t worry, I have scheduled an article for next week (divided into two parts) that I truly believe you will enjoy. Personally, I really enjoyed writing them, and I think it’s something different that deserves to be told.

So now, let’s get started with this week’s news, in a slightly lighter edition than usual.

📉 More signs of a trend shift in investments

In edition #96 of Windletter, we carried out an analysis of how some of the major global renewable players were making a shift in their investment strategies.

The general trend is that companies are prioritizing the value and quality of investments over volume. In the face of rising costs and market uncertainty, the focus is on profitable, low-risk projects with quick returns, rather than expanding capacity at any cost.

Many of them are also making divestments, bringing in strategic partners in their renewable assets, thereby reducing their exposure to electricity price fluctuations and securing fresh cash.

Sylvain Cognet-Dauphin from S&P Global Commodity Insight has published on his LinkedIn account some reflections and a brief summary of the strategy of the main utilities in Europe and the United States (Equinor, Orsted, Repsol, Naturgy, Iberdrola, EDP, Galp, AES, RWE, ERG), including excerpts from their investor presentation slides.

The trend is quite clear, and we will have to see how this affects the volume of megawatts built in the coming years.

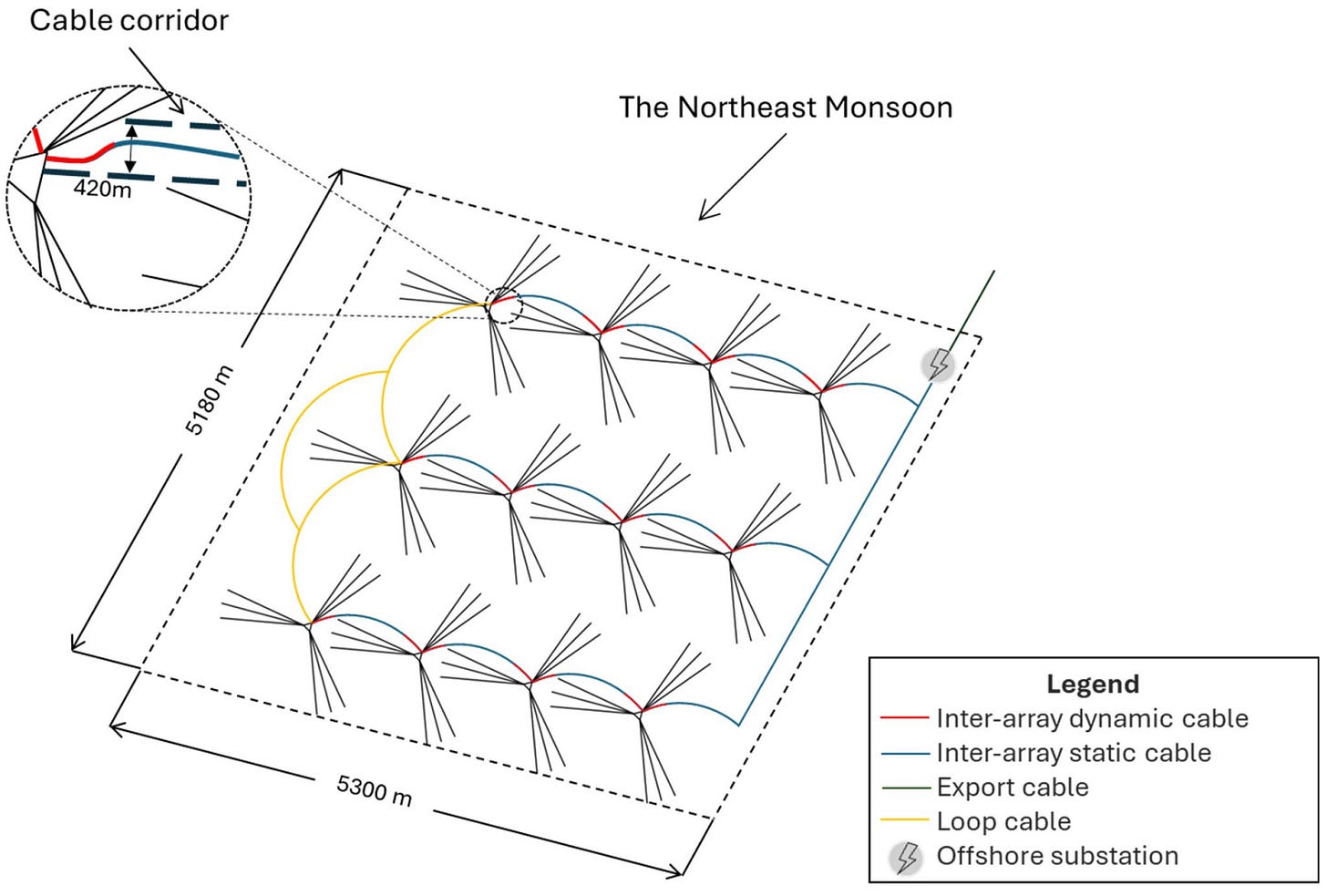

⚓️ The spacing between floating wind turbines could be defined by anchoring systems

I found this LinkedIn post by Glib Ivanov very interesting, where the topic of spacing between floating offshore wind turbines is discussed.

In onshore and fixed-bottom offshore wind, this spacing is designed considering two main parameters: the available space and the wake effect (the impact of one turbine on another).

However, in floating wind, there may be an additional constraint. The anchoring systems may require a considerable area, meaning that the distance between turbines would have to be larger.

I haven't gone into much detail, but for those who are interested, you can take a look at the paper.

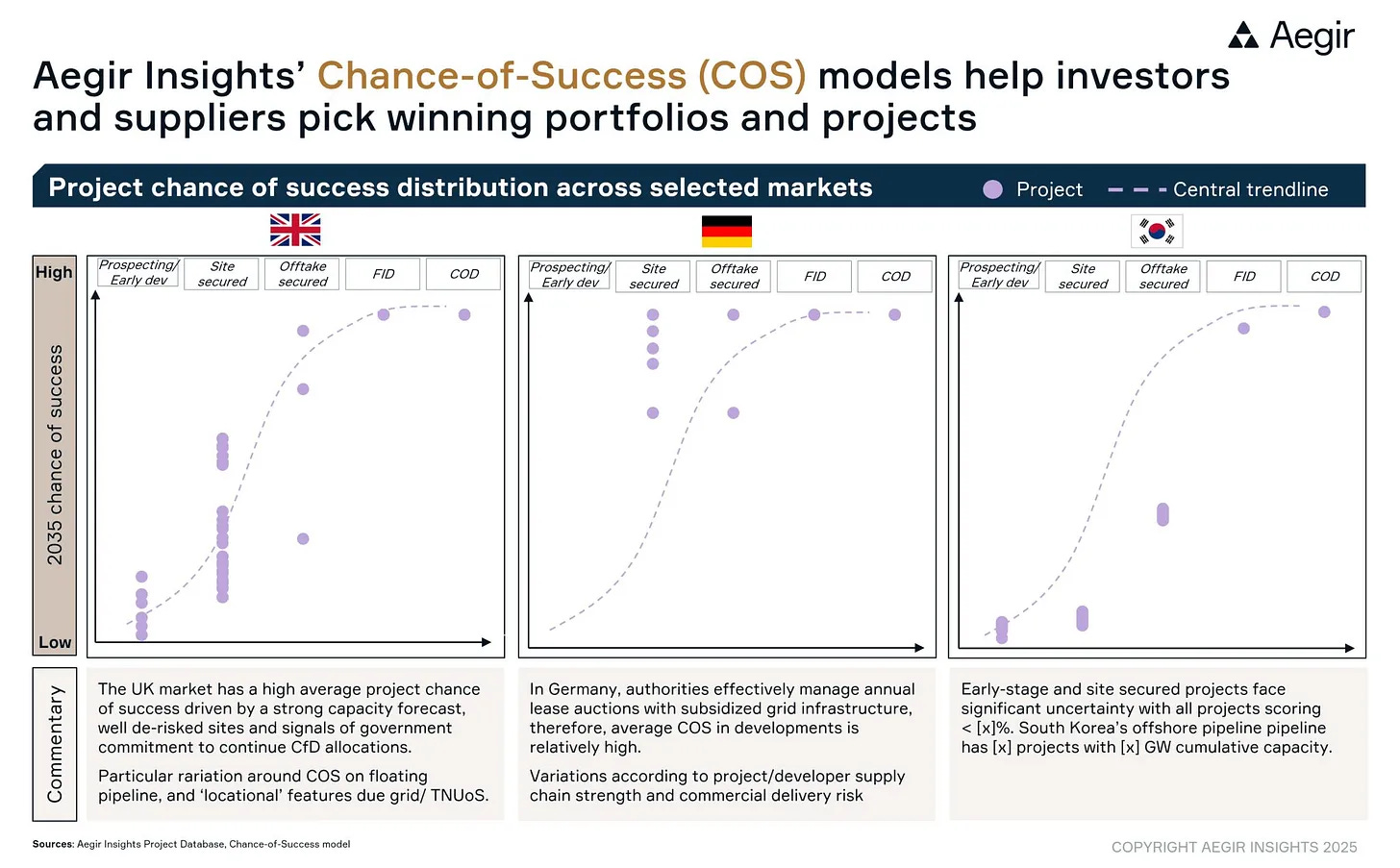

💧 Probability of success in offshore project development

Very interesting is the latest infographic published by the team at Aegir Insights, whose analyses always allow us to draw ideas and conclusions about the offshore wind sector.

In this case, it is an analysis of the expected success rate (Chance-of-Success (COS)) of offshore projects depending on the milestone they have reached in their development process.

The milestones are: initial prospecting, securing maritime space, closing the power purchaser, making the investment decision, and reaching commercial operation.

It is very interesting to see the differences between countries. For example, in the United Kingdom there are many projects with maritime space secured, but that does not imply that the success rate is high, with a significant difference between projects. It is not the same to develop a project in deep waters and far from the coast as in shallow waters and close to shore.

In Germany, on the other hand, securing maritime space greatly increases the chances of project success. Meanwhile, in South Korea, even having the power purchaser secured, the chances of success remain relatively low.

These analyses allow developers, investors, and the supply chain to make better, data-driven decisions.

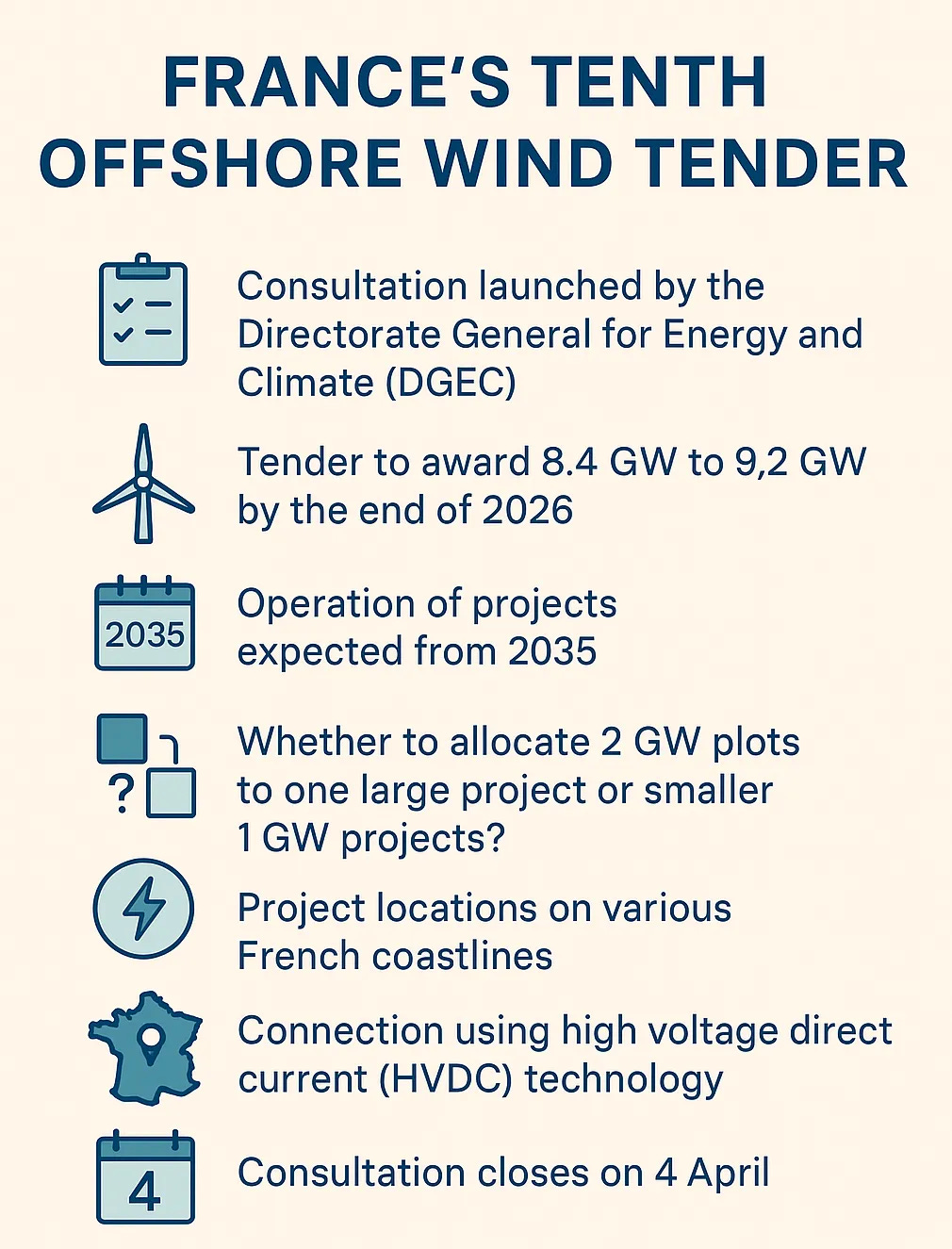

🏦 Public consultation on the offshore wind auction (AO10) in France

The Directorate General for Energy and Climate (DGEC) of France has launched a public consultation on the tenth offshore wind auction call, known as AO10. We recently commented in Windletter on the prequalification of the 12 participants in the AO9 auction.

France has positioned itself as the most active market in Europe in terms of offshore wind, with ambitious targets for both fixed-bottom and floating offshore wind.

The auction seeks to award between 8.4 GW and 9.2 GW of new offshore wind capacity before the end of 2026, with the projects expected to enter into operation around 2035. A few months ago, the French government identified areas for these auctions, which you can see here.

This consultation seeks opinions on points such as:

Whether the 2 GW lots should be awarded as a single large project or divided into smaller 1 GW projects with shared connection infrastructure (offshore substation and transmission cables to shore).

Location of the lots, target commissioning dates, project schedule…

Mechanisms to prevent a single bidder from winning all the lots.

The geographical areas are distributed along the French coast and the connection of the projects to shore is expected to be carried out using HVDC technology.

🌏 Siemens Gamesa sells 90% of its business in India

Months ago, it was reported in the press that Siemens Gamesa was putting its business in India up for sale. Since then, there had been no major news, until last week when the information was confirmed.

Siemens Gamesa has agreed to sell most of its onshore wind energy business in India and Sri Lanka to the TPG fund along with other minority shareholders, retaining a 10% stake. The agreement also includes a long-term technology license, through which it is understood that the new owners will be able to continue manufacturing Siemens Gamesa technology.

The operation includes two factories, the services business, and around 1,000 employees. According to what has been published in the press, the engineering center that the company has in India, which supports SGRE's technology function, with about 700 employees, will remain within the company. In addition, another 500 employees from other functions will also stay.

With this, Siemens Gamesa seeks to focus its strategy on key markets (mainly Europe and the United States), while the new company, backed by TPG and other local investors, will continue to serve the Indian market. Neither party has disclosed financial details of the operation.

The Indian business of Siemens Gamesa dates back to the Gamesa era, when it became one of the company’s main markets. SGRE has installed nearly 10 GW of turbines in India to date and currently services more than 7 GW through long-term agreements.

India is one of the largest wind markets in the world and has significant growth potential. Siemens Gamesa foresees that 57 GW of wind capacity will be installed by the end of 2032, which would be added to the approximately 48.5 GW currently installed.

📄 All the paperwork needed to process a wind farm barely fits in a van

Guy Willems, from WindEurope, has posted a photo on LinkedIn that I wasn’t sure whether to laugh or cry about.

The photo shown below displays all the papers required to develop a single wind farm. Specifically, it is the paperwork for an offshore wind project in Ireland.

According to Guy, an average application in Europe consists of around 10,000 pages, but this one has nearly 170,000. In reality, the full application has about 13,000 pages, but it had to be sent to 13 different institutions, resulting in the amount you can see in the photo.

I really liked the joke by Michał Kaczerowski in the comments section:

It's not easy to describe shortly how clean and green wind is 😁

Let’s better take it with a bit of humor…

🌊 The impressive video of the components of the floating projects Eolmed and EFGL at the port

I know we have shared images of these projects several times here, but the truth is that I personally love them, and they allow us to see unique details in our sector, as it is the first time that a project of these characteristics is being carried out.

This time, the video was published by Euroports and shows the port logistics operations of the Eolmed and Eoliennes Flottantes du Golfe du Lion projects.

Both use the same type of turbine, the Vestas V164-10.0 MW, while the floater is different:

Eolmed uses the barge-type floaters from BW Ideol, the large "boxes" seen in the video.

Eoliennes Flottantes du Golfe du Lion is a twin project of WindFloat Atlantic, so it uses floaters from Principle Power. The structures are not visible in the video.

It is interesting to see how, despite having different developers, they have decided to join forces to optimize port costs. It is even very likely that they have negotiated jointly with Vestas for the purchase of the turbines.

We will continue to follow the progress of these projects closely.

Thank you very much for reading Windletter and many thanks to Tetrace, RenerCycle and Nabrawind our main sponsors, for making it possible. If you liked it:

Give it a ❤️

Share it on WhatsApp with this link

And if you feel like it, recommend Windletter to help me grow 🚀

See you next time!

Disclaimer: The opinions presented in Windletter are mine and do not necessarily reflect the views of my employer.